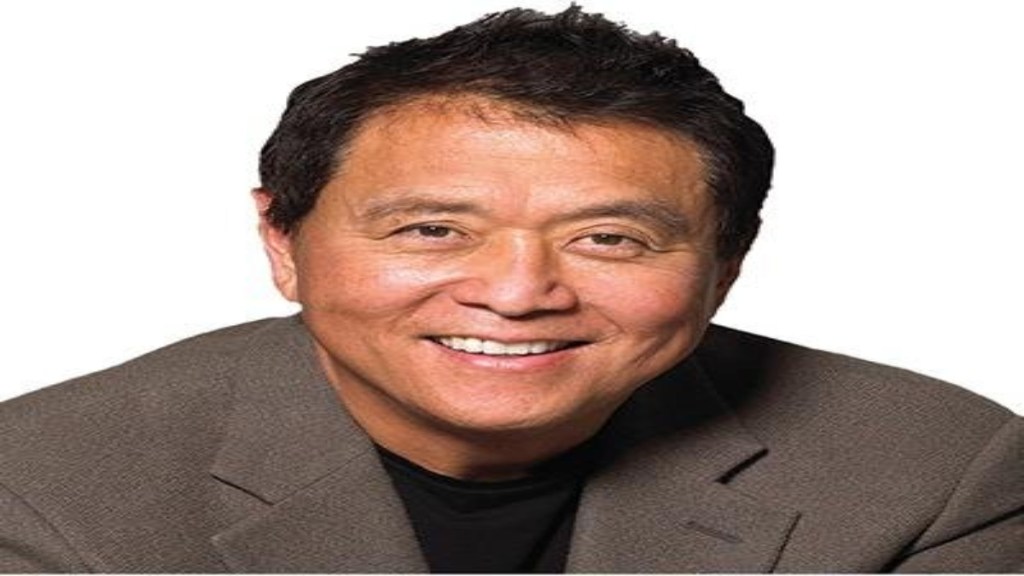

Robert Kiyosaki, author of the bestselling personal finance book Rich Dad Poor Dad, often shares money and investing tips to help people build wealth. In a recent social media post, he pointed to two key “laws of money” that he believes most people break and that is why, in his opinion, they stay poor. Declaring that “savers are losers”, Kiyosaki said he prefers to invest in gold, silver, and Bitcoin, as they align with fundamental financial principles.

The two financial principles Kiyosaki highlighted are Gresham’s Law and Metcalfe’s Law. “Are you breaking the laws?” he asked his followers on X (formerly Twitter) before answering, “Most poor people are poor because they break the two most important laws of money.”

Quoting Gresham’s Law, Kiyosaki argued that traditional savers are setting themselves up for failure by saving what he calls “fake money” like fiat currency.

“Law 1: Gresham’s law: ‘When bad money enters a system….good money goes into hiding’,” he quoted the law and said that people are poor because they are “working for and saving fake money”. The real money, in his opinion, is gold, silver and Bitcoin, as they preserve value better over time.

Kiyosaki also pointed to Metcalfe’s Law, which states that the value of a network increases with the number of its users. He compared successful network-based businesses like McDonald’s and FedEx to their smaller counterparts such as “Mom & Pop burgers” or “Joe’s one-truck delivery” to underline how scale and network effects create wealth.

“Metcalfe’s law: The law of ‘Networks’. McDonald’s is a franchise network. Mom Pop Burgers is not. That’s why they’re poor. FEDEX is a network. Joe’s 1 truck package delivery is not. I invest in Bitcoin because it is a network. Most cryptos are not,” he further said and reiterated, “If you want to be rich, obey the laws.”

He also quoted words of Michael J Saylor, former CEO of MicroStrategy: “Only invest in things…. a rich person will buy from you.”

Kiyosaki emphasised that he avoids saving US dollars as it violates Gresham’s law and doesn’t invest in random cryptocurrencies that lack network effects, which, he says, break Metcalfe’s Law.

“That’s why I save gold, silver, and acquire Bitcoin. They obey the laws,” he said.

ARE YOU BREAKING the LAWS?

— Robert Kiyosaki (@theRealKiyosaki) May 24, 2025

Most poor people are poor…. because they break the 2 most important laws of money.

LAW #1: GRESHAM’s LAW: “When bad money enters a system….good money goes into hiding”

In Rich Dad Poor Dad….I stated….

“ Savers are losers.” In 2025 poor people…

In a post dated May 18, he highlighted several instances and predicted major financial crisis ahead. He also urged people to ditch “fake fiat money” and “bail themselves out” by putting money into real gold, silver, and Bitcoin.