Personal loans are best suited for addressing financial emergencies especially when you quickly need funds, and you know that you can repay the amount you are borrowing at a later stage when your finances improved. It is also essential to understand the specific purpose of the loan, whether it’s for a medical emergency, home renovation, or another reason.

Knowing your purpose will help you decide the loan amount. Borrowing without purpose means that you have no repayment plans, and you are unaware of the interest liabilities.

When you apply for a personal loan, lenders have specific eligibility criteria, including age, income, employment status, and credit score. You must ensure you meet these eligibility criteria before applying to avoid rejection. Here are the key things you must keep in mind.

Also Read: 10 things to do with your credit cards to maximise your savings

Credit Score

Your credit score can help you secure a loan with favourable terms. Improve your credit score and if your credit score is already good, then you have the opportunity to negotiate better terms of the loan.

Compare Offers

Compare personal loan offers from various banks, financial institutions, and online lenders. Consider factors like interest rates, processing fees, loan tenure, and customer service.

Interest Rates

The interest rate is a critical factor. Choose a lender offering the lowest interest rate, as it will significantly impact the total cost of the loan. Keep in mind that personal loan interest rates can be fixed or floating. A fixed rate remains constant throughout the loan tenure, while a floating rate can change with market fluctuations.

Loan Tenure

Decide on the loan tenure based on your repayment capacity. Longer tenures result in smaller EMIs but may lead to higher overall interest payments.

It is also important to read the loan agreement and terms and conditions. Ensure you understand all clauses and provisions, especially related to prepayment, late fees, and default penalties. Additionally, good customer service is crucial in case you face issues during the loan tenure. Check reviews and feedback about the lender’s customer service.

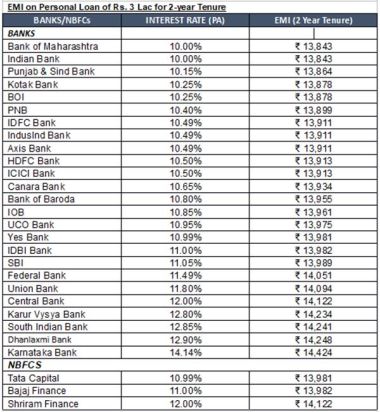

The table below will help you compare the interest rates of various institutions and EMIs for the loan amount of Rs 3 lakh for a 2-year period.

Interest Rates & EMI on Personal Loan

Compiled by BankBazaar.com

Note: Interest rate on Personal Loan for all listed (BSE) Public & Pvt Banks and selected NBFCs considered for data compilation. Banks for which data is not available on their website are not considered. Data collected from respective institution’s website as on 17 Oct 2023. Banks and NBFCs are listed in ascending order on the basis of interest rate in their respective category, i.e., bank offering lowest interest rate on Personal loan is placed at top and highest at the bottom. EMI is calculated on the basis of interest rate mentioned in the table for a Rs 3 Lac Loan with a tenure of 2 years (processing and other charges are assumed to be zero for EMI calculation). Interest and charges mentioned in the table are indicative and may vary depending on the bank’s T&C.