A potential investor told me that he had a dream scenario: a Public Provident Fund (PPF) that would take any amount of money and give back tax-free returns. He said he would put all his savings in PPF if that were possible.

I tried to persuade the client to invest in the equity asset class for a long-term horizon, but he only had eyes for PPF. It’s not fair to compare them because they are different asset classes with different roles in a portfolio. The only thing they have in common is that they are both long-term investment tools. But what about their long-term returns?

PPF gives an 8% post-tax return, while the equity asset class can give around a 12% post-tax return in general. This leads us to the questions:

- Does the extra 4% return from equity compensate for its volatility?

- Do we forgo the security of government-backed bonds?

New investors may not find equity a convincing alternative to PPF, even with a 4% higher return, given the uncertainty and risk involved.

Also Read: Should you invest in multi-cap or flexi-cap mutual funds?

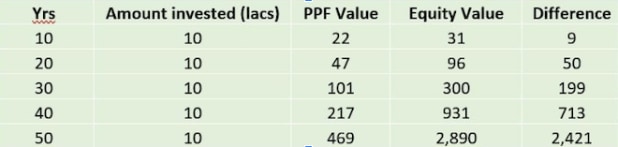

Let’s make a stronger case for equity. A 4% extra return may not seem like much, but when you compound it over 10, 20, 30, 40, or 50 years, it makes a huge difference. Here is the calculation:

The chart illustrates how the gap widens as the years go by. In 10 years, the difference is only Rs 9 lakh, but in 50 years, it is Rs 24 crore. This difference can make or break one’s wealth and lifestyle. This is why people with similar incomes end up living very differently. One travels within the country, while the other goes abroad. One drives an ordinary car, while the other drives a luxury car, and so on.

You must also consider that inflation erodes the value of money over time, and PPF barely manages to outperform inflation. So PPF investors are only maintaining their purchasing power without creating wealth. Their lifestyle remains unchanged. Please note that we are talking about PPF, which is the best of the best in the fixed income category because it offers a slightly higher and tax-free rate than fixed deposits (FDs). Fixed deposits, on the other hand, have lower rates than PPF and are fully taxable. So FDs would not even keep up with inflation, let alone generate wealth.

As for the volatility of equity, it is a natural characteristic of the equity market to respond to events. It plunges on bad news and surges on good news. There is always some obstacle or challenge in the economy that scares investors away. Crises also keep occurring, such as the subprime crisis in 2008, the Euro crisis in 2011, the Chinese crisis in 2015, and COVID in 2020. But these are all temporary phenomena.

Also Read: LANDLORD’S DILEMMA: Tenant not paying rent? Know your options

The equity market will always recover and rise. The Sensex has gone up from 5000 in January 2000 to 62000 in May 2023. This is an 11.5% compounded annual growth rate (CAGR). Other types of equity, such as mid-cap and small-cap, grow even faster.

Equity may be a problem in the short term, but fixed income with a low return is a problem in the long term. You need to make a smart choice between stable, low returns and high returns with volatility. We recommend spreading the money between both. This will smooth out the volatility and let you enjoy the long-term growth of equity.

Have a safe and secure investing journey!

This column has been written by Akhil Bhardwaj, Partner Alpha Capital

Disclaimer: The views expressed in this article are that of the respective authors. The facts and opinions expressed here do not reflect the views of www.financialexpress.com. Please consult your financial advisor before investing in mutual funds.