India’s electricity demand is steadily increasing, driven by shifts in energy consumption across homes, industries, and digital infrastructure. In FY25, peak power demand touched a record 250 GW—up nearly 70% over the past decade—driven by factors like industrial expansion, wider access to electricity, and greater use of appliances such as air conditioners.

Cooling needs alone are expected to play a significant role in future demand. The International Energy Agency (IEA) estimates that air conditioners contributed around 60 GW to peak load in 2024 and could account for nearly a third of total demand by 2050. Meanwhile, the growing footprint of data centers and the broader adoption of AI are also likely to push up power consumption.

To meet this shift, India will need substantial investments in its power infrastructure. Analysts at Motilal Oswal estimate a ₹40 trillion capex opportunity over the next decade, with a focus on transmission, grid upgrades, and the integration of renewable energy.

In this context, we have selected three power sector stocks that are well-positioned to benefit. Let’s take a look..

#1 Voltamp Transformers

Voltamp Transformers is engaged in the manufacturing of electrical transformers.

Its product portfolio comprises oil-filled power and distribution transformers up to 160 megavolt-ampere (MVA) and 220 kilovolts (KV) class, as well as dry-type transformers up to 12.50 MVA and 33 KV class. Its total installed capacity stands at 14,000 MVA.

Voltamp has a diversified customer base of over 1,000 customers across various industries, including power, oil refineries, textiles, chemicals, real estate, automobiles, infrastructure, and steel.

The company has maintained long-term relationships with many of these customers, which helps it secure repeat orders. In recent years, most of its sales have come from private sector clients, with limited exposure to state-owned power utilities, which tend to have longer receivable cycles.

Margins Under Pressure Despite Strong Growth

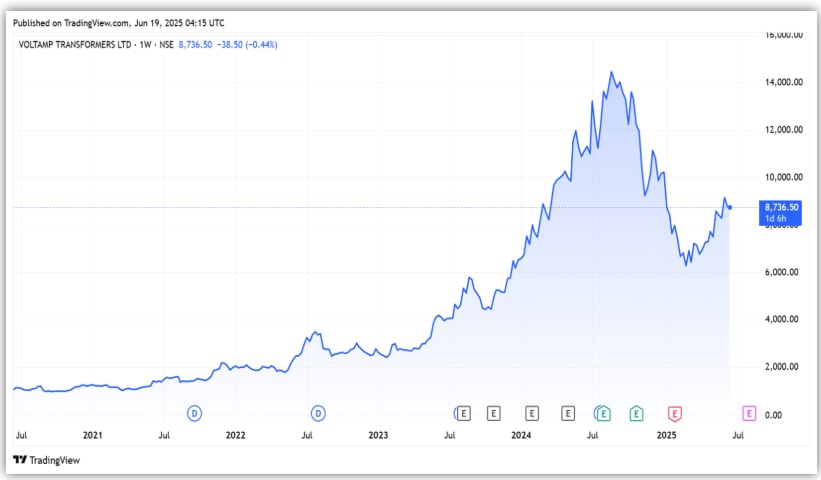

In FY25, revenue grew 20% from last year to ₹19.3 billion, driven by strong transformer demand. However, net profit grew only 6% to ₹3.3 billion, as margins fell 101 basis points to 18.9%. The company is now operating at 100% capacity, up from 93% in FY24, 85% in FY23, and 80% during FY22.

Order Book Visibility Low, Expansion in Pipeline

As of March 2025, Voltamp’s order book stood at ₹11.3 billion, providing revenue visibility for only about six months. The company is taking fewer orders due to capacity constraints. That’s why it is selecting orders with execution periods of less than 9 months.

It aims to achieve 100% capacity utilisation in FY26, and remains confident of securing profitable orders. To alleviate the capacity bottleneck, the company is undertaking capital expenditures (CAPEX), which are expected to increase its current capacity by approximately 43%. The enhanced capacity is expected to be operational in Q1FY27.

However, margins are expected to normalize in the future due to a high base and rising competition. The company’s outlook remains positive, given the strong demand for transformers from sectors such as data centers and green energy.

From a valuation perspective, it trades at a price-to-equity (P/E) multiple of 27x, at a premium to the 10-year median of 17x. But, it’s significantly lower than its peak P/E of 45x.

Voltamp Transformers Share Price Up 7x in the last 5 years

#2 GE Vernova T&D

GE Vernova is a part of the GE Vernova Group, a global energy giant that operates in the power sector. This strong parentage offers access to advanced technology and a broader client base, thanks to its international presence.

It is engaged in the manufacturing of transmission equipment, including transformers, switchgears, control panels, relays, and line traps. It provides transmission systems, comprising substations ranging from 66 kV to 1,200 kV.

The company primarily operates in the high-voltage space (440 kV and 765 kV), a segment with established players such as Siemens and ABB. It caters to power generation and transmission companies and industrial end-users.

Strong Financial Performance and Robust Order Book

From a financial standpoint, revenue increased 35% from last year to ₹42.9 billion in FY25. 72% of revenue came from the domestic market, and the rest came from exports. Net profit jumped 3.1 times to ₹8.2 billion, as the margin almost doubled to 19% from 10% in FY24.

The company’s order backlog stood at ₹126.6 billion, providing revenue visibility for about three years. 62% of orders are from the private sector, 34% from central utilities companies, and 4% from state utilities.

Positive Outlook Backed by Sector Tailwinds

Looking ahead, the management remains optimistic on multi-year growth. It expects a large opportunity from the data center. It is currently executing several 22 kV projects for data centers. Although these orders are small, it expects to grow its share as large data centers (400/765 kV) come online.

The company also sees strong demand from satellite communication as renewable energy penetration rises. It states that its global expertise will enhance its technological capabilities in this space. It also expects to benefit from the green energy transition in export markets like Europe, Australia, and the Middle East.

To cater to the demand, it also plans to invest about ₹2.5 billion to expand its manufacturing capacity. It also plans to invest ₹14 billion in a manufacturing line for high-voltage direct current Thyristors and voltage source converter valves.

From a valuation perspective, it trades at a P/E multiple of 100x, at a premium to the 10-year median of 81x.

GE Vernova Share Price Up 31x in the last 5 years

#3 Hitachi Energy

Hitachi Energy provides products, systems, software, and service solutions across the power value chain. The portfolio encompasses a diverse range of high-voltage products, transformers, grid automation solutions, power quality products, and systems.

Strong Growth Across Most Verticals in FY25

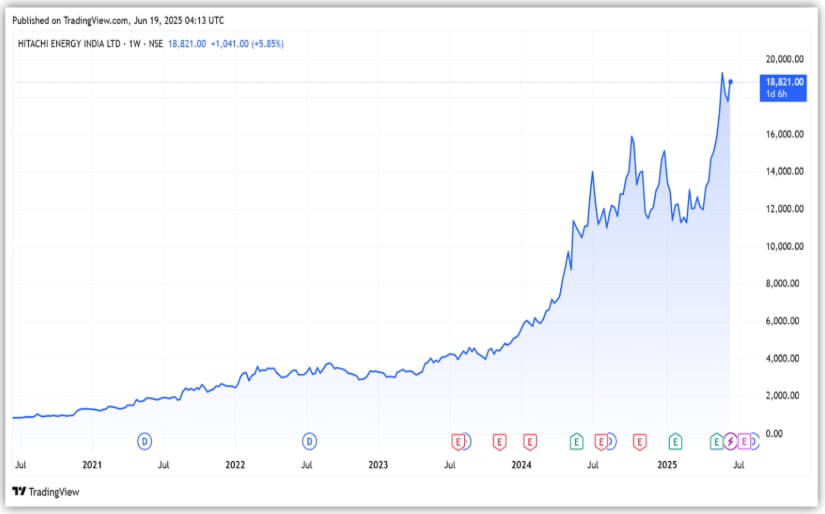

In FY25, revenue increased by 23% to ₹64.8 billion, driven by solid order execution. The company experienced overall growth across all verticals. Transmission grew 750%, followed by renewables (107%), and data centers ( 36%). In contrast, railways and metros lagged, falling by 33%.

Net profit grew 134% to ₹3.8 billion, while margins expanded by 250 basis points to 9.2%. A better product mix also contributed to the improved profitability. The company became debt-free at the end of the last quarter, which helped reduce its finance costs.

Order Backlog, Expansion Plans

Looking ahead, the order backlog stood at ₹192.5 billion, providing revenue visibility for about three years. A new service business unit became fully functional in April, aimed at strengthening this segment and exploring potential opportunities.

The services segment accounted for approximately 7.4% of total orders. The company expects investments of about ₹1 trillion over the next two financial years, driven by data centers and railway modernisation. It has also raised ₹25 billion through qualified institutional placements. One-third of the proceeds are planned for expansion.

From a valuation perspective, it trades at a P/E multiple of 215x, at a premium to the five-year median of 178x.

Hitachi Energy Share Price Up 21x in the last 5 years

Conclusion

Power demand is not only driven by rapid urbanisation, but the primary demand driver will come from data centres and artificial intelligence. Deloitte, in its report “Attracting AI Data Centre Infrastructure Investments in India,” has stated that India will require 40-45 terawatt-hours (TWh) of additional power to meet the expected demand for data centers by 2030. This will require large-scale infrastructure upgrades, transformers, etc.

These companies are among the leading players in this sector and are expected to be the primary beneficiaries. However, it is always beneficial to study the business, risks, and future growth potential.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.