Fixed deposits (FDs) have always been a favored investment option for Indians, particularly for senior citizens seeking stability and consistent income. Senior Citizen Fixed Deposits are designed specifically to meet the requirements of this group, providing higher interest rates and additional perks.

Nevertheless, it is essential to grasp the intricacies and factors involved in order to maximize the benefits of these investments.

Senior Citizen Fixed Deposits

Senior Citizen Fixed Deposits are deposit schemes provided by banks and financial institutions specifically for individuals who have reached a certain age limit, typically 60 years or above. These fixed deposits generally come with higher interest rates compared to standard fixed deposits, which can be appealing to retirees or individuals seeking consistent income during their retirement years.

Key Benefits

* Higher Interest Rates

Fixed deposits for senior citizens typically come with interest rates that are 0.25% to 0.75% higher than those for regular fixed deposits. This extra interest has the potential to greatly enhance their earnings, particularly in the long run.

* Stable Returns

Fixed deposits are recognized for their reliability and consistency in yields, which makes them the top choice for cautious investors, especially senior citizens.

* Regular Income

Senior citizens often depend on FD interest as a reliable source of income post-retirement. The payouts can be received monthly, quarterly, semi-annually, or annually, offering flexibility according to individual cash flow requirements.

* Tax Benefits

Section 80TTB of the Income Tax Act allows senior citizens to claim a deduction on the interest earned from deposits in banks, co-operative banks, and post offices, thereby reducing their tax liability. Senior Citizens FDs present a lucrative option for retirees and older investors looking for a steady income stream and moderate growth.

By taking into account factors like interest rates, tax implications, investment duration, and diversification strategies, senior citizens can optimize their fixed deposit investments to align with their financial objectives while managing risks effectively. Supplementing FDs with other investment tools can further boost overall portfolio returns.

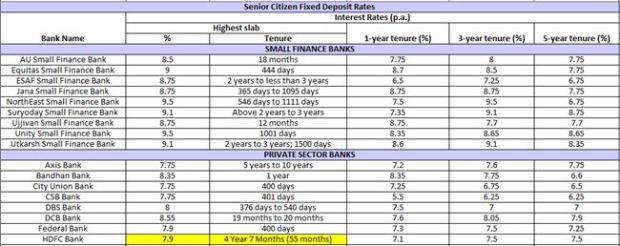

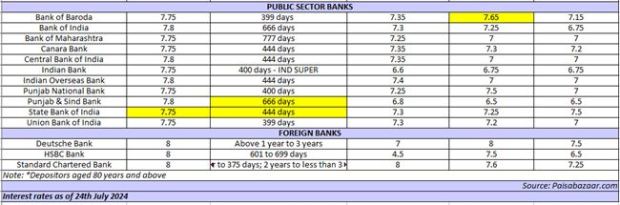

The following table outlines the interest rates and respective tenure options for senior citizens FDs. This comparison can assist in selecting the most suitable option based on individual financial goals and requirements.