India as we know it is stepping into a new era. With strong aspirations, the government is investing heavily in Defence and rightly so, given that geographically India is surrounded by known foes. With the government earmarking almost Rs 700,000 cr as the Defence budget, it’s only clear that the sector will be backed by them for a stronger future.

At such a time, 2 defence shipping companies in the government arsenal, where the President of India holds major promoter stakes, are getting attention from smart investors. Both the companies boast of good profit growth, a strong return on capital employed and gains of over 800% in the last 5 years.

The icing on the cake is that both these companies have super strong order books of over Rs 21,000 cr and are both in the phase of fast capacity and capability scale up. Add to it that both of them are trading at discounts from their all-time high prices. No wonder they are attracting attention. What should be the next course of action for investors?

Smooth sailing to the future – Garden Reach Shipbuilders & Engineers Ltd

Incorporated in 1934, Garden Reach Shipbuilders & Engineers Ltd is a premier shipbuilding company in India under the administrative control of the Ministry of Defence, primarily catering to the shipbuilding requirements of the Indian Navy and the Indian Coast Guard.

With a market cap of Rs 27,775 cr, the company is a diversified, profit-making and the first Shipyard in the country to export warships and deliver 100 warships to the Indian Navy and Indian Coast Guard.

The President of India holds 74.5% stake in the company through the Ministry of Defence, India.

The company has a current ROCE (Return on Capital Employed) of 37% while the industry median is 19%. This simply means for every Rs 100 the company invests as capital expenditure, it makes a profit of Rs 37 on it, the overall industry makes just around Rs 19.

Let us look at the other financials now.

The company’s sales were at Rs 1,433 cr for FY20 which has jumped to Rs 5,076 as for FY25, logging in a compound growth of around 29%.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Garden Reach grew at a compounded rate of 59% from Rs 42 cr in FY20 to Rs 421 in FY25.

The net profits more than tripled from Rs 163 cr in FY20 to Rs 527 cr in FY25, logging in a compounded growth of 27%.

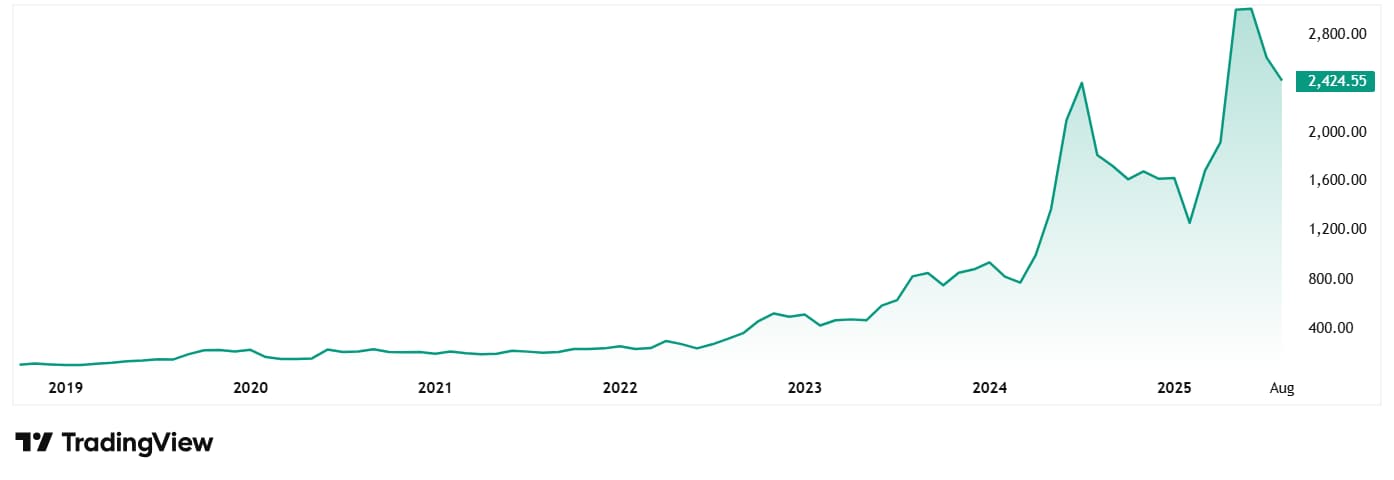

The share price of Garden Reach Shipbuilders & Engineers Ltd went from around Rs 213 in August 2020 to its price as of closing on 26th August 2025, which is Rs 2,425. That’s a jump of 1,040% in just 5 years.

If one had invested just 1 lakh in the company 5 years ago, it would today be close to Rs 11.4 lakhs.

The current price of Rs 2,425 is over a 30% discount from the stock’s all-time high price of Rs 3,538.

The company’s share is trading at a current PE of 50x, which is lower than the industry median of 67x.

The company is in a strong execution phase, delivering complex projects ahead of schedule and scaling up capacity to meet a robust order pipeline. It is also aggressively pursuing new business in both Defence and non-Defence shipbuilding, including exports. With a clear control on ongoing investments in R&D (autonomous platforms, green vessels) and a clear roadmap for capacity expansion, including greenfield shipyard plans, the company has a strong order book of over Rs 21,700 cr. It is expecting the Next Generation Corvette project, whose value is about Rs 25,000 cr expected to be signed in FY26.

The company’s management is highly optimistic, with no material headwinds identified, and is positioning Garden Reach Shipbuilders as a leader in indigenization, technology adoption, and project execution in the Indian shipbuilding sector.

Floating with consistent financials – Cochin Shipyard Ltd

Incorporated in 1972, Cochin Shipyard Limited is a leading player in construction of all kinds of vessels, repairs, and refits of all types of vessels including periodic upgradation and life extension of ships.

With a market cap of Rs 43,192 cr, the company has built & repaired some of the largest ships for its esteemed customers across the globe. It has exported some 45 ships to various clients outside India. It has developed its expertise from building bulk carriers to smaller ships and ships which are more advanced in terms of technology such as Platform Supply vessels, Anchor Handling Tug Supply Vessels.

The President of India holds a 68% stake in the company, and the Life Insurance Corporation of India holds another 3.05%.

Cochin Shipyard Ltd has a current ROCE of 20% which is almost as much as the industry median of 19%.

As for the financials, the company’s sales have jumped from Rs 3,422 cr in FY20 to Rs 4,528 cr in FY25, which is a compound growth of 6% in 5 years.

EBITDA has seen a jump from Rs 714 cr in FY20 to Rs 873 cr in FY25, logging in a compounded growth of 4%.

The net profits also grew at a compounded rate of 6% from Rs 610 cr in FY20 to Rs 843 cr in FY25. In all, not a very exciting growth journey.

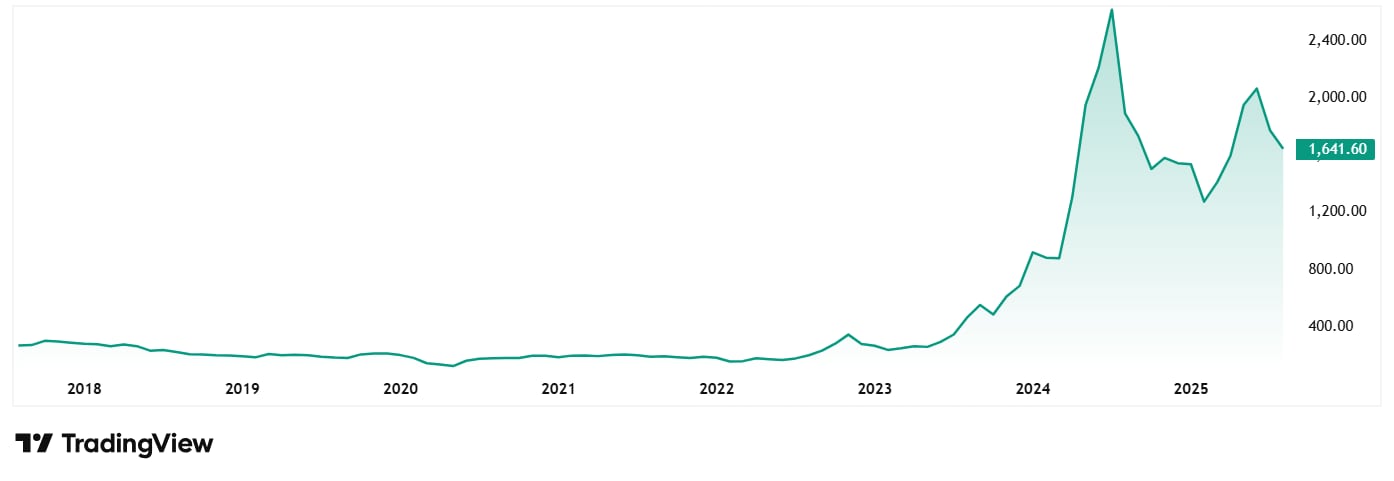

The share price of Cochin Shipyard Ltd was around Rs 177 in August 2020 which has grown to its current price of Rs 1,642 as of closing on 26th August 2025. This is a jump of around 828%, even though sales and profit growth have been modest.

Rs 1 lac invested in the stock 5 years ago would have been around Rs 9.3 lac today.

At the current price of Rs 1,642, the company’s share is trading at a discount of almost 45% from its all-time high of Rs 2,979.

The share is trading at a PE of 51x while the industry median is 50x.

With an order book of Rs 21,100 crore, the company is entering a phase of capacity and capability expansion, backed by strong government policy tailwinds, and deepening global partnerships. While FY26 margins are expected to normalize, the company, according to the latest investor presentation, is well-placed to capitalize on Defence and commercial shipbuilding opportunities, with significant investments in infrastructure and technology already made. Management is very confident with clear strategic plans for exports, global partnerships, and leveraging new facilities for growth. Key risks however involve margin normalization and the timing of large Defence orders, but the long-term outlook remains positive.

Set sail for the profit voyage?

With impressive returns on capital employed of 37% and 20% respectively, Garden Reach Shipbuilders & Engineers Ltd and Cochin Shipyard Ltd are in the limelight for smart investors. Both companies have robust order books of over Rs 21,000 cr each, have logged in sustained operating profits and are backed by the government of India. No wonder these shipping giants are creating ripples in the Defence sector.

What is interesting is that both the companies are entering a phase of accelerated growth. They are stepping on the pedal to move to the next level, with no immediate headwinds in foresight. Add to that the government’s commitment and resolve to make India a self-reliant nation in terms of Defence with high budgetary allowances, and you have a killer combo.

It will be one ride to watch how these stocks will perform for the economy as well as its investors in the near- and long-term future. For now, one could just add these to a watchlist and track them closely to ensure no opportunity is missed. Especially as these companies are now trading at high discounts.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.