In equity investments, investor psychology often plays a more decisive role than fundamentals. Following geopolitical tensions between India and Pakistan, the recent surge in defence stocks offers a textbook example of this dynamic. With rising expectations that Indian defence companies may secure international contracts post-conflict, the sector has become a magnet for speculative interest.

But in times like these, it is important to ask – Are you investing with insight or simply following the herd?

When dramatic events unfold, such as a military standoff, markets tend to overreact. Investors rush in, fearing they will miss out on potential gains, pushing up prices and volumes. This behaviour, known as the herd mentality, stems from a basic psychological trigger: Fear Of Missing Out (FOMO).

While this may offer short-term rewards, the long-term risks can be severe. Herd-driven rallies often end in steep corrections once the excitement fades or reality checks in. Investors who buy near the top, influenced by the noise, are often left holding depreciating assets.

To evaluate whether the recent volume spurts in defence stocks are signs of sustainable trends or warning signals of a herd-induced bubble, we analysed three stocks showing volume increases of more than 200% over their 20-month average. Here’s a closer look at three such names:

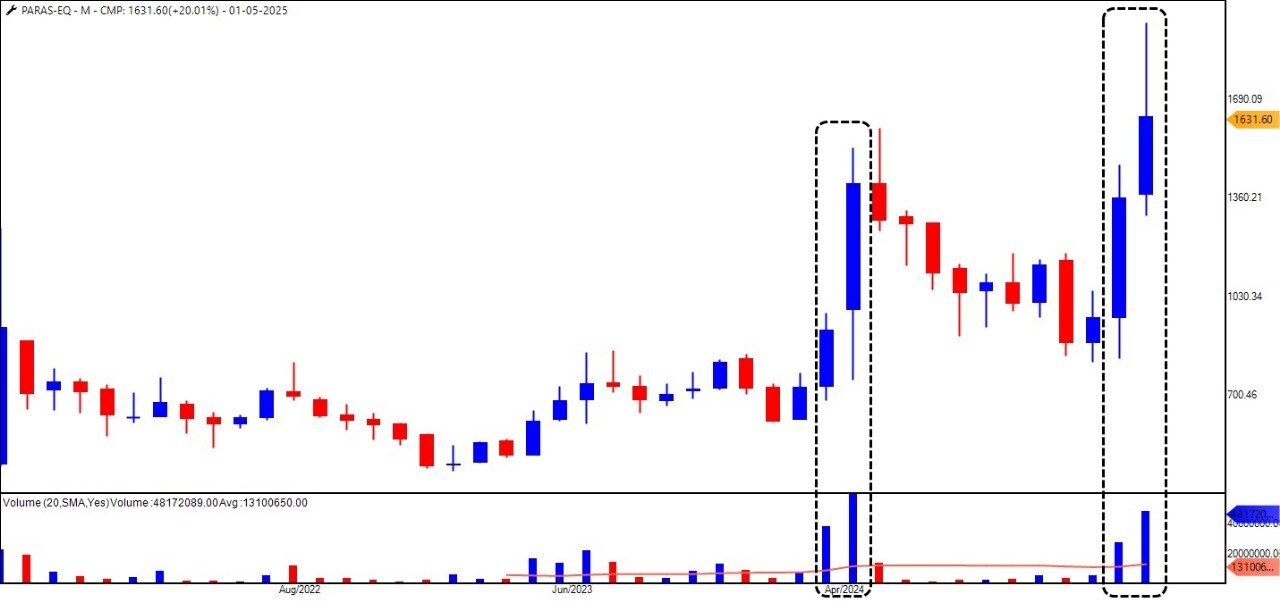

1. Paras Defence and Space Technologies Ltd

Paras Defence specialises in defence and space optics, EMP protection, heavy engineering, and niche technologies tailored for national security needs. It plays a critical role in India’s indigenous defence manufacturing ecosystem.

Source: TradePoint

The stock saw a sharp rally from ₹1,301 to ₹1,945, only to correct back to ₹1,650, a decline of nearly ₹300 from the highs. This suggests that profit-booking is taking place.

The volume is 267% higher than its 20-month average, and the price corrects from high. An unusually large spike often signals a potential distribution phase rather than accumulation. A similar pattern occurred in 2024, which preceded a bearish trend over subsequent quarters.

If history doesn’t repeat, it often rhymes. Unless the stock takes out the current month’s high, it is best to resist the psychological pull and avoid buying into euphoria.

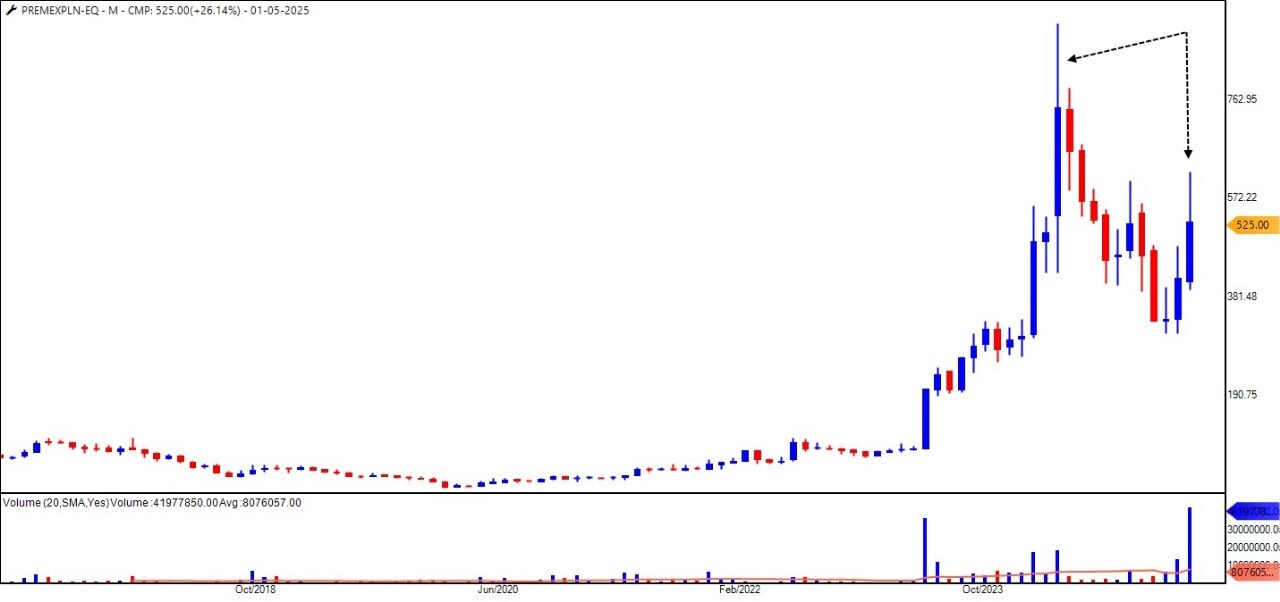

2. Premier Explosives Ltd

Premier Explosives is a prominent player in manufacturing solid propellants, explosives, and defence pyrotechnics. It supplies critical inputs to ISRO, DRDO, and other defence establishments, placing it at the heart of India’s strategic deterrence capabilities.

Source: TradePoint

The stock experienced a 400% surge in monthly volumes, a potential signal of a price-volume breakout. However, the price corrected 15% from its high, even after a 49% intra-month rally.

Such divergences between volume and price suggest that bulls are cautious and possibly squaring off their positions, rather than entering new ones.

While the overall structure remains technically bullish, the correction from the highs indicates a lack of conviction. This is not the moment to follow the crowd; wait for price stability before considering exposure.

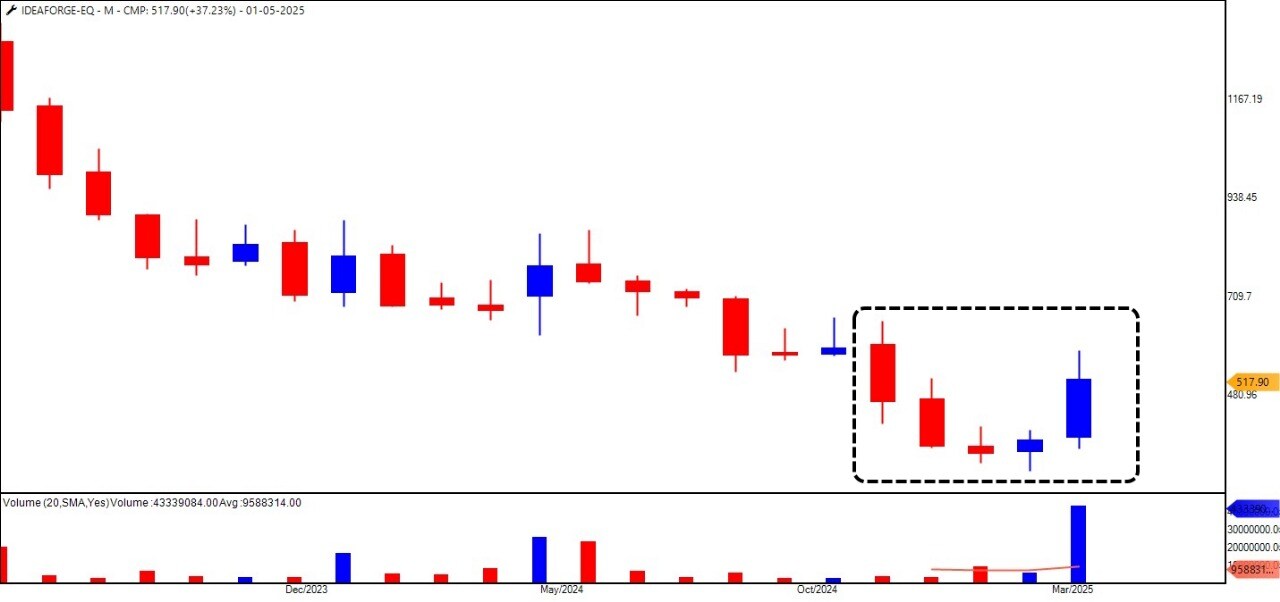

3. IdeaForge Technology Ltd

IdeaForge is a leading manufacturer of Unmanned Aerial Vehicles (UAVs) and surveillance drones, supplying to defence, homeland security, and industrial clients. It was one of the most anticipated defence tech IPOs of 2023.

Source: TradePoint

After its July 2023 listing, the stock saw a 75% drawdown from its highs, a punishing decline that shook investor confidence. However, the current month has seen the highest volume since listing, suggesting a possible bottoming-out process.

The last four-month pattern hints at a Frying Pan candlestick formation, a classic bullish reversal signal, but only if the stock breaks above this month’s high.

The stock is in a wait-and-watch phase. It might signal a trend reversal if it confirms a breakout above the current month’s high. Until then, jumping in early could be premature.

Think Independently, Act Rationally

In moments of heightened market enthusiasm, particularly when driven by geopolitical events, the rational investor can step back, analyse the facts, and resist emotional decision-making.

As Benjamin Graham, the father of value investing, once said:

“The investor’s chief problem and even his worst enemy is likely to be himself.”

The volume surges we are seeing are not necessarily signs of strength. They could be signs of distribution, as smart money exits while retail chases the headlines. Avoid the herd. Stick to the process. And remember, every war rally eventually gives way to reality.

Disclaimer:

Note: We have relied on data from http://www.definedgesecurities.com throughout this article. Only in cases where the data was unavailable have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with UTI, Asit C Mehta, and Edelweiss Securities. Presently, he is an analyst at Definedge.

Disclosure: The writer and his dependents do not hold the Stocks discussed in this article. However, clients of Definedge may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.