Personal retail loan disbursements recorded an impressive growth of 42% between March 2021 and March 2022, reflecting an improvement in overall economic and business sentiment which took a beating during the COVID-19 pandemic, according to a joint study by Equifax and Andromeda.

The number of active personal loans increased from 3.5 crore as of March 2020 to 4 crore by March 2021, and increased again to 6 crore by March 2022, the study said.

The book size of personal loans rose from Rs 5 lakh crore as of March 2020 to Rs 6 lakh crore as of March 2021 and increased again to Rs 8 lakh crore as of March 2022. The highest number of personal loans were disbursed by NBFCs (Non-Banking Financial Company) followed by private banks.

“The retail loans portfolio segment of the Indian lending industry has shown double-digit growth, with personal loan disbursements specifically recording significant growth. This is a strong indicator of the revival in consumption in the country,” said K M Nanaiah, Managing Director, Equifax Credit Information Services Pvt Ltd and Country Leader, India & MEA, Equifax.

The study further revealed the total portfolio outstanding of retail industry increased from Rs 71 lakh crore as of March 2020 to Rs 80 lakh crore as of March 2021, and further increased to Rs 89 lakh crore as of March 2022. Private banks experienced the highest growth of portfolio outstanding with a 32% increase from March 2020 to March 2022. The public sector recorded a growth of portfolio outstanding with a 21% increase during the period. The portfolio outstanding of NBFCs showed a growth of 7% from March 2020 to March 2021, and a 13% increase from March 2021 to March 2022.

Also Read: Credit Cards – Upgrading your card? Follow these 4 tips

“If the trend in the growth of personal loans sustains, we can safely assume the economy will do well in the coming years. At the same time, we must keep in mind interest rates are on the rise following three consecutive rate hikes by the Reserve Bank in four months. Additionally, there is no let up in the geopolitical tensions, and these two factors will certainly weigh on the minds of consumers,” said Raoul Kapoor, Co CEO, Andromeda Sales and Distribution pvt Ltd.

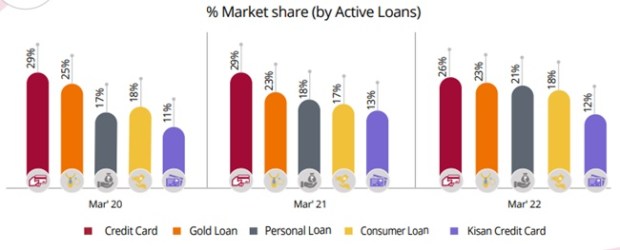

Top 5 Products as on 31st March 2022 by Number of Active Loans

The retail industry reported 46 crore active loans as of March 2022. Active personal loans increased by 46% from March 2021 to March 2022, Kisan credit cards by 15% and credit cards by 13% during the same time period.

The total portfolio outstanding of the retail industry as of March 2020 worked out to be Rs 85 lakh crore with 50% being contributed by the top five sectors: housing loans, personal loans, property loans, gold loans and auto loans.

As of March 2022, the portfolio outstanding was Rs 26 lakh crore for housing loans. It grew by 11% from March 2020 to March 2021, and again by 12% from March 2021 to March 2022.

From March 2021 to March 2022 personal loan portfolio outstanding grew by 23%.

According to the study, the retail lending industry disbursed 20 crore loans from March 2019 to March 2020, 18 crore loans from March 2020 to March 2021, and 24 crore loans from March 2021 to March 2022.

NBFCs led the retail industry by disbursing the highest number of loans. They disbursed 12 crores of loans from March 2021 to March 2022, registering a growth of 64% over the previous fiscal year.