In a market like India, where investors are looking for the next big things, the super investors of India, or as we call them, the Warren Buffett of India almost always give something to the investor circles to be gossipy or worried about. After all, they are widely followed by many investors who are looking for their next big bet.

Two of such Warren Buffets of India, Ashish Kacholia (Holds 49 stocks word Rs 2,750 cr) and Mukul Agarwal (Holds 62 stocks worth Rs 6,700 cr) have just added two fresh manufacturing stocks to their portfolio. No wonder the ones following them have been trying to find out all about these two moves.

Let us try and find out everything we can about these two new favourites of Kacholia and Agarwal.

Gujarat Apollo Industries Ltd

Incorporated in 1986, Gujarat Apollo Industries Ltd manufactures different types of Mining & Road Construction and Maintenance Machinery.

With a market cap of Rs 442 cr, Gujarat Apollo Industries is a flagship company of the Apollo group

of Industries, offering crushing and screening solutions to industries like quarries, mining, construction, and recycling.

India’s Warren Buffett Ashish Kacholia just bought a 1.1% stake in the company worth around Rs 5 cr as per the exchange filings made by the company for the quarter ending June 2025.

The sales of the company grew at a compounded growth rate of 9% from Rs 26.5 cr in FY20 to Rs 41.6 cr in FY25.

When it comes to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), the company hasn’t made any operating profits in at least the last 10 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | -6.78 | -11 | -3.68 | -5.11 | -1.91 | -13.7 |

Also, in the case of net profits as well, the company hasn’t seen much success in the past years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profit/Cr | 13.58 | 44.6 | 8.18 | 12.47 | 11.33 | 2.34 |

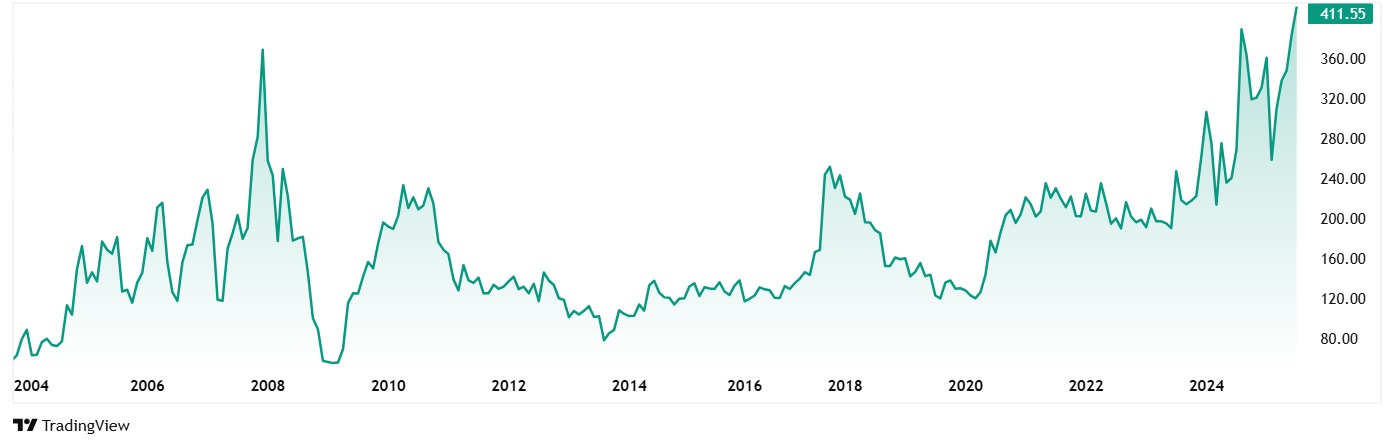

The share price of Gujarat Apollo Industries Ltd was around Rs 185 in July 2020 and as on 14th July 2025, the price was Rs 412. That’s a growth of 123% in 5 years. Rs 1 lac invested in the stock 5 years ago would have been around Rs 2.3 lacs today.

The stock is trading at a PE of a 208x which is much higher than the current industry median of 38x. The 10-Year median PE of Gujarat Apollo Industries is however a modest 15x while the industry median for the same period is 27x. It is however trading at 1 time its book value.

There are no significant FII (Foreign Institutional Investor) or DII (Domestic Institutional Investor) in the company and the promoter holding has also dropped by almost 5% between June 2024 and June 2025.

Monolithisch India Ltd

Incorporated in 2018, Monolithisch India Ltd is a manufacturer of premixed high-quality ramming mass.

With a market cap of Rs 1,024 cr Monolithisch is in the business of manufacturing and supply

of specialized ramming mass, a heat insulation/lining material used as a refractory consumable for Induction furnaces installed in iron, steel, and foundry plants. The company also undertakes trading activities occasionally to meet excess and urgent customer demands.

The company was recently listed in June 2025 and ace investor Mukul Agarwal bought a 2.3% stake in the company worth almost Rs 24 cr.

The sales of the company have grown at a compounded rate of 81% from Rs 5 cr in FY20 to Rs 97 cr in FY25. EBITDA jumped from Rs 1 cr in FY20 to Rs 21 cr in FY25, logging in a compound growth of 84%.

As for the net profits, the company has shown tremendous potential as it has jumped from no profits in FY20 to net profits of Rs 14 cr in FY25, which is a compounded growth of 114%.

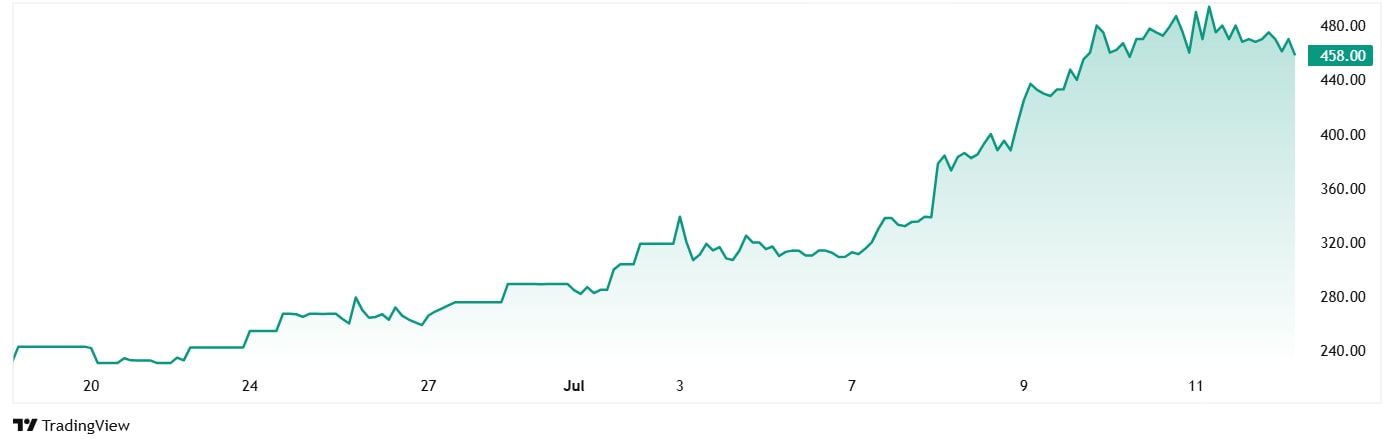

The share price of Monolithisch India at listing in June 2025 was around Rs 243, and as of 14th July 2025 the price was at Rs 471, which is a jump of almost 94% in just about a month of listing. Just Rs 50,000 invested in the stock a month ago would have been close to the double, almost Rs 1 lac today.

The company’s stock is trading at a PE of 71x, while the industry median is 25x. The 10-Year median PE for the industry is again 25x, which we will have to wait and see how Monolithisch fares against in the long term.

One of the strongest points to consider when looking at Monolithisch is that it has a current ROCE (Return on Capital Employed) of 61%, which means it is making Rs 61 in profits on every Rs 100 it invests as capital in the business. The industry median ROCE when compared to peers is about 16%, which means Monolithisch is doing a better job of making profits from capital investments than its peers.

Buy or Add to Watchlist?

Mukul Agarwala and Ashish Kacholia are two of the most respected and followed super investors of India and hence deserve a spot in our list for the Warren Buffetts of India. They are known for their stock picking skills which almost always result in making their bank accounts a bit heavier than it was. No wonder the changes they make to their portfolios cause ripples across the board and a topic of discussion amongst investors.

So, their latest picks, Gujarat Apollo Industries Ltd and Monolithisch India Ltd have gotten the attention of their fellow super investors as well as the common investor. While Kacholia’s stake in Gujarat Apollo raises some valid question given the company’s dwindling financials, Agarwal’s pick in Monolithisch is seen by most as a strong move.

How these two stocks will do in the months and years to come will now be something to look at. For now, it would be a safe bet to add them to a watchlist and watch them closely, as we wait for the strategy behind Kacholia and Agarwal’s picks to be revealed.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.