The small-cap rally has evoked both hopes and fears among investors. While several funds have given very high returns in the last 3 years, analysts believe an abrupt correction in the small-cap segment is around the corner. Small Cap segment generally falls first whenever there is a market downturn.

Many investors are, therefore, wondering what should be the ideal strategy to follow in current circumstances. In an email interaction with FE Money, Arihant Bardia, CIO and Founder, Valtrust, an investment advisory firm, answers some important questions and an “ideal” strategy that investors should know. Edited excerpts:

AMFI data for July 2023 show that small-cap funds saw an influx of Rs 4,171 crore into their AUM, despite this some of the schemes stopped taking further inflows. Why is it challenging for the fund manager of a small-cap fund to effectively manage it? How does the fund size matter in the mid and small-cap segments? Is it of any concern for the investors?

Fund houses like Nippon and Tata had taken a break from fresh inflows, but the overall AUM for the small-cap category continued to expand. Due to the shallowness of the small-cap segment, the impact cost is very high for the fund manager with a very high AUM if they need to deploy into or exit from a specific stock. For instance, a 5% position in a Rs 30,000 crore fund means a position of Rs 1,500 crore.

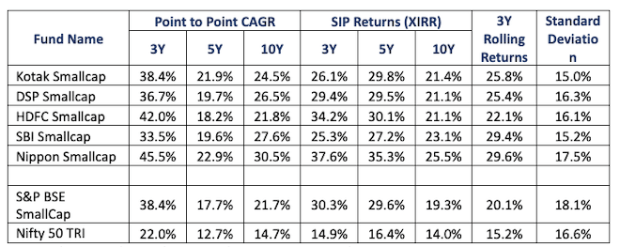

The Fund Manager’s decision to enter or exit this position can create a humongous distortion of stock prices. Clearly, smaller-sized funds are better suited. Hence, in the case of a small-cap fund, the fund size is an important yardstick. Yet, there are funds like Nippon or SBI which are outperforming the smaller-sized funds with ease.

Also Read: Mirae Asset Emerging Bluechip Fund increases SIP limit. Here’s a look at its returns since launch

Small caps are also known to have long snooze or recovery periods. Is the correction time suitable to seek entry in the category?

Small-cap funds typically have long gestation periods. These extended periods of dormancy or recovery are periods of uncertainty when everything looks to fall apart. Though investment at times of correction may be profitable, some investors take the contrarian route, entering small-cap funds during market downturns when prices are low. While this can be a profitable strategy, it will need nerves of steel to endure the extended periods, at times funds have experienced recovery periods of well exceeding 3 years.

The rally in the small-cap segment is seen to be for a short time. During corrections, it’s small caps that fall first. In such a scenario, can investors afford to have long-term investments in small-cap funds?

It is true that small-cap investments can exhibit greater volatility and may be among the first to experience corrections during market turbulence, but equally deliver much higher and faster returns than large caps during upswings. Look at 2023 YTD for example, BSE Small Cap index has risen 29% compared to 8% of Nifty 50 after a flattish 2022.

While short-term volatility is a consideration, history has shown that small caps can offer robust returns over the long run, making them a viable option for investors who are willing to embrace the associated risks and stay invested for the long term.

What is the ideal way to make investments in small-cap funds?

Given the higher drawdown and the risk associated one should explore appropriate asset allocation towards small-cap funds. A rebalancing discipline based on asset allocation can prove to be beneficial for the portfolio.

Entry and exit timing, can’t be the only strategy to seek entry into this category. While it can be alluring, staggered investing, long-term perspective and a diversified portfolio can help mitigate the risk of entering a bad time. Small-cap funds can inject vigour into your portfolio, but they should be approached with caution and a comprehensive understanding of the associated risks.

Retail investors should not get blinded by the current small-cap rally if they don’t intend to stay invested for the long term. Small-cap funds can offer exceptional returns, but they are not designed for short-term gains or quick exits. The allure of high CAGRs may tempt some to jump on the bandwagon, but without a commitment to the long haul, investors risk losing out on the potential benefits these funds offer.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.