The Finance Minister announced various tax-related measures in her press conference today. She said that the rates of TCS for specified receipts and TDS for non-salaried specified payments made to residents will be reduced by 25 per cent, which will provide more funds at the disposal of individuals and companies.

The reduced TDS and TCS rates will be valid until 31st March 2021. The government said Rs 50,000 crore of liquidity will be introduced by reducing the TDS and TCS rates for certain payments by non-individuals.

Experts believe the reduction in TDS and TCS rates will have a massive positive impact in cash flow for deductor and deductee for the specific payments.

Kapil Rana, Founder and Chairman, HostBooks Ltd, says, “During lockdown business activities are not happening, cash flow is the biggest issue and taxpayers were well aware that they will default in time-bound tax compliances and would end-up up paying huge tax penalties and interests. Extending the due dates for various time-bound activities will allow them to be tax compliant and saving huge penalties and interest burden.”

Vikram Doshi, Partner Tax and Regulatory, PwC India, says, “The immediate reduction of TDS rate by 25 per cent is a direct and practical measure to increase liquidity in the system. While there was an expectation of a higher rate of reduction, the longer period of reduction till 31st March 2021 balances the slightly lower rate. The extension of due dates of various compliances provides additional relief given the practical difficulty in undertaking compliances.”

By reducing the rate of TDS/TCS, the government is helping taxpayers to have more liquidity in their hands. Naveen Wadhwa, Deputy General Manager, Taxmann, says, “The announcement will benefit self-employed, professionals and senior citizens earning interest income or rental income. It does not provide any relief to the salaried persons. However, it should be noted that the relaxation in the rate of TDS/TCS will not have any impact on the ultimate tax liability of a taxpayer. Thus, any deficit in tax liability, due to reduced rate of TDS/ TCS should be payable through advance-tax instalments. Any shortfall in the deposit of advance-tax will attract interest under section 234B and 234C.

Wadhwa adds, “The first instalment of advance-tax is due on 15th June 2020. A taxpayer should re-calculate his/her advance-tax liability to be deposited next month to avoid any payment of interest.”

Further, experts say the announcement to defer the due date for filing of Income-tax returns and the tax audit report will allow taxpayers to focus more on reviving his/her business rather than getting busy in collecting financial data to fulfil the compliance.

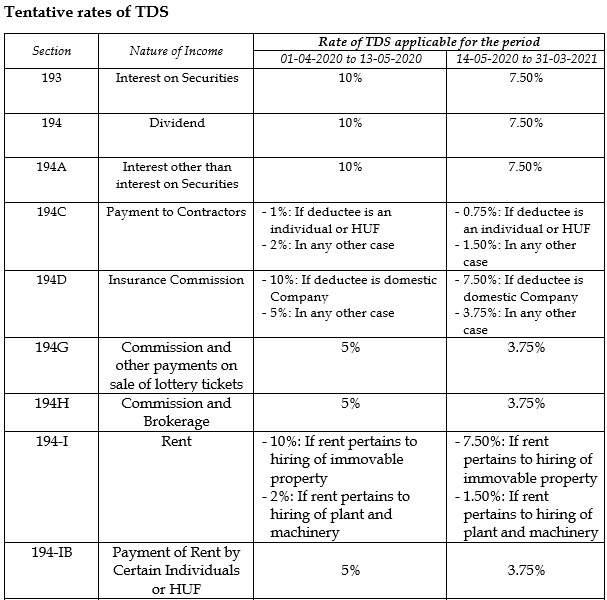

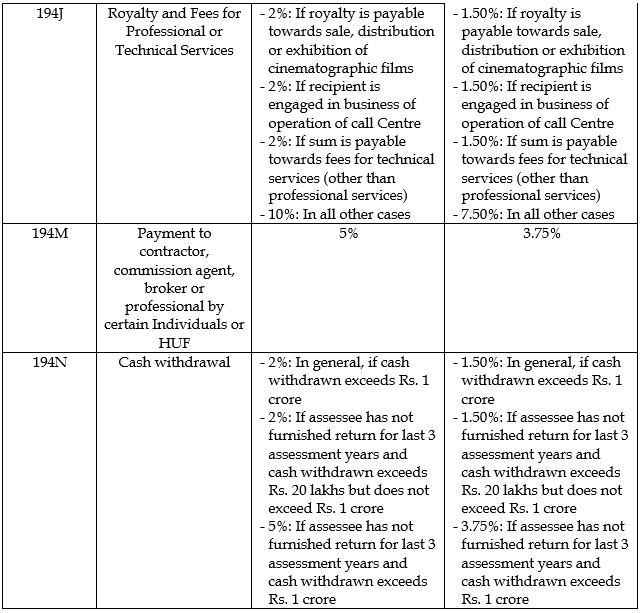

Tentative rates of TDS

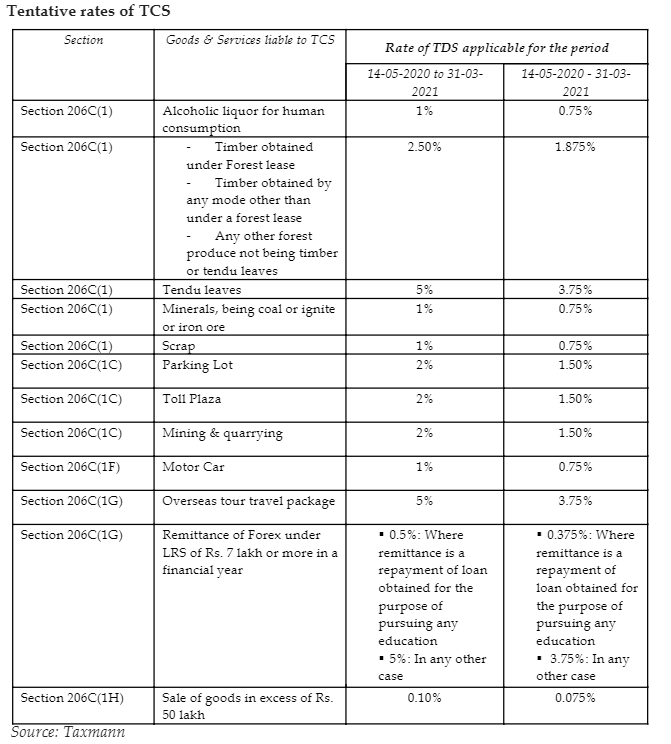

Tentative rates of TCS