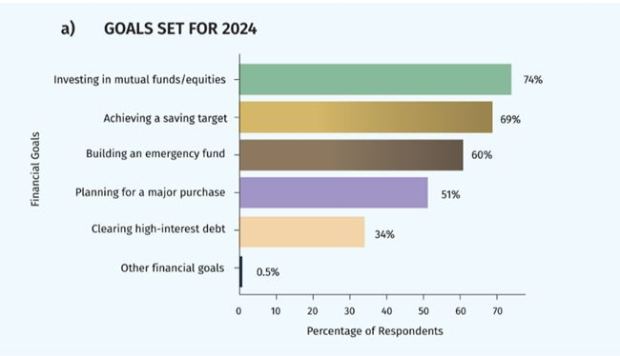

Building wealth was a top financial priority for urban Indians in 2024. The majority, 74% of the surveyed planned to invest in financial instruments like stocks and mutual funds, reflecting a strong focus on wealth accumulation. Sixty percent prioritised building an emergency fund, reflecting the importance of financial security during unforeseen circumstances. This desire for financial security was further shown by the fact that 69% aimed to save a portion of their income, while 51% were saving for major life events such as buying a house or a car.

However, despite strong saving habits and ambitious financial goals, only 30% of participants surveyed successfully achieved all their financial goals in 2024, according to a research report by 1 Finance.

The report titled ‘The Financial Behaviour of Urban Indians in 2024’ highlights that challenges faced by many in translating their financial aspirations into realities. Unexpected expenses and market conditions emerged as major obstacles. Furthermore, 31% cited inadequate financial planning as a key challenge, while 36% attributed their diculties to poor financial literacy.

Also Read: Unified Pension Scheme: Key features, benefits, eligibility

Saving Habits of Urban Indians in 2024

The saving habits of urban Indians surveyed indicated a commitment to building a secure financial future. In 2024, around 36% of the urban Indians surveyed were diligent savers, setting

aside between 20% and 30% of their income. Notably, a sizeable group (around 31%) saved more than 30%, highlighting a strong commitment to long-term financial security.

The survey is based on the responses from 406 individuals across cities like Bengaluru, Delhi, Mumbai, and Hyderabad and highlights their financial goals, saving habits, challenges faced, and the tools they found most helpful in planning for their future.

KEY TAKEAWAYS:

1. Mutual funds were the most popular investment choice among urban Indians in 2024, with 78% opting for them and 60% preferring stocks. 65% of urban Indians still relied on fixed deposits (FDs) to achieve their financial goals.

2. 31% of urban Indians surveyed saved over 30% of their income, while 36% saved between 20% and 30%. The data highlights a strong commitment to long-term financial security.

3. Despite strong saving habits and ambitious financial goals, only 30% achieved all their financial goals in 2024. Unexpected expenses and market conditions emerged as major obstacles. 31% cited inadequate financial planning as a key challenge, while 36% attributed their difficulties to poor financial literacy.

4. Only 38% primarily relied on financial advisors, including mutual fund distributors and insurance brokers, for financial guidance in 2024.

FINANCIAL GOALS FOR 2024:

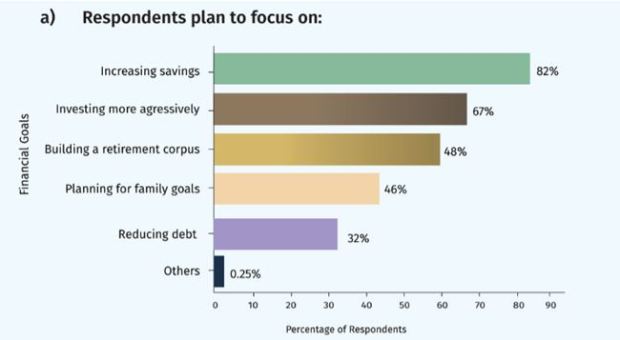

FINANCIAL GOALS SET FOR 2025:

> 82% of urban Indians surveyed aim to increase their savings in 2025, with 67% plan to invest more aggressively.

OBSERVATIONS FROM THE SURVEY:

1. A significant portion (67%) saves over 20% of their income, but many struggle to align their savings behaviour with long-term goals like retirement planning and debt reduction. Proper financial planning can help manage finances better, ensuring savings are directed towards achieving these goals.

2. A significant portion sought advice from less reliable sources, with 27.59% turning to friends and family and 10% relying on social media influencers, potentially exposing themselves to biased or inaccurate information.

CONCLUSION:

The findings of this survey highlight that while most respondents exhibit confidence in their financial literacy and demonstrate healthy saving habits, gaps in practical application, preparedness for economic uncertainties, and alignment with long-term goals remain evident. The challenges faced—such as unexpected expenses, inflation, and insufficient income—underscore the need for more holistic financial planning. This includes focusing on integrating short-term, medium-term, and long-term financial goals, improving financial literacy through practical education, and leveraging digital tools and personalised advisory services to streamline financial management.