Question: I have purchased a house on a home loan for which I am paying more than Rs 3.5 lakh as interest annually. I have given this house on rent and am receiving Rs 20,000 per month from a tenant. In this case, what will be my tax liability for the rental income?

Answer given by CA (Dr.) Suresh Surana: Any rental income derived by a taxpayer would be liable to taxation under income from house property. Taxpayers may take the benefit of nil annual value on any two house properties as self occupied properties (SOPs). However, a self-occupied property would constitute a property owned by the taxpayer which is occupied throughout the year by the owner for the purpose of his own residence and is not actually let out during the whole or any part of the year. Thus, the taxpayer may not be able to claim the benefit of SOP on any property given on rent.

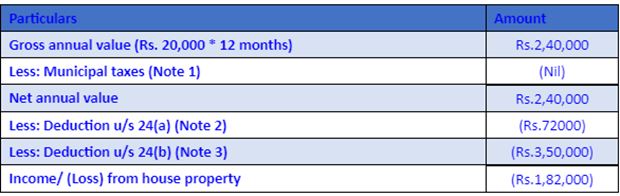

Computation of Income from House Property for the above-mentioned case would be as follows:

Note 1: Municipal taxes levied by local authority are to be deducted from the gross annual value if such taxes are borne and paid by the owner during the previous year.

Also Read: Top 5 Premium Credit Cards in India for exclusive benefits, airport lounge access

Note 2: Under section 24(a) of IT Act, a standard deduction of 30% on the Net Annual Value can be claimed with respect to expenses such as painting, repairs, insurance, repairs, electricity, water supply, etc.

Note 3: Under section 24(b) of IT Act, a deduction of up to Rs. 200,000 for home loan’s interest can be claimed by the owner of a self-occupied property. Further, owner of a let out property shall be eligible to claim the entire interest on the home loan as a deduction.

Note 4: If loss under the head “Income from house property” cannot be fully adjusted in the year in which such loss is incurred, then unadjusted loss can be carried forward for 8 years immediately succeeding the year in which the loss is incurred.

Income from house property is the one of the most common source of income. Hence, it is crucial for taxpayers claiming aforementioned deductions and exemptions against said income to keep the following points in mind:

a. The taxpayers should ensure proper rental agreement in order to substantiate the value of their rental income.

b. In case the rent amount exceeds Rs 1 lakh per annum, the assessee will be required to submit the PAN card details of property owner to claim the deduction.

c. Any subsequently recovery of unrealized rent shall be deemed to be the income of taxpayer under the head “Income from house property” in the year in which such rent is realized irrespective of the fact that the taxpayer is the owner of that property in that year. However, the taxpayer may claim deduction of 30% u/s 24(a) of the IT Act against such rent arrears.

This Q&A series is published every week on Thursday.

Disclaimer: The views and facts shared above are those of the expert. They do not reflect the views of financialexpress.com