India’s benchmark indices, Sensex and Nifty 50 tumbled sharply on Monday this week, dragged down by intensifying global trade tensions and renewed fears of a US recession that have jolted investor sentiment worldwide.

The BSE Sensex crashed 3,939 points intraday, hitting a low of 71,425.01, while the NSE Nifty50 slipped below the 21,800 mark, falling 1,160 points to 21,743, marking its steepest single day drop since June 2024.

Pain was deeper in the broader markets, with the Nifty MidCap and SmallCap indices plunging 7.5% and 9.9%, respectively.

The selloff wiped out nearly Rs 19 trillion (tn) in investor wealth, as the total market capitalisation of BSE-listed firms nosedived to Rs 384 tn from over Rs 403 tn in just one session.

The turmoil came after China slapped a 34% tariff on all US imports, triggering a global selloff and reigniting fears of a prolonged trade war.

But even as the global storm rages on, some homegrown stars may still shine bright.

Here are 5 domestic-focused, tariff-free stocks to keep on your radar during the chaos.

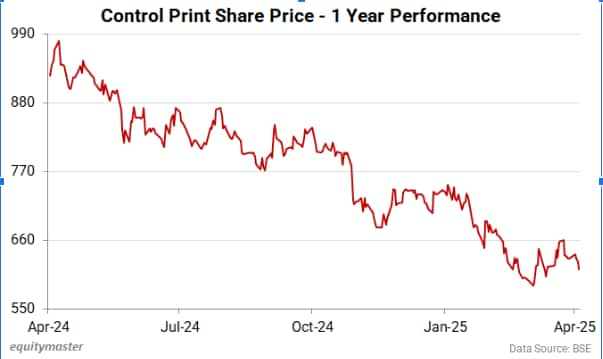

Control Print is a leading player in India’s coding and marking industry. The company manufactures and supplies solutions such as Continuous Inkjet Printers, High-Resolution Printers, Thermal Inkjet Printers, and Thermal Transfer Overprinters.

These products cater to a variety of sectors, including agrochemicals, food and beverages, healthcare, automotive, cement, and textiles, making the company deeply integrated into India’s industrial ecosystem.

Over the years, Control Print has diversified its product line and strengthened its market presence. A notable milestone was its acquisition of Netherlands-based Markprint BV in 2022 for €1.5 million, a move that boosted its technological edge.

The company also forayed into the production of surgical and N95 masks, broadening its portfolio further.

According to its FY24 annual report, its exports contributed only 2.8% to the company’s total turnover, underscoring its strong domestic focus. This positions Control Print as relatively insulated from global trade disruptions and tariff shocks, making it a potential safe haven during volatile market phases.

Financially, the company posted revenues of Rs 1 billion (bn) in the December 2024 quarter, registering a year-on-year growth of 16.6%.

However, net profit declined by 38.5% to Rs 82.7 million (m) due to rising input costs and margin pressure. Still, the company maintains an approx..19-20% share in the organised coding and marking market in India and continues to expand its B2B customer base with high-quality, reliable printing solutions.

#2 Mold-Tek Packaging

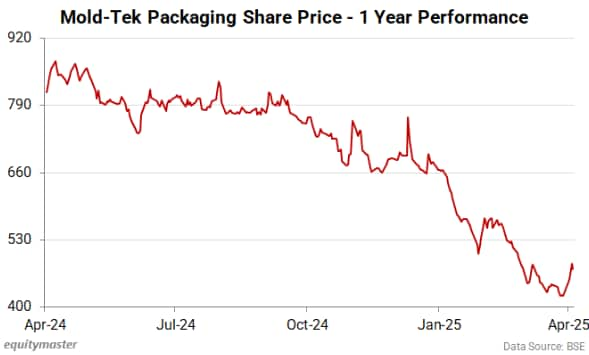

Next on the list is Mold-Tek Packaging.

Mold-Tek Packaging is a prominent player in the packaging industry, specializing in the manufacturing of injection-moulded containers used across a wide array of sectors, including lubricants, paints, food, pharmaceuticals, and FMCG products.

The company’s robust clientele features major domestic names such as Asian Paints, Castrol, Adani Wilmar, Nescafe, Dabur, Himalaya, P&G, Haldiram’s, and Mondelez, among others—highlighting its deep integration into India’s consumer and industrial value chains.

With 12 manufacturing units and 2 stock points spread across India, the company boasts a pan-India footprint and an installed injection moulding capacity of around 50,000 MTPA. This extensive infrastructure allows Mold-Tek to meet demand efficiently and scale operations in response to market needs.

According to its FY24 annual report, exports account for merely 0.60% of the company’s total turnover, clearly establishing it as a domestic-focused business.

This minimal export exposure makes Mold-Tek less vulnerable to global trade disruptions.

In terms of financials, the company reported a 15.25% year-on-year increase in sales to Rs 1.9 bn for the December 2024 quarter. However, net profit declined by 3.94% to Rs 136.4 million (m), mainly due to input cost fluctuations and operational expenses.

Looking ahead, Mold-Tek is leveraging its stronghold in injection moulding technologies—particularly in mould design, in-mould labelling (IML), and productivity—to target high-growth areas such as pharmaceuticals, cosmetics, and FMCG.

The company also plans to launch 3–4 innovative packaging concepts each year to stay ahead in design and functionality.

#3 Action Construction Equipment

Next on the list is Action Construction Equipment.

Action Construction Equipment Ltd (ACE) is a leading name in India’s construction and material handling equipment space.

The company manufactures a wide range of equipment including hydraulic mobile cranes, tower cranes, and forklifts.

Over the years, ACE has established a dominant position in the domestic market, emerging as the world’s largest Pick & Carry crane manufacturer with over 63% market share in the mobile cranes category and more than 60% share in the tower cranes segment within India.

It is also India’s top forklift manufacturer, commanding a 19% market share, and holds over 10% share in the tractor market in Assam.

As per its FY24 annual report, only 5.5% of ACE’s total revenue comes from exports, underlining its strong domestic orientation. This low export dependence makes the company largely insulated from international trade risks.

In the December 2024 quarter, ACE posted a 16% year-on-year jump in net sales to Rs 8.8 billion. Its net profit also saw a healthy rise of 26.6%, reaching Rs 1.1 bn, reflecting both operational strength and consistent demand in its core segments.

Looking ahead, the company is actively exploring growth avenues in the defence sector and is anticipating order inflows from the Ministry of Defence.

It aims to increase the defence vertical’s contribution to over 5% of total revenue by FY26–27, with a target of reaching 10% over the medium to long term.

Additionally, ACE is eyeing a 70% market share in the Pick & Carry crane segment, reinforcing its focus on maintaining domestic leadership.

With its minimal export exposure, strong domestic demand, and strategic sector expansion, Action Construction Equipment remains well-positioned as a tariff-proof play.

#4 Coal India

Next on the list is Coal India (CIL).

The company contributes 82% of the country’s coal production and supplies over 80% of its output to the power sector, making it a cornerstone of India’s power infrastructure.

CIL operates across 84 mining areas spread over 8 states, with a network of more than 350 mines—174 of which are open-cast, 158 underground, and 20 mixed. Notably, around 90% of its coal output is derived from open-cast mines, ensuring higher productivity and operational efficiency.

The company offers a diverse range of coal products including coking and non-coking coal, along with value-added offerings such as coke and tar.

Operations are managed through a network of subsidiaries, ensuring seamless coal extraction and supply across the country.

Although CIL had earlier in 2022 floated a plan to allocate 3% of its annual coal production for exports to boost bulk international trade, this proposal has taken a backseat amid rising domestic demand and coal shortages.

As a result, the company remains largely domestic-focused.

According to its December 2024 quarter results, CIL reported a slight 1% dip in revenue from operations at Rs 357.8 bn.

Its net profit also saw a decline of 17%, coming in at Rs 85.1 billion. Despite this, the company continues to play a central role in meeting India’s energy needs.

Looking ahead, Coal India plans to significantly ramp up its underground mining operations, targeting an output of 100 million tonnes by FY28, almost four times its current underground production.

With minimal export exposure and a mandate tightly aligned with India’s domestic energy requirements, CIL is well-insulated from global trade shocks and tariff risks.

#5 IRCTC

Last on the list is IRCTC.

Indian Railway Catering and Tourism Corporation (IRCTC), listed in 2019, holds a unique monopoly within India’s railway ecosystem. It is the only entity authorized by Indian Railways to manage online ticketing, catering services, and packaged drinking water under the ‘Rail Neer’ brand.

With a 100% market share in the online railway ticketing segment, IRCTC has transformed the travel experience by making ticket reservations convenient and accessible through its robust digital platform.

The company earns a convenience fee of Rs 15–30 per ticket booked online, generating steady, transaction-based income.

IRCTC also oversees all catering services on trains and at major railway stations across the country, offering meals and refreshments to millions of passengers daily.

Furthermore, it operates as the exclusive supplier of packaged drinking water at railway premises, reinforcing its stronghold across essential railway services.

Unlike many companies exposed to the volatility of global trade, IRCTC derives no revenue from exports. Its operations are entirely domestically oriented, catering solely to Indian travelers and railway passengers.

While it facilitates international tourism through its agents, the revenue generated is still routed through its domestic framework. This makes IRCTC fully insulated from global tariffs, currency fluctuations, or international supply chain disruptions.

For the quarter ended December 2024, IRCTC reported a 10% rise in revenue to Rs 12.3 bn and a 14% increase in net profit to Rs 3.4 bn.

Looking ahead, the company is focused on enhancing its digital infrastructure to streamline services and further improve customer experience.

Conclusion

Investing in domestic-focused stocks can be a prudent strategy, especially during times of global uncertainty like trade wars, currency fluctuations, or recession fears.

These companies primarily cater to the Indian market and are relatively insulated from external shocks such as international tariffs or geopolitical tensions.

As a result, their earnings tend to be more stable and predictable. Moreover, India’s structural growth story, driven by rising consumption, infrastructure development, and supportive government policies, provides a strong runway for domestically focused businesses.

However, it’s important to note that not all domestic-focused stocks offer the same quality or growth potential.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.