Ace investor and one of India’s Warren Buffetts just made some big changes to his portfolio and it has kept the investment circles buzzing.

Here is a glimpse of the big changes that we are talking about

4 New Stock Picks

2 Existing Stocks See Rise in Stake

7 Stocks That Saw a Cut in Stakes

Those are some big movements, and the investment community is still wrapping its heads around it.

What triggered these changes is something only Mukul Agarwal, who we refer to as one of India’s Warren Buffetts, can tell us. But for now, we must look at the stocks, especially the ones he added to his portfolio.

The New Buys

#1 Bella Casa Fashion & Retail Ltd

Bella Casa is into manufacturing of home furnishings/home made-ups, women ethnic wear and men’s ethnic wear, has a market cap of Rs 759 cr.

Agarwal has bought aa 6.85% stake in this company as per the filings made for the quarter ending December 2024.

The company’s sales have grown at a compounded rate of about 10% in 5 years from Rs 147 cr in FY19 to Rs 230 cr in FY24.

The PAT (Profits after tax) or net profits however grew at a smaller compounded growth rate of 2% from Rs 9 cr in FY19 to Rs 10 cr in FY24.

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) grew from Rs 17 cr in FY19 to Rs 19cr in FY24, which makes it a compounded growth of 2.2%.

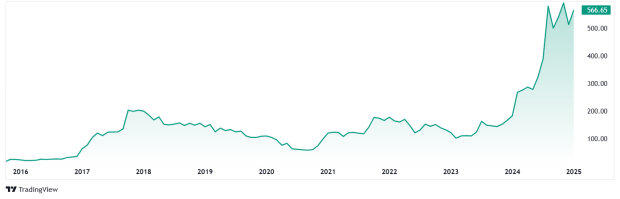

The stock prices of Bella Casa saw a big jump of 435% from the 5-year-old price of around Rs 106 to the current price of Rs 567 (as on closing 17th January 2025).

As for the valuations, the company’s share is currently grading at a P/E of 56x, which is higher than the industry average of 44x. The 10-Year median P/E however is 24x, which is lower than the industry median which is 28x for the same period.

The promoter holding has seen a drop of almost 10% between the quarter ending September 2024 and the one ending December 2024.

#2 AYM Syntex Ltd

AYM Syntex, which has a market cap of Rs 1,458 cr is a manufacturer and exporter of Polyester Filament Yarn, Nylon Filament Yarn and Bulk, Continuous Filament Yarn.

Mukul Agarwal has bought a 3.93% stake in the company as per the filings for the quarter ending December 2024. Apart from him, Utpal Sheth has also bought a 1.01% stake in the company.

The company’s sales grew from Rs 992 cr in FY19 to Rs 1,358 cr in FY24, which is compounded growth of 6.5% in 5 years.

The net profits however saw a big drop of 66% as it dropped from Rs 6 cr in FY19 to Rs 2 cr in FY24.

The EBITDA however saw a compounded growth of 7% as it grew from Rs 72 cr in FY19 to Rs 101 cr in FY24.

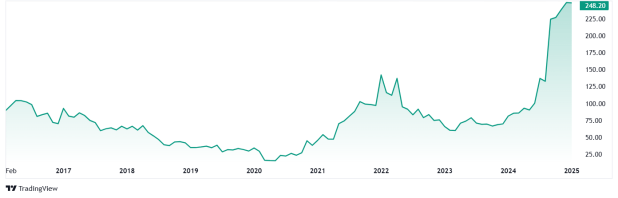

The stock price of AYM Syntex went from Rs 34 in January 2020 to the current price of Rs 249 (as on 17t January 2025 closing), which is a compounded growth of 50%.

The company’s share is currently grading at a P/E of 77x, which is higher than the industry average of 28x. The 10-Year median P/E however is 15x, which is closer to the industry median which is 14x for the same period.

AYM also has seen a drop in promoter holding of about 7.5 from the last reported quarter.

#3 KRN Heat Exchanger and Refrigeration Ltd (KHERL)

KHERL designs, manufactures, and supplies of heat exchangers and related thermal solutions. These products are used for efficient heat transfer between fluids, typically for heating or cooling applications.

Agarwal has bought a 1.61% stake in this company that has a current Market cap of Rs 5,103 cr.

The company’s sales have grown at a compounded rate of about 60% in 3 years from Rs 76 cr in FY19 to Rs 308 cr in FY24.

The profits also grew at a compounded growth rate of 153% from Rs 2 cr in FY21 to Rs 40 cr in FY24.

The EBITDA grew from Rs 5 cr in FY21 to Rs 59 cr in FY24, which makes it a compounded growth of 264%.

These numbers are enough for investors like Mukul Agarwal to be attracted towards a stock like this.

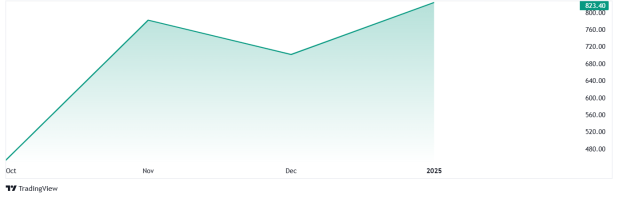

The company was listed in October 2024 at a price of around Rs 478 and is Rs 821 as on 20th January 2025, which is a growth of around 72%.

As for the valuations, the company’s share is currently grading at a P/E of a huge 128X which is higher than the industry average of 44x. Since the company was recently listed, we don’t have a long-term median P/E, but the 10-year median for the industry is around 22x.

As per the company’s investor presentation from November 2024, the company plans to expand its customer base further by enhancing existing product base & quality. The company also plans to increase their global footprint and augment growth in current geographies.

#4 Enviro Infra Engineers Ltd

Enviro Infra has a current market cap of Rs 4,860 cr and is engaged in the design, construction, operation, and maintenance of water and Waste-Water Treatment Plants (WWTPs) and water supply projects (WSSPs) for government agencies/entities.

Agarwal has bought a 1.03% stake in the company as per the filings for the quarter ending December 2024. He is the first investor to take a stake in the company that was listed in November 2024.

The company’s sales grew from Rs 108 cr in FY20 to Rs 729 cr in FY24, which is compounded growth of 60% in the 4 years.

The net profits also saw a big jump at a compounded growth of 94%, as it went from 5 cr in FY20 to 106 cr in FY24.

The EBITDA showed a compounded growth of 90% as it grew from Rs 10 cr in FY20 to Rs 166 cr in FY24.

Once again, all numbers that could grab the attention of investors from miles away.

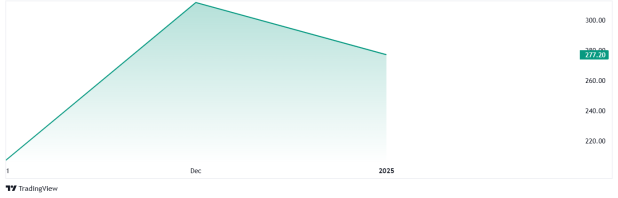

The stock price of Enviro Infra went from its listing price of Rs 204 in November 2024 to Rs 277 as on 20th January 2025, which is a growth of 36%.

The company’s share is currently trading at a P/E of 45x which is higher than the industry average of 35x. Once again, we don’t have a long-term median, but the industry median for the last decade is 20x.

Apart from these fresh additions, there have been some other noteworthy movements in Agarwal’s portfolio

He has raised stakes in the following companies as of the quarter ending December 2024.

Hind Rectifiers Ltd (1.39% to 1.46%) and PDS Ltd (2.41% to 2.46%)

Also, he has cut his stakes in the following stocks:

| Company | September 2024 Holding | December 2024 Holding |

| Intellect Design Arena Ltd | 1.45 | 1.44 |

| J Kumar Infraprojects Ltd | 2.64 | 2.61 |

| Oriental Rail Infrastructure Ltd | 5.53 | 5.27 |

| Pearl Global Industries Ltd | 3.05 | 2.61 |

| Strides Pharma Science Ltd | 1.52 | 1.16 |

| Sula Vineyards Ltd | 2.37 | 2.19 |

| Tracxn Technologies Ltd | 1.91 | 1.89 |

Add to Watchlist?

While the stocks Mukul Agarwal has trusted and has invested in with big numbers might not seem like an obvious choice to many investors, it must not be forgotten that Agarwal has been known for picking some solid small and midcap winners over the years.

Now the financials of some of these companies may not be on the top when compared to the usual suspects, but that is what sets India’s Warren Buffets apart from others. They see things on companies that and average investor might not see. What that thing or the strategy is will always be a well-kept secret.

But keeping a vigilant eye on the stocks that see movement form the Indian Warren Buffets is always a promising idea.

Disclaimer

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do / do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.