Mutual Fund Investment: The New Year has started on a good note and is anticipated to be positive for small cap funds. With an expected economic revival in the next few quarters, the small cap basket can prove to be a major wealth creator for investors. Based on the past three year performance, here are some small cap funds to consider for 2020:

Important points to note:

# These funds are not recommendations.

# The AUM (Assets Under Management) or size of a fund and TER (Total Expense Ratio) should not be the only criteria for fund selection.

# Top five and ten stock holdings by weight can provide investors with information on funds deployment style by the Mutual Fund.

# Past performance of a fund provides no guarantee of a similar future performance.

Axis Small Cap Fund

About the Fund:

The Fund is being managed by Anupam Tiwari since October, 2016. The objective of this scheme is to provide long-term growth in capital by investing in a well-diversified set of small cap stocks.

Nifty Small Cap 100 TRI is this scheme’s benchmark.

This scheme has been continuously in the top performing funds in the Small cap category, outperforming the peers by a wide margin.

It has comparatively been stable over a period of time and has one of the lowest expense ratio.

Scheme Details:

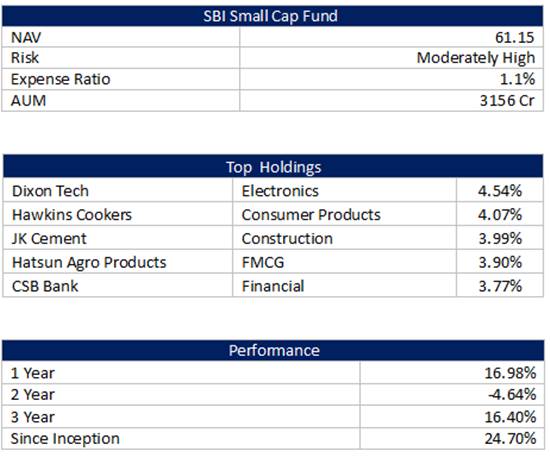

SBI Small Cap Fund

About the Fund:

The Fund is being managed by R Srinivasan since November, 2013. The objective of this scheme is to provide long-term growth in capital by investing in a well-diversified set of small cap stocks.

S & P BSE Small Cap TRI is this scheme’s benchmark.

The scheme has been continuously in the top performing funds in the Small cap category. It has been known for providing continuous high returns.

HDFC Small Cap Fund

About the Fund-

The Fund is being managed by Chirag Setalvad since June, 2014. The scheme aims to provide long term capital income by investing predominantly in Small-Cap companies with sound financial strength and with reasonable growth prospects.

Nifty Small-cap 100 TRI is this scheme’s benchmark.

The scheme has been one of the oldest schemes in its category with high AUM and has a good performance record.

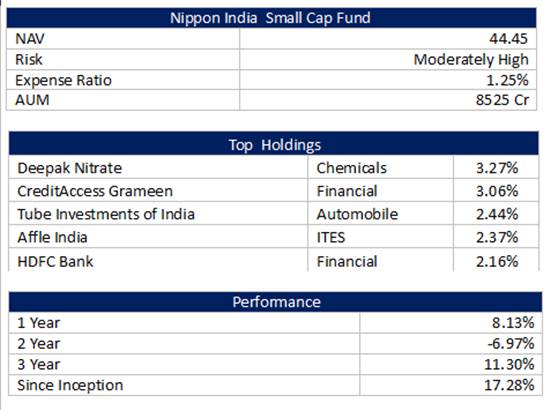

Nippon India Small Cap Fund

About the Fund-

This fund was earlier known as Reliance Small Cap Fund.

The Fund is being managed by Mr Samir Rachh since January, 2017. The scheme invests predominantly in Small-Cap companies with sound financial strength and with reasonable growth prospects to provide long term capital income.

S & P BSE Small-cap TRI is this scheme’s benchmark.

The scheme has a high AUM and good track record in the Small-cap category.

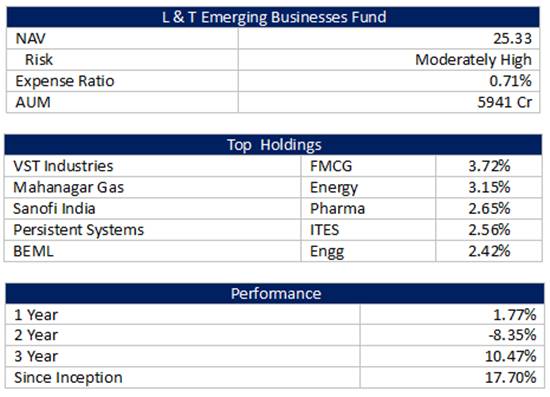

L&T Emerging Businesses Fund

About the Fund-

The Fund is being managed by Venugopal Manghat since December, 2019.

This scheme has been structured to be a diversified equity plan with the aim to invest primarily in small cap companies for generating long-term capital growth.

S&P BSE Small Cap TRI is this scheme’s benchmark. The scheme has been able to identify future multi-baggers in different market cycles and has been a good performer.

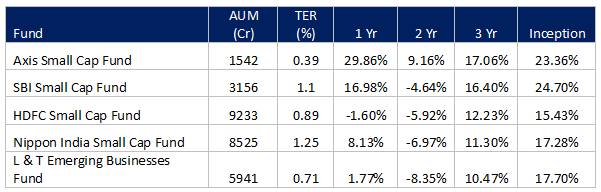

A Final Comparison:

Conclusion

Small cap funds have the potential to provide investors with out sized returns though they come with an inherent risk and are volatile in the short term. Investors should conduct a thorough research and due diligence before taking any decision to invest.

The funds mentioned here are NOT recommendations – all fund details mentioned are for information purpose and for comparison on a few metrics only.

SIP (Systematic Investment Plan) investing can prove to be beneficial and act as a very effective risk mitigation strategy. Investing on the basis of ‘One year returns’, especially in the case of Small cap funds, comes with high risks and should be avoided.

Happy investing !

(By Harsh Jain, Co-founder and COO, Groww)