In December last year, WhatsApp kicked off a one-of-its-kind initiative in India — the WhatsApp Bharat Yatra. Through this yatra, a WhatsApp-branded bus was to travel to tier-2 cities like Agra, Lucknow, Kanpur, Indore, Ahmedabad, Surat, Nashik, and Mysore to train over 20,000 small and medium businesses to use the WhatsApp Business application.

Ravi Garg, director of business messaging at Meta in India, says, “Messaging is central to India’s digital evolution, with over 90% of people engaging with brands weekly. As this trend continues, we are focused on helping businesses of all sizes reach more customers, drive better sales and grow.”

Since its inception in 2018, WhatsApp Business has been able to pervade through geographies to host users. This is because when WhatsApp launched its WhatsApp Business app, it wasn’t thought of as a ‘never-heard-before’ offering. Garg tells FE, “When we first launched, we saw a critical gap—businesses were already using WhatsApp organically to engage with their customers but lacked the right tools to do so effectively. The WhatsApp Business app was designed to fill that gap, offering a simple, free to use app that helped small businesses build a presence, connect with customers and grow their business.”

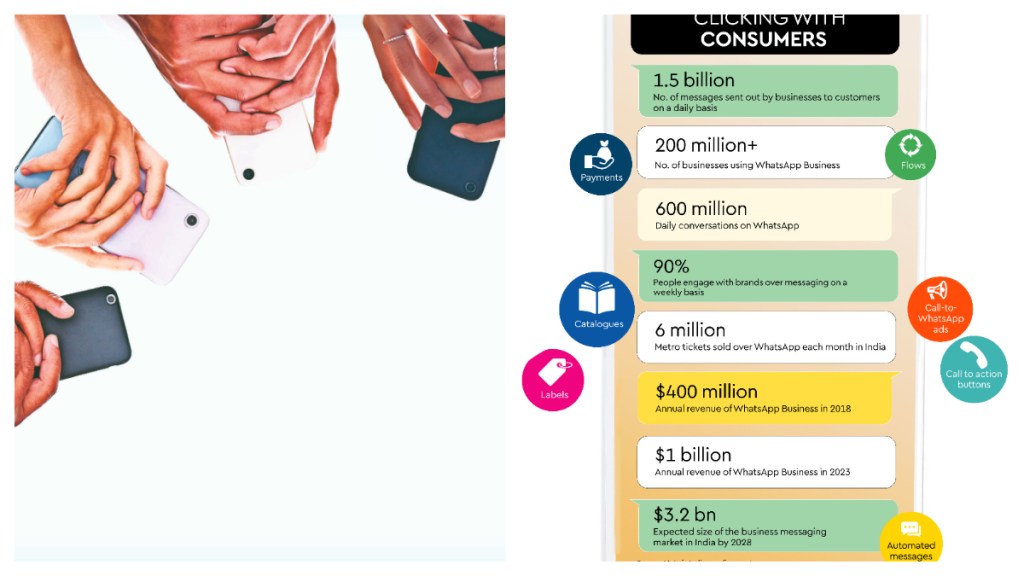

Almost seven years later, the results stand true to what the original intent of the platform was. According to numbers shared by WhatsApp, in India, over 90% people engage with a business at least once a week over text messaging.

“With over 200 million businesses using WhatsApp globally and over 600 million daily conversations, the platform’s potential to drive digital growth is immense,” says Garg.

While WhatsApp does not reveal data about its markets and their size in the public domain, it does say that India is one of the largest and key markets for both WhatsApp and WhatsApp Business.

Message delivered

For Moto Lyfe (formerly Lets Ryde), a Delhi NCR-based company that trains women motorcyclists, the Meta offering has been an important cog in its system. The company’s founder, Amit Saini, tells FE, “We started in 2016 as a motorcycle rental company. Soon after, we started training people to ride bikes, and saw an increased participation from women. Today, we have trained over 2,000 women motorcyclists. Since we have a very niche audience that didn’t exist up until a few years ago, we have had to run very specific marketing campaigns in the past.”

With WhatsApp Business, that has changed. Says Saini, “What works for us is that everybody is already on WhatsApp. So when we run ‘Click-to-WhatsApp’ ads on Instagram, people can directly reach out to us for any queries about the fee, the location, what all we teach, what equipment we provide, etc. So there’s convenience for customers. For us, there’s the added two-fold benefit that we directly connect with both people who want to be customers and people who are curious. Additionally, we get to modify the budget for ads according to our needs.”

Anuj Katiyar, co-founder of Delhi-based Shoe Doctor, a cleaning, restoration, and repair business for sneakers and luxury items, has also used WhatsApp Business since around the same time that he started his company a couple years ago. Having a small shop in Uttam Nagar (a suburb in West Delhi), where getting walk-in customers was difficult, Katiyar’s logic was that he didn’t want to solely depend on the store’s physical setup for business. That’s when he started running ‘Click-to-WhatsApp’ ads on Instagram, sharing his catalogue with the customers, and opting for Google listing ads.

Now Katiyar says almost 90% of his Rs 1.2 crore turnover business happens on WhatsApp, with his venture generating around 200-250 leads through the platform on a daily basis.

Saini, of Moto Lyfe, says his company’s story is pretty similar. Almost 55-60% of his business, he says, comes from leads generated through WhatsApp.

The rest comes from ads run on other social media platforms, word of mouth, and referrals. Says he, “For small businesses with a limited budget and those who have really niche audiences, this might be the way to go.”

Amit Singh, the director of Nomad Eco-Retreat (formerly Camp Nomad), near Shimla in Himachal Pradesh, runs a business that relies a lot on WhatsApp too. Nomad is a campsite that hosts artists for retreats, residencies, and also travellers. Singh tells FE, “We’ve been using WhatsApp Business for ads and outreach for the past 7-8 months. In this period, we’ve seen an increase in revenue from hosting travellers by over 30-40%.”

This, for Singh’s venture, is no small feat. He says that they’re a small business that generates anywhere from Rs 20-25 lakh per annum, and almost 30% of their revenue comes from hosting travellers. He says, “WhatsApp Business has made us more accessible, and we constantly engage with more people now.”

Interestingly, how WhatsApp Business makes money through this is a two-fold model—by monetising the WhatsApp Business Platform which is used by large businesses, and by running ‘Click-to-WhatsApp’ ads on other platforms that direct individuals to a business’ chat on WhatsApp. The latter are ads that can be placed on other Meta platforms like Facebook and Instagram, and help drive any queries, sales, and leads directly to the business’ WhatsApp number.

This is also a profitable marketing option for businesses because unlike email marketing or other traditional means, WhatsApp Business has in the past few years shown reportedly up to a 98% open rate, which means at least 98% of the messages businesses sent to clients (or potential ones) on WhatsApp are opened by the latter.

According to reports by data gathering and analysis companies including Grand View Research, Spocket, and Statista, WhatsApp Business has grown steadily with an annual revenue of over $400 million in 2018 to over $1 billion in 2023. Consulting firm Gartner estimates that the business messaging market in India could reach about $3.2 billion by 2028.

On a global level, the projected numbers are much bigger. UK-based fintech company Juniper Research earlier this week released a report suggesting that OTT business messaging platforms could generate global revenue worth $3.6 billion in 2025, and that in the next four years, this number could almost triple. Juniper’s estimates for 2029 say that the global revenue from OTT business messaging could reach $9.8 billion.

The report went on to say that WhatsApp’s ‘per message pricing model’ will drive a significant share of this growth, contributing to the increase in revenue by almost 265%.

On the other hand though, Facebook and Instagram which have been in the business game longer have higher revenue shares too. For instance, in the second quarter of 2024, Meta’s ad revenue from Facebook and Instagram was over $39 billion, a 22% increase from the same quarter in 2023.

In the third quarter of the year, Meta reported a quarterly record revenue of $40.50 billion, driven by Facebook and Instagram sales. And it ended the 2024 year with a bang, reporting

Q4 revenue of $48.39 billion, beating Wall Street expectations.

But to be fair, the higher profitability of Facebook and Instagram are not simply luck or better business tactics on the part of other platforms. In 2014, when Meta (then Facebook) acquired WhatsApp for $19 billion from former Yahoo engineers Jan Koum and Brian Acton (who had so far kept the platform an ad-free space), the deal had a clause that WhatsApp would remain a no-advertising app for the public.

At the time of the acquisition, Koum had told the media, “There would have been no partnership between our two companies if we had to compromise on the core principles that will always define our company, our vision, and our product.”

Reaching out

Interestingly, Google is now also looking to pit its Rich Communication Service (RCS) against Meta’s ‘Click-to-WhatsApp’ links by integrating the messaging service with Google Search. Essentially, it means that if users want to search for a specific company’s

customer service, Google will directly lead them to their chatbot to address any queries.

With Google supporting RCS business messaging (RBM), the segment is also seeing an emerging tariff war between telecom operators, FE had reported in February, especially since Vodafone Idea and Jio enabled RMB on their networks. Bharti Airtel, on the other hand, is not in the race yet.

On the other hand, WhatsApp insists that its main aim is helping businesses reach wider audiences. Garg says that new features like Meta Verified on WhatsApp and customised messages on the WhatsApp Business app would be a step in this direction.

“Businesses that choose to subscribe and demonstrate their authenticity will receive a verified badge, impersonation protection, account support, and premium features that help amplify their brand online and make it more efficient to chat with customers. The same badge will appear on their WhatsApp channels and Business pages, making it easy to share on social media and websites,” says Garg.

He goes on to add that Business users can pay a fee to also be able to send personalised messages to their customers such as “appointment reminders, birthday greetings or even updates on a holiday sale all in a faster and more efficient way” with a customisable call-to-action button.

Not just that, the messaging app’s Business offering has also been leveraging artificial intelligence (AI) where businesses with resource constraints can activate GenAI to provide customer support.

Says Garg, “We have started by making it easy to activate AI directly from the WhatsApp Business app to help businesses more efficiently engage with their customers. We started testing this here in India with a very small number of businesses and the early results are really exciting!”

Growing concerns

However, not all is hunky-dory. In the recent past, WhatsApp has become a hub of spam texts and cybersecurity concerns with cybercriminals misusing the platform to extort money out of people by, for instance, putting them in a digital arrest via video calls.

The other side of this is also that you engage with a business online once and then a barrage of texts await you over WhatsApp from said business. This is more likely true in case of large businesses who have the resources for countless pop-up messages.

Every company from every possible sector now has a WhatsApp Business profile and doesn’t matter if you’ve ever browsed their offerings, shopped from there, or not, they will likely reach out to you on WhatsApp without you initiating the conversation. Intrusive much?

But it doesn’t end there. Time and time again, people have also raised concerns about their data being shared between WhatsApp and the other platforms owned by Meta, without being explicitly told how its being used or with whom its being shared.

Garg, though, is quick to dismiss these. He says, “We take privacy and security very seriously, especially when it comes to our business features. We make sure to clearly notify people whenever they are interacting with a business, ensuring full transparency. Additionally, people have the option to block a business at any time, giving them complete control over their interactions.”

But the concerns stay, especially since WhatsApp is also allegedly being used for illegal business pursuits. In the first week of March, US-based non-profit publication Rest of World, that extensively writes on technology, shared an exclusive report by Princeton University’s Digital Witness Lab about how illegal firearms businesses have found a “thriving” marketplace on WhatsApp in India.

In the age of trust and antitrust on the internet, while data sharing, data privacy, and data ownership remain big concerns, illegal activities are certainly not discounted too.