The New Tax Regime under Section 115BAC of the Income Tax Act 1961 was introduced with the objective of enhancing the number of electronic tax filings and bringing transparency in the Income Tax Returns. The statistics shared by the department recently show a huge growth in e-filings, but the irony is that a limited number of individuals have opted for the New Tax Regime. A total of 7.33 crore personal tax ITRs have been reported by the Department for the Assessment Year 2023-24 as against 6.86 crore in A.Y. 2022-23, marking a growth of 6.79%.

A report by ClearTax, a popular e-filing service provider, has also highlighted the growth in the number of taxpayers for Assessment Year 2023-24 but most of them have opted for the Old Tax Regime. Of their 5 million individual tax payers customer base, 15% opted for the New Tax Regime and the remaining 85% opted for the Old Tax Regime. While the New Tax Regime was portrayed as beneficial for individual taxpayers because of reduced slab rates, it has not gained full acceptance among the individual assessees.

The New Tax Regime was introduced in the Financial Year 2020-21 with more number of progressive tax slabs and subsequently prinked in following Assessment years by introducing additional attractions like section 87A rebate on the total income of Rs 7 lakh and below. The compliance and e-filing has also been simplified by making the new website of Income Tax Department more user-friendly, providing all the relevant details including useful provisions and aid to filing ITR. In addition to it, Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) along with earlier form 26AS, are excellent tools to keep a track of one’s financial transactions during the relevant previous year. An ITR filed in conformity with all these and TDS certificates makes processing easy and faster. The mechanism works wonderful in terms of transparency, fraud detection and fast automated processing. However, the tax slabs introduced in the New Tax Regime are although lower than the Old Tax Regime but at the cost of removing the benefits of exemptions and deductions.

Also Read: Optimise your credit card spending with these 9 tips

The Old Tax Regime with 5, 20 and 30 percent progressive tax slabs provides a mechanism to reduce tax liability by availing certain exemptions and deductions under multiple sections of Income Tax Act 1961 by way of certain expenses like section 10(13A) exemption for paying house rent, Section 10(14) for Children Education and deductions under chapter VIA for various investments like section 80C, section 80TTA etc. and therefore, the Old Tax Regime is widely popular and preferred by individual assessees. While the New Tax Regime offers reduced slab rates and ease of filing, individual assessees with income greater than Rs 7.5 lakh still prefer the Old Tax Regime due to exemptions and deductions. The department expects a shift of 70 percent of individuals from the old to the New Tax Regime in the years to come. This indicates that the New Tax Regime, which is a choice now, may eliminate the Old Tax Regime and there are economic costs of it.

The Old Tax Regime served as a means to disciplined investing. For the sake of saving taxes, the individuals used to channelize money in the Financial Markets that served the purpose of personal financial planning as well as the contributor of economic growth. By making the New Tax Regime more lucrative, the department is losing revenue in the name of increased compliance due to lowering the tax slabs. Also, reduced investments will have an impact on various sectors of the economy as household investment will decline in various products like pension funds, provident funds, insurance etc. A latest report from Public Account of India highlights a significant decrease of 8.5% this year from Rs. 3.33 trillion in 2022-23 in small saving schemes like National Saving Certificate (NSC) and Public Provident Fund (PPF).

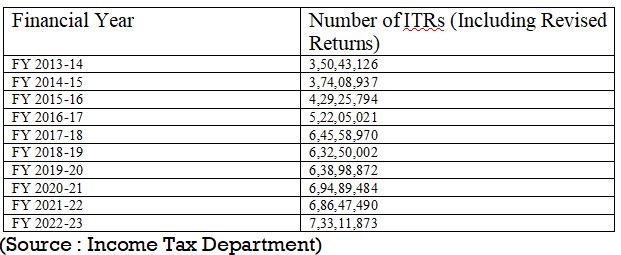

While the Government has met the objective of increasing tax compliance with the newly-introduced tax regime, it has reduced financial investment in the economy. A snapshot of the number of personal ITRs from Financial Year 2013-14 to 2022-23 shows that the growth in number of ITRs cannot be attributed to the New Tax Regime as there has been an average annual growth rate of 15% in the number of ITRs in the periods of Old Tax Regime (see the table below).

Table 1. Number of Income Tax Returns Filed by Individual Assessees (Including Revised Returns)

The compliance, transparency and faster processing are a result of simplification of the mechanism. AIS, TIS, auto populated ITRs and user-friendly website are wonderful tools towards the efficient tax mechanism. Reduced slab rates and elimination of various sections for exemptions and deductions have huge cost for the financial sector of the economy and, therefore, need overhauling before making the New Tax Regime mandatory.

(By Leena Chhabra, Assistant Professor, Department of Commerce, Sri Aurobindo College (E), University of Delhi. Views are personal)