2025 has been rough on the markets.

The bullish sentiment of 2024 has fizzled out, replaced by concerns over inflation, weak demand, and focus on profitability. Stocks that soared in 2024 have come crashing down and investors are struggling to find direction.

But while the broader market looks shaky, some businesses have quietly strengthened their fundamentals. Companies that once faced margin pressures have streamlined operations, improved cash flows and adapted to changing industry dynamics.

Some have gained market share, diversified revenue, or tapped into new growth avenues. Yet, their stock price remains beaten down.

For those willing to look beyond the short-term noise, these businesses could be poised for a strong comeback.

Here are five stocks that could soar again in 2025.

#1 Archean Chemical

First on our list is the Archean Chemical

Archean Chemical Industries is India’s first integrated player in industrial salt, bromine and sulfate of potash. With a strong global presence, the company has built a reputation for reliable deliveries and long-term partnerships.

Archean Chemicals has seen a mixed performance over the past few quarters. While bromine demand remained strong, salt volumes were inconsistent due to logistical challenges, impacting overall performance.

Earnings were under pressure as industrial salt sales declined and weaker realizations further weighed on margins. Delays in the commercialization of bromine derivatives and the Oren Hydrocarbon acquisition also dampened sentiment.

However, going forward, salt volumes are expected to recover as logistical issues have been resolved. Bromine sales have been steady, supported by higher realizations. The company is also ramping up bromine derivatives, which should start contributing meaningfully from next year.

The Oren Hydrocarbon acquisition adds another growth driver, with facilities set to restart soon. This expansion strengthens Archean’s position in the oil and gas drilling space.

With a focus on scaling up bromine derivatives and expanding into higher-value segments, Archean is gradually moving beyond its commodity business. The stock has multiple triggers for a strong performance in 2025.

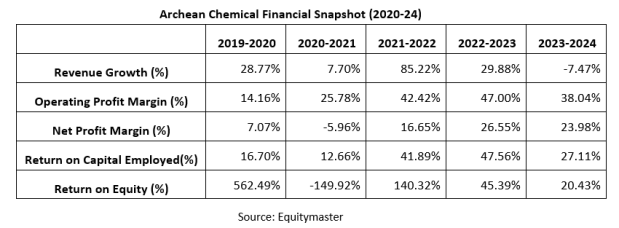

Archean Chemical Financial Snapshot (2020-24)

The business has also improved over the years. Between 2020-2024, the sales have reported a 5-year CAGR of 30.5% and the company has been profitable for three years in a row now.

The 5-year average Return on Equity (RoE) and Return on Capital Employed (RoCE) stand at 38% and 68%, respectively.

For more details, check out Archean’s financial factsheet.

Bottom of Form

#2 Nuvama Wealth

Next on our list is Nuvama Wealth

Nuvama Wealth has been steadily expanding its presence in India’s wealth management space, positioning itself as a key player across multiple segments.

From Ultra High Net Worth Individual (UHNI) and mid-segment wealth management to custody, clearing and asset management, the company has built a diversified business model.

While recent investments in scaling up operations have impacted short-term margins, it set the stage for long-term growth.

Nuvama has been going through a transition phase, with investments in talent, technology and product expansion weighing on near-term margins.

The company has been aggressively scaling its wealth and asset management businesses, adding relationship managers and expanding into new cities. This has led to a short-term rise in costs, but the payoff should be meaningful as AUM scales up.

The wealth segment has seen strong client acquisitions, with a focus on increasing the share of managed products. While this has temporarily pressured margins, operating leverage should kick in as volumes grow.

The asset management business, primarily focused on AIFs, has also been gaining traction. As funds scale up, profitability in this segment should improve.

Another bright spot has been the custody and clearing business, benefiting from increasing activity by FPIs and AIFs. With India’s capital markets continuing to deepen, this segment remains a steady growth driver.

Looking ahead, 2025 could be a strong year for Nuvama. The company’s investments in expanding its wealth and AMC businesses should start yielding results, leading to better margins.

Meanwhile, the broader industry tailwinds—rising financialization of savings, growing investor participation, and digital adoption should provide structural support.

With improving profitability, strong AUM growth and a diversified business model, Nuvama is well-placed for a strong comeback. The stock remains an attractive bet on India’s fast-growing wealth management industry.

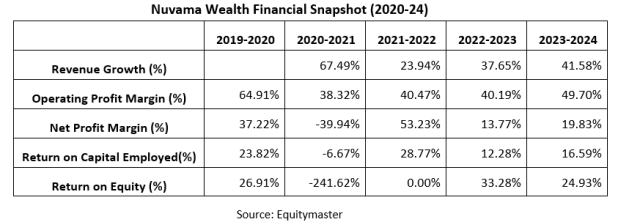

The company has done well in the past. Between 2021-2024, the sales and net profits have grown at a 4-year CAGR of 41% and 21.9%, respectively. The RoCE and RoE have registered a 5-year average of 19.7% and 19.4%, respectively.

#3 Ahluwalia Contracts

Third on our list is Ahluwalia Contracts.

Ahluwalia Contracts is a leading player in the construction industry, specializing in civil engineering and infrastructure projects across various sectors, including residential, commercial and institutional buildings.

Its impressive clientele includes central and state governments, PSUs, renowned business houses, and real estate developers.

Given the government’s focus on infrastructure development in the coming budget, Ahluwalia Contracts is expected to benefit from increased project tenders, particularly in the urban development and affordable housing sectors.

The company has faced execution challenges due to certain bans and delays in project design, which have slowed revenue growth. Weaker margins and higher costs have also weighed on performance. As a result, the company has scaled back its growth expectations for the year.

That said, the outlook remains strong. Execution of key projects, including the CSMT redevelopment, is set to pick up in the coming months.

Ahluwalia has a robust order book and new project inflows continue at a healthy pace. With major contracts moving into the execution phase, revenue growth should rebound and margins are expected to recover.

Moreover, it’s asset-light model and strong balance sheet provide stability and the business remains well-positioned for a turnaround.

The stock has corrected in recent months, but improving execution and margin recovery could drive a strong comeback in 2025.

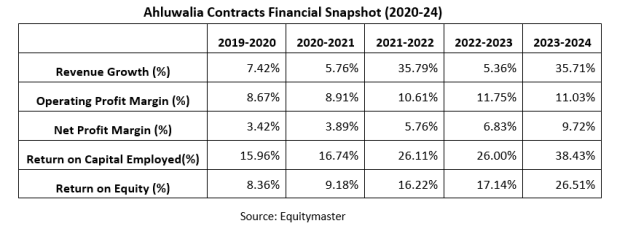

Ahluwalia Contracts Financial Snapshot (2020-24)

Ahluwalia Contracts achieved a solid 5-year CAGR of 24.6% in revenue and 69.2% in net profit. The company’s financials are strong, with an average RoCE of 30.9% and RoE of 19.5%.

#4 Cello World

Fourth on our list is Cello World.

Cello World, a leading consumer houseware brand, has built a diverse portfolio across plastic, glassware and writing instruments. Its writing segment, re-entered in 2019 under Unomax, now contributes 17% of revenue with industry-best margins (25.8% EBIT).

Despite strong fundamentals, the stock has underperformed due to weak exports (40% of segment revenue), hit by geopolitical tensions and shipping disruptions in the Red Sea.

Domestic growth remains strong, but Cello’s distribution reach of 1,522 distributors is still well below competitors like Flair and Linc. This has limited near-term scalability.

However, the company is actively expanding its network, aiming to reach 0.2 million retail outlets by FY26. New product launches, premiumization and diversification into new export markets should offset past challenges.

Additionally, the Rajasthan glassware plant will enhance efficiency and drive growth in a high-margin category.

The company is leveraging global brands like Disney and Marvel to enhance visibility and its premium portfolio. In writing instruments, it’s expanding higher-end offerings to capture more market share.

With cost control, stable exports, and domestic growth, Cello World looks poised for a strong 2025.

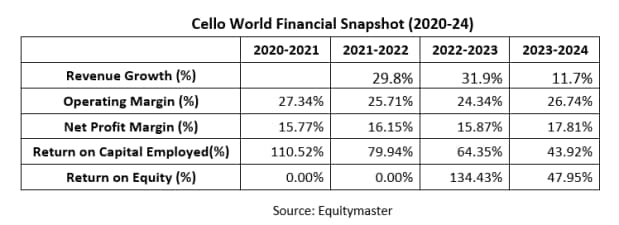

Cello World Financial Snapshot (2020-24)

Between 2021 and 2024, the company reported a 3-year CAGR of 24.8% in sales and 29.6% in net profit. Its return ratios remain strong, with average RoCE and RoE exceeding 62% and 60.2%, respectively.

#5 Vijaya Diagnostics

Last on the list is Vijaya Diagnostics.

Vijaya Diagnostic Centre Limited is a trusted name in India’s healthcare sector, offering high-quality diagnostic services at reasonable rates.

With over 155 centres in Hyderabad and a growing presence across multiple cities, the company has built a reputation for accuracy, reliability and innovation in medical diagnostics.

Vijaya is well-positioned for a strong 2025, driven by aggressive expansion, industry-leading footfall growth and solid financial flexibility. Patient footfalls grew 15%, fuelling a 20% organic revenue surge (ex-PH), reinforcing its leadership in diagnostics. Its B2C revenue mix remains robust at 93%, with an increasing share from high-margin wellness services.

Expansion is a key focus, with six new hubs set to be operational in the next three months across Bengaluru and Pune—two high-growth markets.

The company is also strengthening its presence in Andhra Pradesh, Telangana, and Kolkata. Non-core markets like Bengaluru and Pune are expected to reach EBITDA breakeven within a year, minimizing margin impact.

Despite near-term cost pressures, Vijaya maintains industry-leading EBITDA margins of nearly 40%. With Rs 1 bn+ in annual free cash flow and a Rs 2 bn cash surplus, it has ample room for growth. Mid-to-high teen revenue growth and strong profitability make Vijaya a compelling turnaround story for 2025.

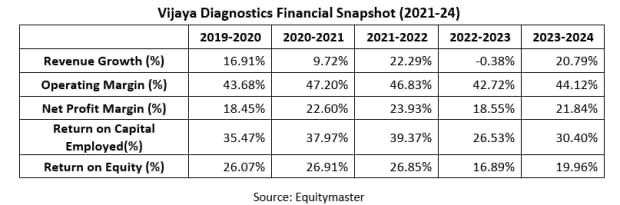

Vijaya Diagnostics Financial Snapshot (2021-24)

The company delivered a solid 5-year CAGR of 13.6% in revenue and 20.2% in net profit. The company’s financials are strong, with an average RoCE of 32.9% and RoE of 21.5%, respectively.

In Conclusion

The market never runs out of opportunities, but picking the right stocks at the right time is what separates winners from the rest.

These five stocks have already shown resilience and strong business momentum, setting the stage for another potential breakout in 2025.

However, investors must keep a close eye on their operational performance, ability to scale, and corporate governance.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.