Education loans help bridge the financial gap and enable students to access quality education without facing immediate financial constraints. Such loans typically have specific terms and conditions that borrowers must adhere to. The loan amount, interest rates, repayment period, and eligibility criteria may vary depending on the lender and the loan scheme. Some education loans may require collateral or a guarantor, while others may be offered without such requirements.

Taking an education loan in India can be a significant financial decision, and it is crucial to be well-informed before proceeding. Here are some essential things you must consider and check before taking an education loan:

Eligibility Criteria

Different banks and financial institutions have specific eligibility criteria for education loans. Check if you meet the requirements regarding age, academic background, the course you wish to pursue, and the institution you plan to attend.

Interest Rates

Compare the interest rates offered by various banks and financial institutions. The interest rates can vary, so it is essential to choose a loan with a competitive interest rate to minimise your financial burden.

Also Read: Effective investment strategies for early repayment of home loans

Loan Amount

Determine the loan amount you require for your education. Different banks have different limits on the maximum loan amount they offer. Consider your tuition fees, accommodation expenses, study materials, and other related costs while calculating the loan amount.

Collateral Requirement

Many education loans in India require collateral as security. Check whether the bank requires collateral and evaluate the terms and conditions associated with it. If you cannot provide collateral, explore options for loans that do not require security or collateral.

Repayment Options

Understand the repayment options available to you. Some banks offer a moratorium period during which you do not have to make any payments. After completing your studies, you will have a grace period before you need to start repaying the loan. Determine the repayment tenure and the instalment amount to plan your finances accordingly.

Loan Subsidies and Schemes

Stay updated with any government subsidies or schemes available for education loans. Various government initiatives may provide interest rate subsidies or repayment assistance for certain categories of students. Research and inquire about such schemes to maximise your benefits.

Loan Processing Time

Inquire about the loan processing time as it can vary from bank to bank. If you require the loan within a specific timeframe, ensure that the bank can process your application and disburse the loan accordingly.

Also Read: Key reasons your loan can get rejected despite high income

Hidden Charges

Carefully review the terms and conditions of the loan agreement to understand any hidden charges or additional fees associated with the loan. These charges may include processing fees, prepayment charges, late payment fees, or any other penalties. Be aware of these charges to avoid any surprises later.

Documentation Required

Familiarise yourself with the necessary documentation for the loan application. Prepare all the required documents, such as identity proof, address proof, income documents, academic records, and admission letter from the institution. Having the necessary documents in order will streamline the loan application process.

Bank’s Reputation and Services

Research the reputation and credibility of the bank or financial institution you plan to borrow from. Consider factors such as their track record in disbursing education loans, their customer service quality, and any feedback from previous borrowers. It is essential to choose a reliable lender that offers excellent customer support.

Taking an education loan is a significant financial commitment, and it is crucial to assess your financial capabilities and understand the terms and conditions associated with the loan. Thoroughly research and compare different loan options, consider the factors mentioned above, and consult with financial advisors, if necessary, to make an informed decision that aligns with your educational goals and financial well-being.

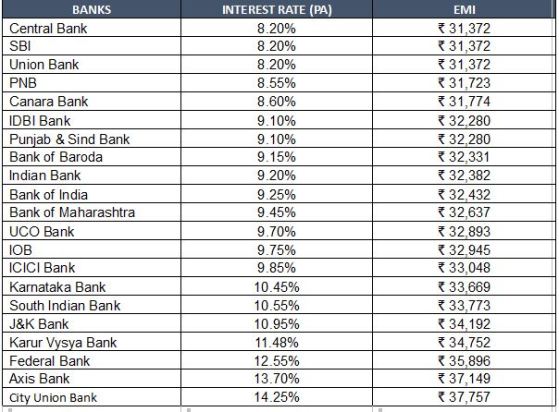

The table below compares different banks and their interest rates along with the EMI on Rs 20-lakh loan for 7-year tenure. You can decide based on your requirements.

Interest Rates & EMI on Education Loan

EMI on Education Loan of Rs 20 Lakh for 7-year Tenure

Compiled by BankBazaar.com

Note: Interest rate on Education Loan for all listed (BSE) Public & Pvt Banks considered for data compilation. Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 13 Jun 2023. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on education loan (irrespective of loan amount and tenure) is placed at top and highest at the bottom. EMI is calculated on the basis of Interest rate mentioned in the table for Rs 20 Lakh Loan with a tenure of 7 years (processing and other charges are assumed to be zero for EMI calculation).