Page 2 of Bank of Maharashtra

Related News

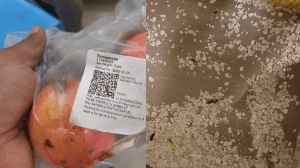

‘76 kg of expired articles, misleading labels’: Warehouses of Zepto, Blinkit, Swiggy and 5 others inspected in Telangana

Zero debt, high ROCE, solid dividends: 2 gems in Radhakishan Damani’s portfolio

Aadhaar Card Update: How to change address in Aadhaar Card online in simple steps

8th Pay Commission: Govt to merge DA with basic pay as interim relief? Parliament to seek clarity on ToR concerns flagged

Rent changes in Bengaluru and Mumbai — tenants to pay only 2 months security