Understanding loan interest can be tricky, but the reducing balance method offers an easy way to calculate and manage interest payments on your loans.

Loan, home loan, personal loan, auto loan, car loan, Simplifying Loan Interest, reducing balance method, flat rate method, reducing balance method loan calculator, reducing rate interest, reducing balance interest rates

Many banks and financial institutions offer reducing balance loans for housing loans. With this method, interest is calculated based on the remaining principal amount after each repayment. When you make an EMI payment, the outstanding loan balance decreases.

For example, if you pay monthly EMIs on your housing loan, the lender calculates interest on the reduced outstanding amount after each payment. This means the interest portion is highest at the beginning of the repayment cycle. As you make payments and the outstanding principal reduces, so does the interest portion in your EMI amount.

Also Read: Loan Against Rental Income: How your rental income can help get you a loan

Understanding loan interest can be tricky, but the reducing balance method offers an easy way to calculate and manage interest payments on your loans.

What is the Reducing Balance Method?

The reducing balance method, also known as the diminishing balance method, is a common way of calculating interest on loans. Unlike simple interest calculations, where interest is charged only on the principal amount, the reducing balance method recalculates interest periodically based on the remaining principal balance. This means that as you repay the loan, the interest is charged on the reduced outstanding balance, leading to lower interest payments over time.

How Does it Work?

When you take out a loan, the initial principal amount is set. Interest is calculated based on this principal balance initially. As you make periodic loan repayments (monthly, quarterly, etc.), a portion goes towards reducing the principal balance while the remainder covers interest charges. With each repayment, the outstanding principal reduces. The interest for the next period is calculated based on this reduced principal amount, not the original loan amount. Since interest is recalculated on the reducing principal balance, the interest component decreases with each payment. This results in lower interest payments over the loan tenure.

Adhil Shetty, CEO, Bankbazaar.com, says, “The loan formula computes interest based on the remaining balance, not the entire loan amount. Therefore, the overall interest paid on home loan repayments is lower with reducing balance loans compared to fixed-rate loans. This method is commonly used for housing loans. However, vehicle loans and personal loans typically utilise the flat-rate method.”

Example of Reducing Balance Method

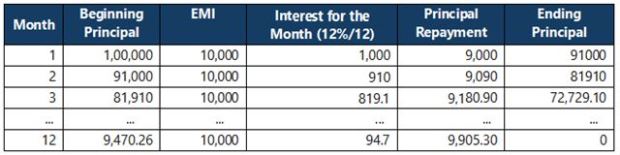

Let’s say you take a loan of Rs 1,00,000 at an annual interest rate of 12% for 1 year, with monthly repayments.

Initial Principal: Rs 1,00,000

Monthly Payment: Rs10,000

Loan Tenure: 1-Year

In the table below, you can see how the interest component decreases with each payment as the principal reduces. By the end of the loan tenure, the principal is fully paid off.

Advantages of Reducing Balance Method

Lower Effective Interest: Borrowers benefit from lower effective interest payments over time compared to flat interest rate calculations.

Encourages Timely Repayments: Since interest is recalculated based on the reducing principal, borrowers who make timely repayments reduce their interest burden faster.

Transparency: The reducing balance method offers transparency as borrowers can see how each repayment reduces the outstanding balance and subsequent interest charges.

Flexible Loan Management: Many loans, such as home loans and personal loans, use the reducing balance method, providing flexibility for borrowers to manage their loans effectively.

The reducing balance method is a fair and transparent way of calculating interest on loans. It benefits borrowers by reducing the effective interest burden over time, encouraging timely repayments, and offering flexibility in handling their loans.