India’s IT services sector is showing signs of resilience, with deal momentum stabilising and artificial intelligence (AI) initiatives gaining critical urgency, even as macroeconomic caution and tariff-related uncertainties cloud the near-term outlook.

Deal momentum rebounds in June amid global caution

According to analysis by BNP Paribas, deal-win announcements in June 2025 recovered after recent softness with strong deal-signing momentum from Europe and North America. Among verticals, it added, Consumer Packaged Goods (CPG) and Retail saw strong deal signings followed by Energy & Utilities, while BFSI was a tad soft after strong recent bookings.

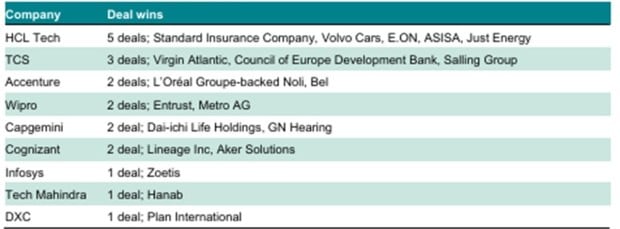

In terms of companies, HCLTech topped the leaderboard with five deal wins in June, followed by TCS with three deal wins and Accenture, Wipro, Capgemini and Cognizant recording two each in the month of June. Further, Infosys, Tech Mahindra and DXC closed 1 deal each. Notably, most of the wins were centred around digital transformation and business modernisation.

GenAI takes centre stage with strategic partnerships

The IT services sector has accelerated expansion on AI and Gen AI innovation via high-profile partnerships.

– HCL Tech teamed up with OpenAI and with Salesforce to accelerate adoption of enterprise-scale AI and agentic AI.

– Infosys collaborated with Adobe to reinvent global marketing workflows.

– Cognizant strengthened its AI stack with its Agentforce suite and is growing its India presence with a new campus in Visakhapatnam.

– Accenture launched a proprietary Agentic AI framework and partnered with NVIDIA to advance Europe’s AI strategy, with a focus on scalable, sovereign and agentic AI solutions.

– IBM strengthened its GenAI offerings by simplifying enterprise data stacks and introducing AskIAM, its new agentic AI for identity and access management.

Tariff uncertainty and slow ramp-ups keep firms cautious

However, near-term caution persists. InCred Equities said that discussions with management of IT companies indicated hesitation in taking long-term decisions and delay in deal ramp-up due to ongoing tariff uncertainty.

That said, InCred Equities stated that the 90-day tariff pause window announced earlier and Accenture’s Q3FY25 earnings commentary of “clients moving from pause to focus and leapfrog” was constructive enough to lift valuations from their peak uncertainty-led bottom in Feb/Mar 2025. Even so, the first quarter of FY26 is still expected to see a modest 0.4 per cent sequential revenue decline in constant currency terms across Tier-I firms. This will result from the tariff-led uncertainty-led delay in decision making which will continue to impact both existing/new deal conversion and ramp-up.

Further, while the global capability centre or the GCC-led channel remain a key driver to new deals, complicating the landscape are travel restrictions, particularly in regions affected by geopolitical conflicts. Conversely, analysts at InCred Equities suggest a potential ‘budget flush’ in H2FY26 which could create a positive surprise, as companies make up for H1’s tepid spending.

Mid-tier firms expected to outperform on strong deal execution

In terms of mid-tier firms, Elara Capital said, Coforge and Persistent systems are expected to post outperform their larger peers in terms of USD revenue growth, on the back of strong deal execution and client-specific ramp-ups. Coforge is expected to post strongest sequential USD revenue growth to be aided by continued robust deal execution and partial numbers from the Sabre deal. “The disruption caused by tariffs is likely to impact companies with higher exposure to manufacturing and retail verticals. We are likely to see strong deal momentum across companies and cost take-out deals will continue to dominate,” the brokerage firm said.

Cost take-outs, vendor consolidation drive new deal structuring

Meanwhile, Kotak Institutional Equities projected the June quarter to be mixed, with mid-tier IT services companies reporting strong growth, while large IT companies and ERD names expected to disappoint. The deal pipeline, however, will remain strong. “The deal activity is tilted toward cost takeout. This is being achieved through vendor consolidation and outsourcing. Many vendor consolidation deals announced by companies are not net new for the IT industry,” Kotak report said, while maintaining that companies that are aggressive, have good client engagement and can structure deals smartly are gaining wallet share.

To conclude…

While macroeconomic and tariff-related headwinds continue to weigh on decision-making in the near term, India’s IT services sector is showing resilience through strategic GenAI investments, strong deal pipelines, and agile execution—especially among mid-tier players.

With clients moving from a wait-and-watch approach to focused transformation, companies with AI capabilities, strong client engagement and smart deal structuring are well-positioned to capture a larger share of IT budgets in the second half of FY26.