If you are investing in mutual funds through SIP, you must have come across the suggestion to remain invested for the long term for maximum returns. The primary reason behind this suggestion is that the power of compounding takes time to deliver awesome returns.

For instance, an analysis by FundsIndia shows that it takes eight years to reach Rs 50 lakh if you are investing Rs 30,000 per month and the annualised return is 12%. However, it takes just four more years to add another Rs 50 lakh to the corpus even as the SIP amount and return are the same. For another Rs 50 lakh, it takes just three more years. What this suggests is that an investor’s corpus grows faster in the later years of the SIP compared to the initial years.

So, as seen above, it pays to do nothing and just continue the SIP for a very long term. However, there is something more that investors can do to ensure an even higher corpus. This strategy is popularly called Step Up SIP, wherein investors increased their SIP amount by a fixed percentage every year.

Personal Finance experts believe that following the step-up SIP strategy can be very fruitful in the long run. Recently, this strategy was a subject of interesting discussion on social media. Let’s have a look:

On August 4, Niranja Awasthi, Senior Vice-President at Edelweiss Mutual Fund tweeted that best thing he has learnt after doing SIPs for the last 15 years is to do nothing. “The best rule I have learnt doing SIPs for last 15 years is to do nothing. Absolutely nothing.”

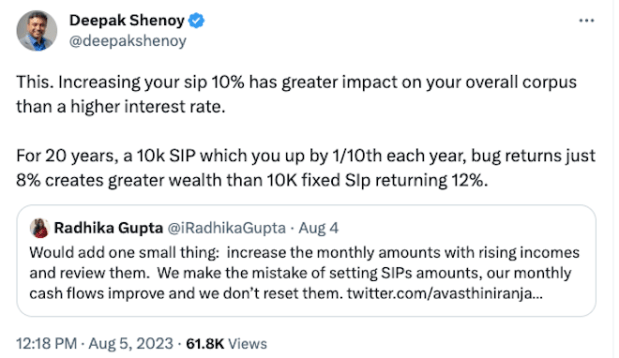

While Awashti’s statement generated several positive responses, Radhika Gupta, MD and CEO of Edelweiss MF, added to his point, saying one should also increase the SIP with rising incomes and review them.

According to Gupta, not increasing the SIP amount even when the income increases is one of the mistakes investors often make.

“Would add one small thing: increase the monthly amounts with rising incomes and review them. We make the mistake of setting SIPs amounts, our monthly cash flows improve and we don’t reset them,” said Gupta.

Agreeing with Gupta’s point, Deepak Shenoy, Founder and CEO of Capital Mind, an investment research and wealth management firm, said increasing the SIP by 10% has a greater impact on the overall corpus than a higher interest rate.

For instance, according to Shenoy, increasing Rs 10,000 SIP by 10% every year for 20 years can create greater wealth even at 8% returns compared to fixed SIP at 12%.

“This. Increasing your sip 10% has greater impact on your overall corpus than a higher interest rate. For 20 years, a 10k SIP which you up by 1/10th each year, bug returns just 8% creates greater wealth than 10K fixed SIp returning 12%,” Shenoy tweeted.

To know more about step-up SIP, you can also read this, this and this article on step-up SIP published by FE Money in past.