As the benchmark equity indices touch all-time highs, investors are looking for value in sectoral funds. In August, net inflows in these funds touched `4,806 crore, the highest among all equity mutual fund categories and a whooping 236% rise over July inflows. Sectoral/thematic funds accounted for 24% of the total monthly net flows in August on the back of five new fund offerings.

Sectoral mutual funds invest in stocks of companies operating in a specific sector and concentrate their portfolio in a particular market segment. Experts say mutual fund investors are accelerating their equity investments in sectoral funds anticipating robust returns on the back of higher economic growth translating into improved corporate growth and profitability.

While sectoral funds offer the potential for high returns, they also come with elevated risk due to concentrated exposure.

Investors must ensure that their risk tolerance aligns with the investment choices to maintain a balanced and sustainable portfolio.

Sectoral funds are designed to capitalise on sector-specific growth potential. Sectors often exhibit cyclical behaviour, and not all sectors perform uniformly within an economy. Anirudh Garg, partner and head, Research, Invasset, a portfolio management service, says by conducting thorough research and analysis, investors can identify sectors with strong growth prospects, making sectoral funds an appealing choice for achieving their financial goals. “This trend underscores investors’ willingness to take calculated risks in thematic schemes, reflecting their confidence in the current market environment,” he says.

Sectoral watch

Most sectors are cyclical, with periodic tailwinds and headwinds generating investor interest, due to changing valuations of the underlying stocks. Gopal Kavalireddi, vice-president, Research, FYERS, an online trading & investment platform, says investors should use these opportunities to start investing in the longer term. “Capital goods and infrastructure (construction, realty and engineering-related including electrical, electronics and other manufacturing) sectors are witnessing good fund flows owing to the return of the capex cycle, stable interest rate environment and better financial strength,” he says.

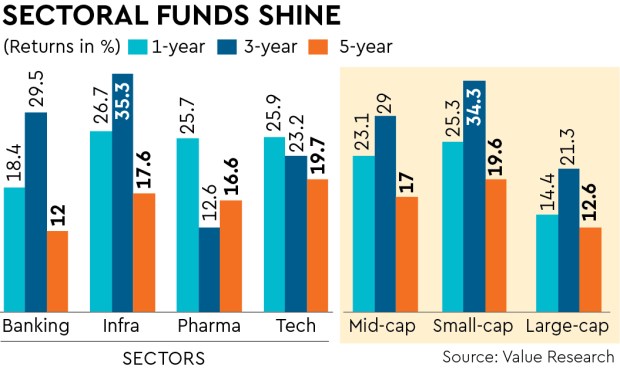

Sectors such as banking, pharma, infrastructure and technology are attracting investors seeking growth opportunities. The banking sector is regaining momentum with low non-performing assets and robust credit growth. Akhil Bhardwaj, senior partner, Alpha Capital, a registered investment advisor, says sectors such as banking, consumer durables, cement and infrastructure look promising for several compelling reasons. “However, these sectors also come with higher levels of risk. Any adverse developments can have a ripple effect on the entire investment portfolio, leading to potential losses,” he says. “Consider allocating 10% of your overall portfolio to these sectors. You can then participate in their growth potential while spreading risk across industries.”

Risk-reward

High volatility and high risk reward are inherent to investing in a sector fund. Mukesh Kochar, national head, Wealth, AUM Capital, says compared to the index over a given period of time, any particular sector may be able to perform better or worse. “This means that investors should make no aggressive allocations or, in particular, allocate a high percentage of their portfolio to certain sectors,” he says.

Sectoral funds are very high risk funds and should not be random picks. Soumya Sarkar, co-founder, Wealth Redefine, a wealth management company, says at times investors ignore the risks. “ It is better to seek guidance or have understanding about the sector and choose the funds accordingly. If not, then it is better to go for equity-oriented diversified funds,” he says.

Sector funds are market cap agnostic and invest across market capitalisations but are restricted to a single sector allocation. Such an investment objective increases the sector concentration risk to a very high level and is susceptible to the vagaries of macro and micro economic factors. Kavalireddi says due to these reasons, sectoral funds may not be suitable for those with low risk appetite. “Aggressive investors need to identify the right sector based on the prevailing market scenario and identify appropriate mutual fund schemes, led by an experienced fund manager with a track record of navigating economic cycles,” he says.

Relying solely on a single sector for long-term goals can be risky. Garg says investors must consider allocating a small portion of their equity portfolio to sectoral funds as an alpha-seeking strategy, maintaining discipline and have a clear exit plan to manage concentration risk while primarily relying on diversified funds for their core investments.

NO RANDOM PICKS

These are high-risk funds. Have a clear exit plan to manage concentration risk

Banking, infrastructure, pharma, technology and consumer durables are attracting investors

Most of these sectors are cyclical with periodic tailwinds and headwinds