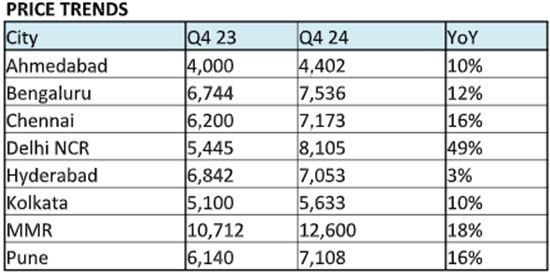

Average property values in India’s National Capital Region (NCR) showed a whopping 49% appreciation in the past one year as demand for luxury homes continued to sustain. This comes amid an escalation in the cost of building materials and labour, according to a new report by PropTiger.com.

As per the report titled ‘Real Insight: Residential Annual Round-up 2024’, property prices increased across cities during the October-December period of 2024, albeit in varying degrees. While price growth slowed in the southern housing market of Hyderabad after nearly a decade of sharp rise, all other cities covered in the analysis showed double-digit annual appreciation.

Source: Real Insight Residential – Annual Round-up 2024, Housing Research

Cities covered in the analysis are Ahmedabad, Bengaluru, Chennai, Hyderabad, Kolkata, Delhi-NCR (Gurugram, Noida, Greater Noida, Ghaziabad & Faridabad), Mumbai Metropolitan Region (Mumbai, Navi Mumbai & Thane) and Pune.

Also Read: How being a loan guarantor can affect your finances and credit

“High-net-worth individuals deploying money in Delhi-NCR — this region is home to over 10 recently-listed start-ups — has kept the growth momentum going for this coveted residential market as developers prioritise premium offerings to affordable homes. This is the single biggest reason why home sales in key contributors like Gurugram (144% increase YoY), Greater Noida (54% increase YoY) and Noida (3% increase YoY) showed annual rise in sales even though pan-India numbers showed 26% year-on-year dip,” the company said in a statement.

Property prices in India’s financial capital Mumbai rose by an average 18% YoY because of similar factors, the report said. Home to India’s biggest business stalwarts, Bollywood stars and sports celebrities, Mumbai is the most unaffordable housing market in the world’s most populous country, it added.

“No doubt, this kind of price growth is indicative of underlying demand, growth prospects and a positive buyer sentiment. However, cost pressure might further affordability concerns in a country where a large part of the population relies on government subsidies for house purchases. Amid hardening inflation and slowing growth, the government must launch policy measures that take care of this crucial aspect to promote affordable housing. Positive tweaks in taxation laws in the upcoming Budget and rate cuts by the RBI could go a long way in ensuring greater affordability for India’s burgeoning middle class,” said Dhruv Agarwala, Group CEO, Housing.com & Proptiger.com.

Commenting on the report, Yukti Nagpal, Director, Gulshan Group, said that Noida and Greater Noida are not just witnessing a rise in property prices—they’re emerging as the future of real estate. This growth is driven by robust infrastructure projects like the upcoming Noida International Airport, expanded metro connectivity, and expressway developments linking the region to key hubs. What’s even more compelling is the shift in buyer sentiment. Investors and end-users are now recognizing the long-term potential of these markets. High-net-worth individuals (HNIs) are increasingly drawn to the region, attracted not only by its world-class amenities but also by the promise of substantial appreciation.

“Rising disposable incomes, evolving aspirations, and the continuous urban development make Noida and Greater Noida prime real estate hotspots. For those considering the bigger picture, this is no mere temporary surge—it’s a market poised for sustained growth and strong returns. The signs are evident, and the future looks promising for those who make strategic investments now. Noida’s infrastructural strides are garnering global attention, with international brands setting up their headquarters along the Noida expressway. It won’t be long before Noida is not just compared to Dubai—it may very well outshine it,” she added.

Amit Modi, Director, County Group, said, “The sharp rise in property prices in NCR stems from rising urbanization and an influx of NRIs and HNIs. These buyers are well-travelled and are exposed to the global standard of living. They seek well-decked-up residences within iconic real estate projects in the country. In addition, the expansion of skilled professionals, coupled with a growing demand for premium housing, has intensified the demand. As the region continues to evolve, property values are expected to sustain their upward trajectory, reinforcing NCR’s position as a high-growth market.”

Dr. Gautam Kanodia, Founder of KREEVA and Kanodia Group, said, “The luxury housing growth in Delhi-NCR is the result of multiple factors, and infrastructure development is the major one. Gurugram remaining as a key driver, developments like the Dwarka Expressway and metro expansions propel property prices, providing significant momentum to luxury housing growth. The region’s 144% Y-o-Y sale increase underscores its growing appeal for luxury housing in NCR. Further, the evolving business ecosystem, coupled with rising demand for luxury homes, has significantly contributed to price appreciation. As buyers seek properties that reflect their lifestyle aspirations, we expect Gurugram to sustain this momentum in the long run.”