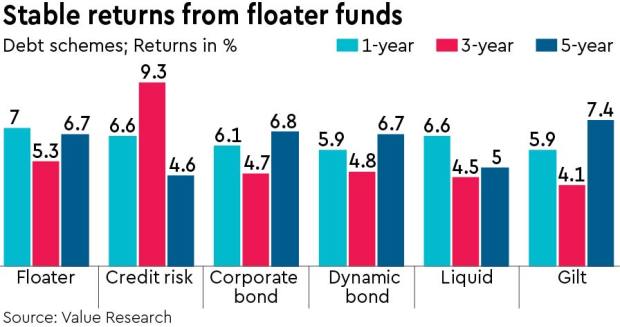

As floater funds mitigate interest rate risks and adjust the duration based on prevailing interest rates, investors are finding them attractive. In August, when most debt-oriented schemes saw net outflows, floater funds attracted net inflows of `2,325 crore, data from Association of Mutual Funds in India show.

Floater funds invest in debt securities where coupon rate is dynamic in nature. The funds invest in a blend of floating rate and fixed-rate instruments, including government securities, corporate bonds, and money market instruments. The diversification spreads risk and potentially delivers higher risk-adjusted returns compared to bank fixed deposits.

Experts recommend such funds to those who want to invest for a short term, say, six months, as these are protected from interest rate risk. Moreover, these funds carry lower risk compared to equity instruments, making them suitable for risk-averse investors.

Adjust fund duration

Investors seek funds with the ability to re-align fund exposures in sync with the prevailing interest rate environment. “Considering borderline risks of a rate hike, a floater rate fund will be able to effectively reflect higher interest accruals in sync with the external rate environment,” says Nirav Karkera, head, Research, Fisdom. “At the same time, a relatively lower duration and relatively higher credit quality ensure effective risk mitigation.”

When interest rate conditions are uncertain or inflation is likely to be high, floating-rate funds seem to attract inflows. Says Abhishek Banerjee, founder and CEO, Lotusdew Wealth and Investment Advisors, “The bonds themselves have floating rate coupons or inflation-linked coupons which automatically adjust the fund duration which is the sensitivity to changes in interest rate risk by virtue of the bonds the fund holds,” he explains.

If interest rate moves up, then coupon rate of floater funds also moves up and investors benefit by getting extra returns. On the other hand, if the six-month treasury bill rate falls then the coupon rate of floater also falls. Akhil Bhardwaj, senior partner, Alpha Capital, a registered investment advisor, says in floater funds investors do not have to worry about volatility in the interest rate. “The coupon rate of the floating rate fund is tagged to six-month treasury bills plus there is some extra return of around 0.5%,” he says. “Therefore, the coupon is directly proportional to the six-month treasury bill. The funds get adjusted to prevailing rates and provide 100% liquidity as well.”

More attractive than fixed deposits

Investors are increasingly turning to floating rate funds, even when bank fixed deposits are offering higher interest rates as these funds provide a dynamic and adaptable strategy for managing interest rate risk. Unlike fixed deposits that lock in investors at a static interest rate, these funds primarily invest in instruments with variable interest rates. As interest rates climb, the returns from floating rate funds adjust upwards, enabling investors to capitalise on rising rates.

Anirudh Garg, partner and head of research, Invasset, a portfolio management services, says floating rate funds offer diversification within the fixed-income realm. “These funds often employ interest rate swaps to transform fixed-rate securities into floating rate positions, bolstering their ability to navigate shifting rate environments. Floating rate funds suit investors with moderate risk appetite seeking regular income from debt instruments,” he says.

Investors must note that bank deposits do not re-adjust quickly and it is usually sticky around preset levels. To take advantage of dynamic interest rate scenarios, an investor can add this as a satellite allocation to existing debt allocation. “However, typically these are tactical allocations that investors need to do in consultation with an advisor based on their risk profile. Hence, for an active debt investor, this could be a good way to quickly ramp up their views on future interest rates,” says Banerjee of Lotusdew .

Factors to consider

Before investing in a floater rate fund, investors need to ensure that it suits their overall portfolio allocation strategy. They have to check the fund management team’s ability to effectively optimise for returns across interest rate cycles and ensure that the portfolio reflects a relatively higher yield to maturity, post expenses while minimising possible duration and credit risk incidence. Investors need to pay attention to how the fund has fared in diverse interest rate environments and market conditions. They must understand the fund’s specific investment strategy as different floating rate funds may have varying risk profiles based on their bond holdings.

Vivek Banka, co-founder, Goalteller, says the duration of the reset determines the impact of interest rates on the fund and also the benefits. “Since the base returns are low, high costs can erode the returns and hence a low-cost fund is essential for good net returns,” he says.

TACTICAL BETS

Floater funds invest in in a mix of floating rate & fixed-rate instruments where coupon rate is dynamic in nature

They often employ interest rate swaps to transform fixed-rate securities into floating rate positions