As we step into 2023, geo-political risks, rising Covid cases in China, sticky inflation and recession fears will keep the equity markets volatile. While Indian equities have outperformed global peers for the third year in a row, prospective returns may be muted as slower economic growth and expensive valuations could be potential headwinds.

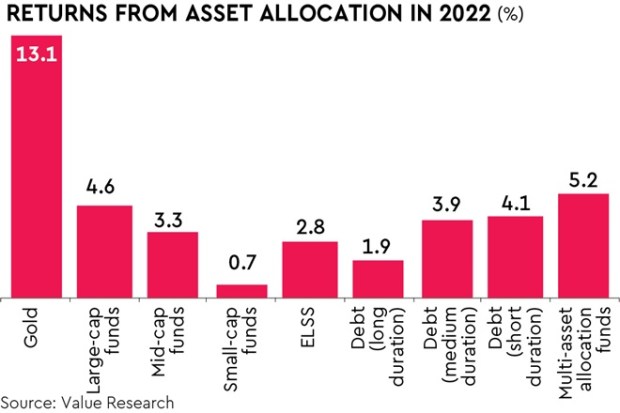

However, risk-averse investors will benefit from higher rates as banks and companies are competing to mop up funds. Gold has been an outperformer due to the rupee’s depreciation and a hedge against global uncertainties and is expected to add value to the portfolio. Thus a multi-asset strategy will work well for this year.

Also read: ‘Rates will not come down anytime soon’

Equity investing

While volatility will provide an opportunity to investors to buy stocks at lower prices, they should play it safe this year. Varun Fatehpuria, founder & CEO, Daulat, a new-age, wealth-tech firm, says volatile markets have provided good appreciation for building a diversified portfolio by following a disciplined investment strategy and not investing randomly based on tips. “Investors should continue to align their investments with the time horizon and their own risk profile and invest broadly across different asset classes to withstand this volatility,” he says.

Similarly, Anil Rego, founder and CEO, Right Horizons, a SEBI-registered Portfolio Management Service provider, says retail investors should be cautious in the first half of 2023 as macroeconomic uncertainties and the effects of policy response will linger on in H1CY2023. He recommends a diversified approach mainly focused towards large-cap names for H1CY2023 and slightly more concentrated quality mid-cap oriented investment during the second half of the year when there is more certainty on the effects of policy response and demand outlook. “Investors should continue investing in a staggered manner through SIP and STP and downside volatility should be considered as an investment opportunity for the next four quarters as we continue to be bullish on India’s structural story for a four- to five-year time frame,” he says.

Bond yields & asset allocation

The yield on bonds have risen – the yield on 10-year G-Sec is about 7.3% now against 6.5% a year ago — and investors can invest in long-tenure bonds at higher yields. Alekh Yadav, head, Investment Products, Sanctum Wealth, says bond yields are near peak and hence it may be a good time to lock in yields. “Since the gap between prospective returns on equity and bonds has narrowed, we are neutral on equities. We suggest investors rebalance their portfolio and be closer to their long-term asset allocation based on risk profile,” he says.

Investors must look at asset allocation as per their risk profile. Sonam Srivastava, founder, Wright Research, SEBI registered investment advisor, says this might be the time to bet on value stocks, high-quality bets, and some bond allocation. “I would suggest a 50-75% allocation to equities for a moderate risk profile, 10-25% bonds and some exposure to international stocks. Given the volatility in the markets I would recommend being tactical and dynamic in the asset allocation,” she says.

Multi-asset investing

Multi-asset funds which invest across equities, debt and gold can be a good bet now rather than exposing the portfolio to risks of a single asset class. Investors should manage asset allocation at the portfolio level and investing in equity, debt and gold funds separately will allow for better control of the overall asset allocation. However, Yadav says some investors may not have the time, the understanding or the patience required to do so and for them multi-asset allocation mutual funds make sense.

As we are close to the peak of the current interest hike regime which generally follows with the rallies across asset classes when the rate cycle finally reverses, investors should maintain their target asset allocation in face of market volatility and utilise market corrections to add to the equity portfolio in this last leg of the rate hike cycle.

Also read: MSMEs are gripped in an anaconda of regulations

Rego suggests that investors can orient their portfolios towards large-cap equity exposure and short-term fixed-income securities and later move towards mid and small- cap names for equity exposure and long-duration funds for debt exposure when diversifying across asset classes. “We would advise having exposure to real estate through REIT and gold through ETFs as liquidity can be utilised to gear portfolio towards return-enhancing asset class later on in the cycle,” he says.