HSBC Fixed Term Series 128 is a close-ended income scheme designed for moderate investors who can take average risk while investing their money into mutual funds. The product is suitable for those who want to get their money invested in debt funds or money market instruments. HFTS 128 has the maturity period of 1106 days.

Here are a few things which one should know before making any investment in this fund:

New Fund Offer time period

The NFO period for HSBC Fixed Term Series 128 has already commenced from April 10, 2017 and will close on April 18, 2017.

Investment Objective

To seek generation of returns by investing in a portfolio of fixed income instruments which mature on or before the maturity date of the plan. However, there is no assurance or guarantee that the investment objective of the plan will be achieved. The plan does not assure or guarantee any returns.

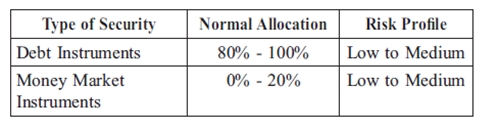

Asset Allocation

The plan will not invest in securitized debt. The total exposure to debt and money market instruments will not exceed 100% of the net assets of the plan.

Liquidity of the Scheme

Being close-ended, subscription to the units of the plan will be permissible only during the NFO period. The plan will not be open for ongoing subscriptions/switch-ins.

The Units of the Plan cannot be redeemed by the investors directly with the Fund until the maturity of the plan and there will be redemption by the Fund only on the maturity of the Plan. However, investors who wish to exit / redeem before the maturity may do so through stock exchange mode by giving a request for redemption in unit terms to the DP.

Further, investors are requested to note that they should have demat account to trade in the units of the plan. Investors must indicate this option in the application form.

Load Structure

Entry load and exit load are nil.

Minimum application Charges

The MAC for an investor to invest in the scheme is Rs 5000, which will increase in multiples of Re 1 thereafter.

Scheme’s Benchmark

Benchmark index for the scheme HTFS 128 – CRISIL Composite Bond Fund Index

It is, however, to be noted that one should consult one’s financial adviser before investing in such a fund. Moreover, one must link one’s investments to one’s financial goals of life.

(Source: amfiindia)