The Indian Artificial Intelligence (AI) market in India is expected to grow to over US$ 17 billion (bn) by 2027, according to Boston Consulting Group.

The market will more than triple from its current size, driven by increased investments in enterprise technology, a flourishing digital ecosystem, and a strong pool of skilled professionals. Some companies are likely to benefit from this growth.

Here are 3 stocks associated with the AI industry that stand to gain. We have shortlisted these stocks from the Equitymaster Stock Screener.

#1 Persistent Systems

First on our list is Persistent Systems.

Persistent Systems is actively involved in artificial intelligence (AI), particularly in generative AI (GenAI).

The company has strategic partnerships with major AI platform providers such as Google Cloud, IBM, AWS, and Microsoft to drive adoption and develop industry-specific AI solutions across sectors like banking, healthcare, insurance, telecom, and technology.

It has initiated initiatives like the GenAI Hub to accelerate enterprise AI integration, and it invests in AI skill development and platforms, including AI-driven software engineering tools and AI for business platforms.

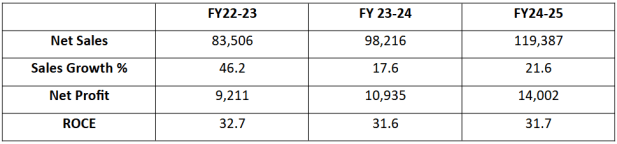

Persistent Systems Financial Snapshot (FY23 to FY25)

On the financial front, the company reported revenues of Rs 33,336 m in Q1 FY26, which was much better than Rs 27,372 m in the corresponding period of last year. The net profits of the company too kept pace with increased revenues rising to Rs 4,249 m in Q1 FY26, as against Rs 3,064 m YoY.

Looking ahead, with well-diversified client base across several key industries, risk of a slowdown reduces.

While there may be some headwinds in specific sectors (e.g., a reported decline in the healthcare vertical), the broad client portfolio helps maintain resilience.

Persistent Systems is poised for future growth driven by its strategic investments in AI, cloud, digital engineering.

#2 Cyient

Next on our list is Cyient.

The company is a global engineering and technology solutions company. It collaborates with customers to design digital enterprises, build intelligent products and platforms, and solve sustainability challenges.

Cyient is actively involved in AI. The company integrates AI and Generative AI (GenAI) extensively across its engineering, manufacturing, supply chain, compliance, and more.

It has developed an internal GenAI platform called CyAI which automates service delivery, supports CAD modeling, predictive maintenance, and diagnostics, and enhances productivity through deep integration with robotic process automation (RPA) and enterprise systems.

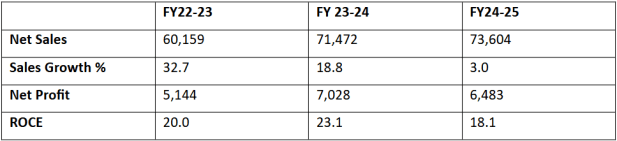

Cyient Financial Snapshot (FY23 to FY25)

On the financial front, the company reported consolidated sales of Rs 17,118 m in Q1 FY26, against Rs 16,757 m in the corresponding period of last year. Cyient reported a net profit of Rs 1,599 m in Q1 FY26, against Rs 1,476 in Q1 FY25.

Through strategic investment and cooperation, Cyient is developing state-of-the-art application-specific integrated circuit (ASICS) that includes AI for applications in motor vehicles, industrial robotics and power distribution.

In mid -September 2025, Scient Semiconductors announced a strategic partnership with anora, a global provider of semiconductor tests, tests and verification services.

Overall, Cyient is expected to capitalise on emerging market demands for engineering innovation, AI-powered solutions, and smart manufacturing.

#3 Affle 3i

Affle 3i is a global technology company that has a consumer intelligence platform that focuses on mobile advertising.

The company helps marketers acquire, engage, and drive transactions with users by transforming ads into recommendations. It uses AI and machine learning to provide consumer insights, analytics, and targeted advertising solutions.

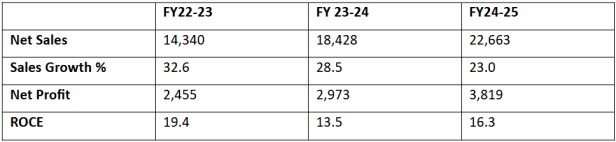

Financial Snapshot (FY23 to FY25)

On the financial front, the company reported consolidated sales of Rs 6,207 m in Q1 FY26, against Rs 5,195 m in the corresponding period of last year. Affle 3i reported a net profit of Rs 1,055 m in Q1 FY26, against Rs 866 m in Q1 FY25.

Moving ahead, Affle 3i says that it will embed intelligence deeper across its platform stack, scale its product innovations, extend its differentiated CPCU model to new verticals and deliver compounding shareholder returns through consistent top-line growth, operating leverage and strong cash flow.

Affle 3i appears to be well-positioned for future growth due to favourable industry trends, a strong business model, and a clear strategic vision.

Conclusion

The AI industry in India is growing rapidly and has a huge potential for technical leadership. India is ready for a global AI powerhouse driving productivity, economic flexibility and social progress.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.