Kotak Mahindra Bank (KMB) is one of India’s leading private sector banks. It is known for maintaining its excellent asset quality even during financial stress.

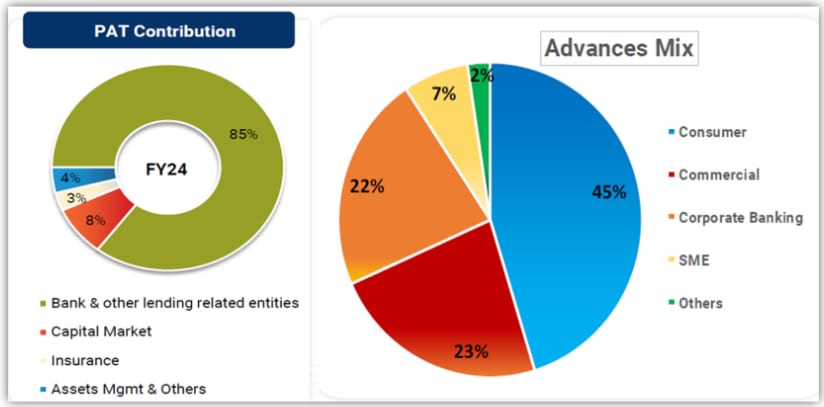

Although the bank has presence in many other business areas, including broking, life insurance, and asset management, the standalone banking entity contributes the most to its profit, 85%.

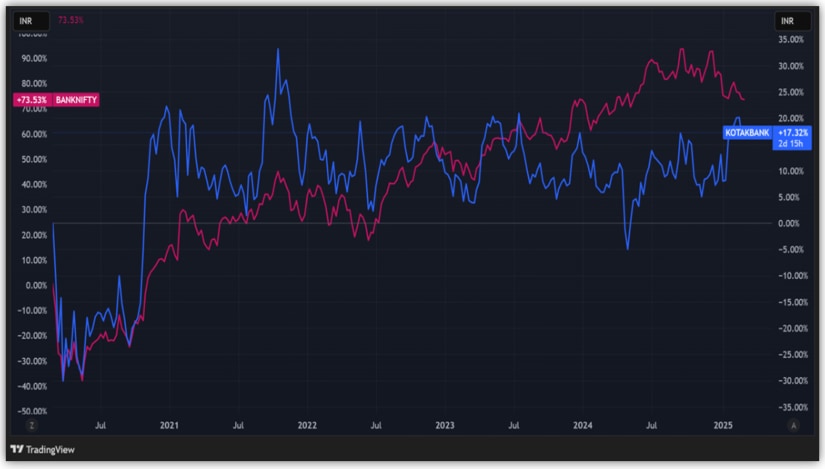

Notably, the bank’s performance has not been up to the mark on Dalal Street, with its share price delivering just a 19% return in the last five years, against the Nifty Bank’s return of 68%, despite robust performance.

KMB underperformed bank nifty significantly

One reason for this vast underperformance is the KMB valuation running ahead of time. RBI’s ban on issuing credit cards and adding new customers digitally also impacted its business, which has now been lifted. However, this is a thing of the past now.

Now, the important question is where Kotak Bank stands as an independent entity in terms of its financial position and valuation. Let’s have a look.

Strong loan book focused on consumer credit

KMB has a strong advance book, which has grown at a compounded annual growth rate (CAGR) of 15% in the last five years to ₹4.3 trillion in FY24.

The book grew by 20% over last year, led by strong overall performance. Strong 20% growth in secured consumer books, 20% in commercial books, 21% in corporate banking, and 18% in SME books drove this strong performance.

KMB Advances’ book is highly diversified. 45% of the book comes from consumer loans, followed by commercial, corporate banking, SME, etc.

Bank contributes 85% to the consolidated entity

Furthermore, 77% of the book is secured loans, while the rest is unsecured. Notably, unsecured retail advances, which are under stress with rising defaults, constitute 11.8% of net advances, increasing just 1.8% from FY23.

KMB’s proactive approach to identifying risks in this sector and curbing loan growth when the segment showed signs of stress is commendable. This foresightedness speaks volumes for KMB’s pristine asset quality in the banking sector.

The bank expects advance growth to continue at the current rate, especially since India is still a credit-starved economy. Kotak has also acquired Standard Chartered Bank’s personal loan portfolio worth ₹41 billion to fortify its position in the retail credit market.

However, this book is too small—just 1% of Kotak advances—not enough to move the needle for it. Nevertheless, Kotak does get about 95,000 affluent customers to whom it can cross-sell products.

Moreover, the RBI has also lifted the ban imposed on KMB this quarter, which will help it grow personal loans and credit cards starting going forward, though at a slower pace due to stress in unsecured loans.

EY estimates that the mortgage market in India will double from $300 billion to $600 billion over the next five years as income levels rise, affordability improves and fiscal support is provided.

Despite this, mortgage penetration will remain at 13% of GDP, significantly lower than in China (18%) and the US (52%). KMB, being a premier bank, is expected to be a big beneficiary of this rising credit demand in coming years.

Steady deposit growth despite CASA ratio decline

KMB deposits have grown at a CAGR of 14% during the last five years to ₹4.5 trillion in FY24, up 24% from the previous year. This growth was commendable as the banking sector deposits grew marginally at around 13%, per CareEdge Ratings.

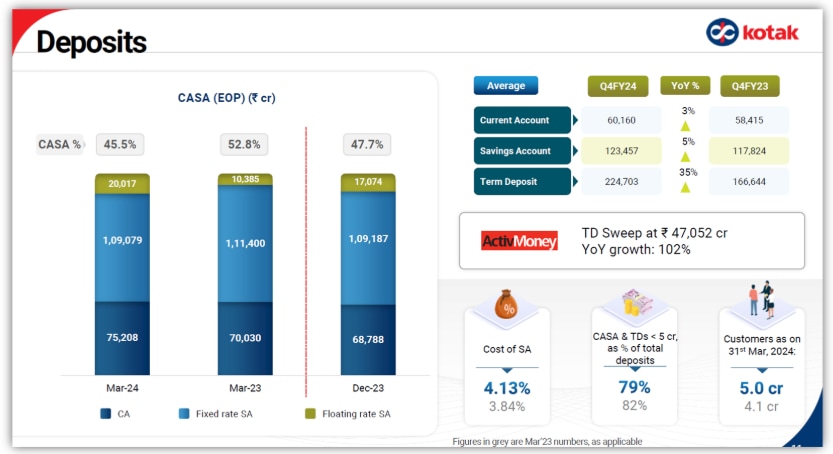

However, like the banking sector, Kotak struggled to attract low-cost current and savings account (CASA) deposits, which stood at ₹2.04 trillion.

KMB CASA deposits have grown at a CAGR of 8% over the last five years; however, the pace of SA growth has recently been challenging for the bank.

Notably, Kotak’s CASA ratio has been on a downward trajectory, after hitting a peak of 60.4% in FY21. This has declined to 45.5% in FY24.

A high CASA ratio helps banks lower their cost of funds and enables the engine to grow the asset book. As Kotak’s CASA deposits declined, the cost of funds to attract deposits has increased.

Thus, it is chasing the salary segment, where deposit rates are stable. Besides, the bank is looking to increase cross-selling to existing customers, as this will lower the marginal cost of acquisition and also help improve SA balances.

KMB CASA ratio declining, but term deposit grew strongly

As the bank struggled to attract deposits, it offered higher rates, increasing the cost of savings accounts by 0.29% to 4.13%. The bank also attracted deposits by offering higher rates on term deposits (TD).

Kotak term deposits stood at Rs 2.2 trillion in Q4FY24, growing 35% year-on-year (YoY). This growth was driven by the Kotak ActiveMoney TD sweep facility (offering a lower rate than term deposits but higher than savings accounts), which grew massively by 102% to ₹470 billion.

The sweep-in facility enables customers to link their existing fixed deposits with a current or savings account, thereby helping them earn higher rates on deposits swept from savings accounts.

Although deposit growth has slowed down due to the slowdown in the Indian economy, there are signs of improvement. According to Anand Rathi Research, deposit growth rose to 10.3% in January after a decline in December. This was led by a surge in time and demand deposits.

Moreover, following the recent stock market correction, retail investors are expected to park their savings in banks, which will help KMB recover low-cost CASA.

KMB net interest income and margins

KMB’s net interest income (NII) has grown at a CAGR of 18% to ₹337 billion during FY20-24, driven by strong loan book expansion, an improved net interest margin (NIM), and a higher share of retail loans.

Notably, the bank’s NIM reduced by 0.1% to 5.31% due to higher funding costs, a shift in the loan mix toward lower-yielding segments, such as secured retail loans, and a slowdown in unsecured lending.

However, RBI cutting interest rates may reduce KMB NIM. Usually, banks pass on the benefits of rate cuts to borrowers more quickly than to depositors. In such a case, the bank will first pass on the benefits of lower rates to borrowers.

However, deposit rates are already low, and the bank will find it challenging to reduce them due to the slowdown in deposit growth.

This is expected to minimise NIM in the future. However, to support margins, the bank has reduced rates by 0.5% in select SA buckets, which is expected to reduce its cost.

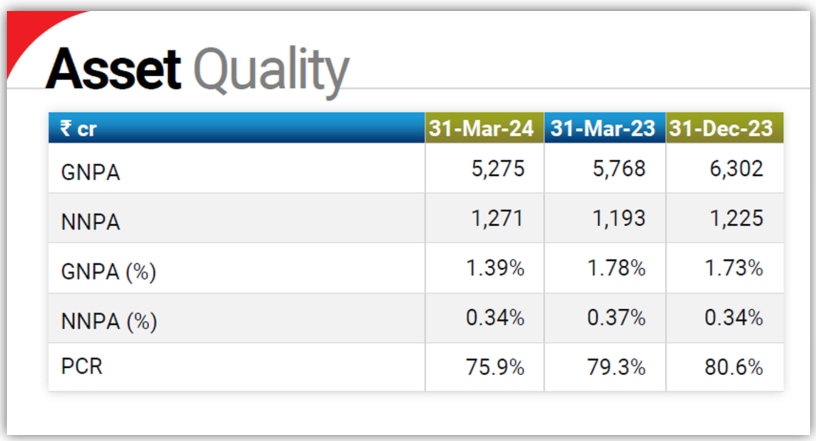

Pristine asset quality

The bank’s gross non-performing assets (NPA) stood at 1.39%, while its net NPA was 0.34%. This was lower than 1.78% and 0.37% in FY23, reflecting improved asset quality.

As a result, credit costs—provisions made for potential loan defaults—moderated to 0.45%, supported by loan recoveries, stable slippage and controlled provisioning.

The bank took a proactive stance and wrote off unsecured retail loans worth Rs 14.5 billion, which it extended in the fourth quarter.

Moreover, the bank’s provision coverage ratio stood at 75.9%, down 3.4% from the previous year. It raised its provision coverage to deal with rising stress in unsecured loans, which is not isolated to KMB but has been an industry-wide phenomenon.

Excellent asset quality with healthy provision coverage ratio

Looking ahead, the Bank is expected to be prudent in its underwriting approach, ensuring quality without compromising on standards.

Further, the Bank’s default rates in unsecured loans are favourable, with low credit costs. Thus, the bank is confident in its risk management stance concerning unsecured loans.

It aims to grow its unsecured lending book with mid-teen growth, ensuring full provision for anything overdue beyond 180 days. Bank credit costs – provisions that banks set aside for potential loan defaults – doubled to 0.4% from 0.17% in FY23.

The management noted reduced stress in personal loans, while stress in the MFI business increased, with signs of stress rising in the CV segment. Thus, KMB’s credit cost is expected to be higher in FY26, which will ease as the stress moderates.

Robust financials and resilient return ratios

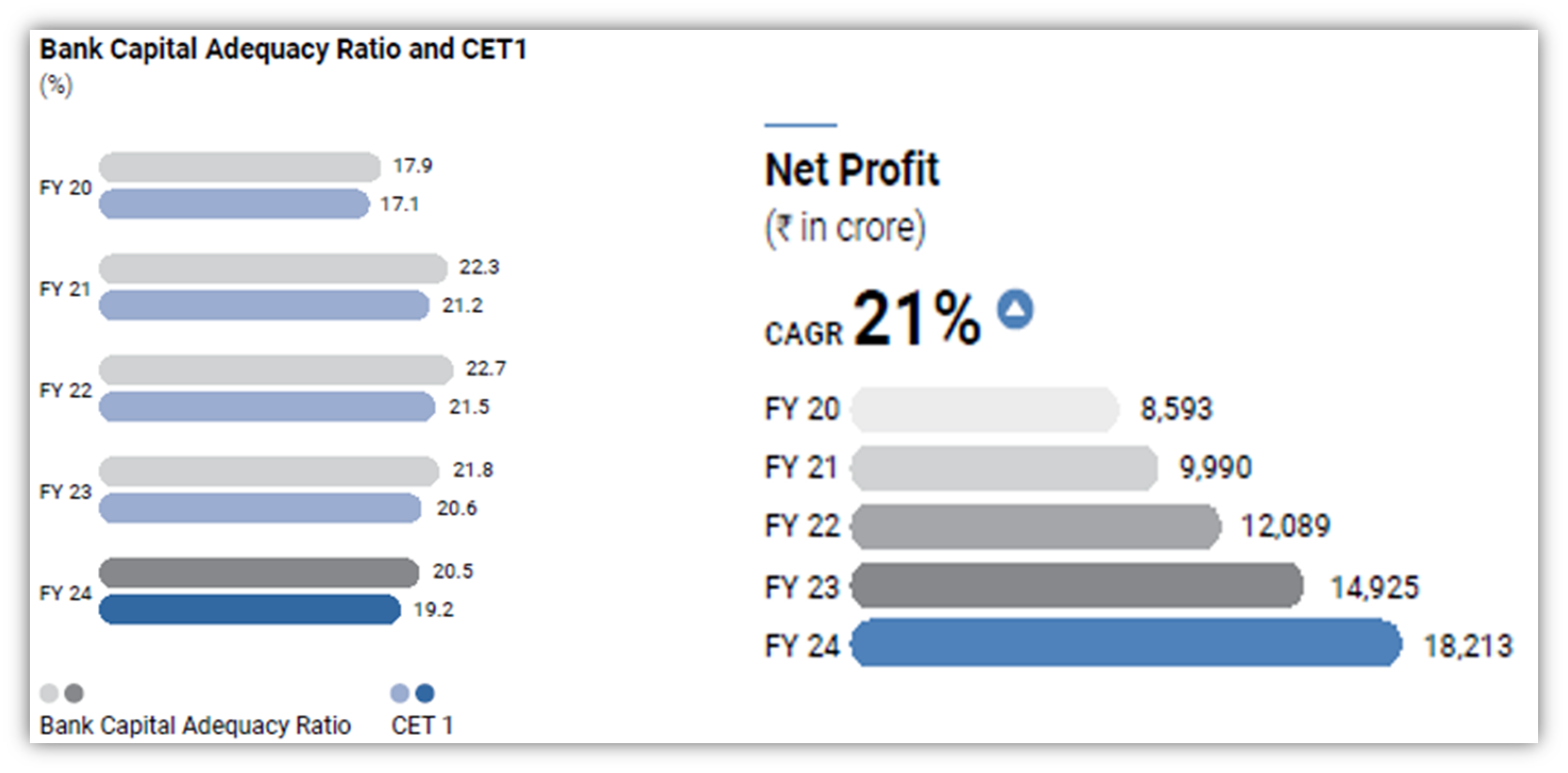

The bank’s net profit has grown at a strong 21% CAGR in the last 5 years to ₹182 billion in FY24, driven by healthy loan book expansion, strong growth in NII post, stable asset quality, and improving operating efficiencies.

KMB’s profit grew 26% over the past year. This was supported by a lower cost-to-income ratio – which compares operating expenses to total income – which fell to 45.9% from 48.2% in FY23.

This reflects KMB’s ability to generate higher revenue than its costs. Consequently, the bank’s return on equity (RoE) also increased to 15.3%, up from 14% last year.

Strong profit growth with a robust capital base

Moreover, KMB’s Capital Adequacy Ratio stands at a strong 20.5%, improving from 17.9% in FY20. On the other hand, its common equity tier 1 (CET 1) – the highest quality capital – ratio stood at 19.2%, better than 17.1% in FY20.

This strong ratio reflects the bank’s robust capital position, ensuring its ability to absorb risks and maintain financial stability. Moreover, the company expects the CAR/Tier-1 ratios to stabilise at around 22 levels.

Return on assets (ROA) measures how efficiently a bank generates profit from assets, including loans and investments. It stood at 2.61%, up 0.14% from last year, which shows the bank’s strong ability to generate returns.

Is KMB’s valuation finally looking reasonable

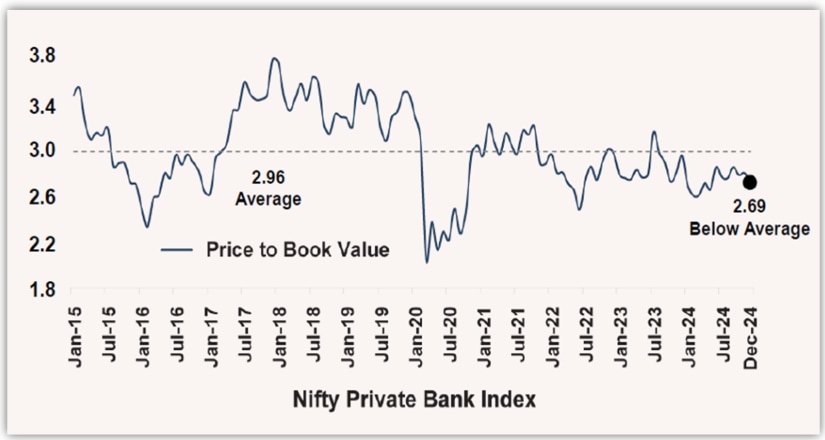

KMB’s valuation has moderated to a price-to-book (PB) ratio of 2.9, 36% lower than 10-year median PB of 4.5.

Relatively, it is trading at par with HDFC Bank, which has a PB of 2.9, and at a nearly 10% discount to ICICI Bank, which has a PB of 3.3.

However, ICICI’s performance has been more robust, leading to its valuation rerating. KMB has underperformed not because its performance has been subdued but because its valuation ran ahead of its time.

Nevertheless, its current valuation is still on par with that of the Nifty Private Bank Index, which means that while lower than the median, it’s still not very cheap compared to its peers.

KMB valuation on-par with nifty private bank index

HDFC Securities has set a target price of ₹2,040 at 2.2x Sep-26 adjusted book value per share, which is just 5% upside from the current market price of ₹1,940, factoring in higher credit costs.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

You can connect with Madhvendra on LinkedIn to explore his insights more and engage in meaningful discussions.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.