Indian Contract Development and Manufacturing Organizations (CDMOs) are rising to the helm of the pharmaceutical sector, capitalizing on the country’s burgeoning status as a R&D hub.

Before doing a deep dive into the key factors responsible for the sector’s growth in India, let us understand the role of a CDMO.

The fast-evolving biopharma landscape has necessitated the production of drugs in a time-efficient and cost-efficient way. To cater to global requirement, most major pharmaceutical companies are outsourcing their R&D processes to Indian CDMOs. Both Contract Research Organizations (CROs) and CDMOs specialize in experimental breakthroughs and mass production. Manoeuvring complex regulatory challenges like the USFDA, adherence to strict quality measures and distribution logistics include top priorities for Indian CDMOs.

Per a report by the IMARC Group, the Indian CDMO market reached a value of INR 67,538 crore in 2024. By the year 2033, the sector is poised to reach INR 135,605 crore, registering a CAGR of 7.7% during the period 2025-2033. Others, like McKinsey expect it to grow much faster.

What is Making India a Favoured CDMO Destination?

The China+1 strategy adopted by global pharma and biotech firms is pivoting the focus away China-centric procurement and helping India emerge as the most favoured alternative destination. A strong regulatory compliance framework and a scalable infrastructure support system have solidified India’s position in the global pharma scenario. Indian CDMOs and CROs are revamping their range of skills to provide unique solutions, enabling global pharma MNCs to integrate the entire product lifecycle under a single outsourcing contract.

The usage of AI-enabled drug discovery, process automation and real-time data analytics is providing further competitive and strategic advantage to India on a global stage. In a recent interview with the Hindu, the MD of Hikal Ltd. cited that India’s INR 15,000 crore Production-linked Incentive (PLI) scheme for bulk drugs and a broader PLI for formulations have pushed the nation to a central figure of pharma manufacturing.

Multiple international reforms such as the US’s BIOSECURE Act, Europe’s shift toward strategic autonomy and Japan’s reassessment of supply chain dynamics have worked to India’s advantage.

Key Strides in India

In January 2024, Aragen Life Sciences announced its plans to invest a substantial amount of INR 2,000 crore in Telangana to bolster its drug innovation and manufacturing capabilities. This indicates a growing strategic focus in India towards expansion of complex generics and high-potency active pharmaceutical ingredients (HPAPIs) production.

Now, let’s take a look at 3 companies expected to cash in on the CDMO and CRO boom in India.

Innova Captab

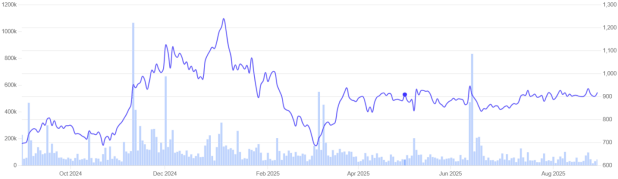

Valued at INR 5,299 crore by market cap, Innova Captab share price has climbed close to 31.9% over the past year. In Q4 FY2025, Innova Captab reported a consolidated revenue of INR 154.8 crore led by its CDMO business. The CDMO unit that comprised 53% of the company’s revenue mix for the fiscal, registered a growth of 12% in the reported quarter.

One of the key highlights for the company has been the commencement of commercial production at its new Jammu manufacturing facility at the early onset of 2025. The facility is equipped to manufacture a wide array of products in oral solid dosages, dry powder injectables, dry syrup, BFS, large volume parenterals, and respiratory respule products.

The company has expanded its customer base to over 200 clients, while also growing its product portfolio from 2900-plus last fiscal to 3,300 in FY2025.

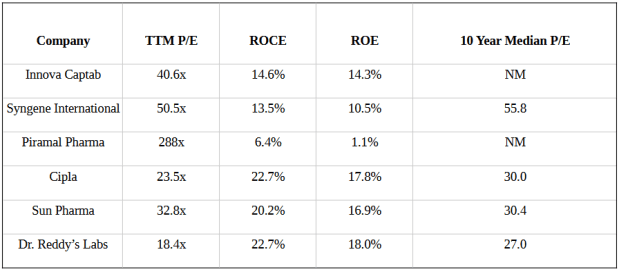

The company has a trailing price-to-earnings multiple (PE) of 40.8x.

Innova Captab Share Price Return: 1 year

Piramal Pharma

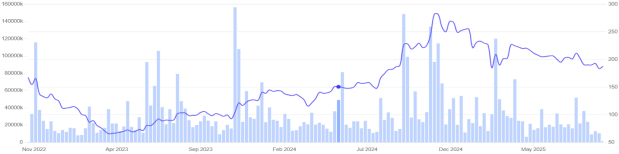

With a market cap of INR 24,830 crore, this leading global pharma player based out of India has returned close to 11.97% in the last five years. For Q1 FY2026, the company reported a 6% year-on-year growth in its CDMO business, driven by resilient performance and profit margin improvements at its overseas facilities. The company also registered solid momentum in its nutrition supplements and generic API portfolio, while streamlining costs via efficient procurement strategies.

The company has recently invested INR 792.49 crore for the expansion of 2 of its US facilities, Lexington and Riverview. These sites are central to the company’s growing integrated antibody-drug conjugate (ADC) program, named ADCelerate. In June 2025, the company commenced operations at its sterile, injectable manufacturing facility project in Lexington.

With a trailing price-to-earnings multiple of 288x, Piramal Pharma is one of the most expensive stocks and currently trades at a premium.

Piramal Pharma Share Price Return: 5 years

Syngene International

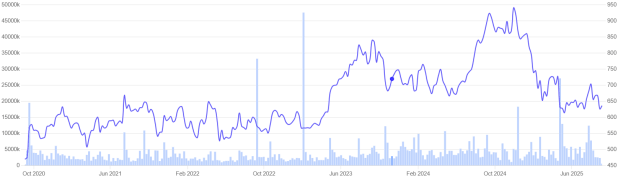

Valued at a market cap of INR 25,599 crore, Syngene International, a subsidiary of Biocon, has returned almost 35.6% over the past five years.

In March 2025, Syngene International announced its plan to invest INR 312 crore for the acquisition of the biologics site of Emergent Manufacturing Operations Baltimore, a subsidiary of Emergent BioSolutions. The acquisition is a significant achievement for the Indian CRDMO sector as it caters to the expanding client demand in the USA for commercial-scale biologics.

The CDMO’s Bengaluru biologics facility commenced operations from the second half of 2024 to serve US and European customers. The site is also dedicated to the firm’s growing pharma and biotech customer base in Mangalore and Hyderabad.

The facility, with a biologics drug production capacity of 20,000 litres, is being currently used to build monoclonal antibodies. The company aims to invest an additional INR 100 crore for more diversified utilization of the unit.

With a trailing price-to-earnings multiple of 50.5x, Syngene is fairly expensive and currently trades at a premium.

Syngene International Share Price Return: 5 years

Valuation Comparison With Peers

In conclusion it can be said that led by policy support, a skilled pool of R&D talent and cost-effective technology, India has already emerged as a powerhouse for pharmaceutical outsourcing. With the geopolitical scenario ushering in diversification of global supply chains, Indian CDMOs are well-positioned to play a crucial role in shaping the future of global drug research and development. On the flip side, one will also need to see if Trump goes ahead and levies tariffs on this sector too in future, and the impact they have.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information. A few other sources used for various data points are Reuters, Telangana State Portal, Business Standard.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.