Compared to Large Cap funds, mid and small-cap mutual funds are considered riskier but with the potential of delivering higher returns. Mid-cap mutual funds select mid-cap category stocks, which are ranked between 100-250 by market capitalisation, for investment. Small-cap mutual funds invest in small-cap stocks that are ranked lower than the top 250 stocks by market capitalisation.

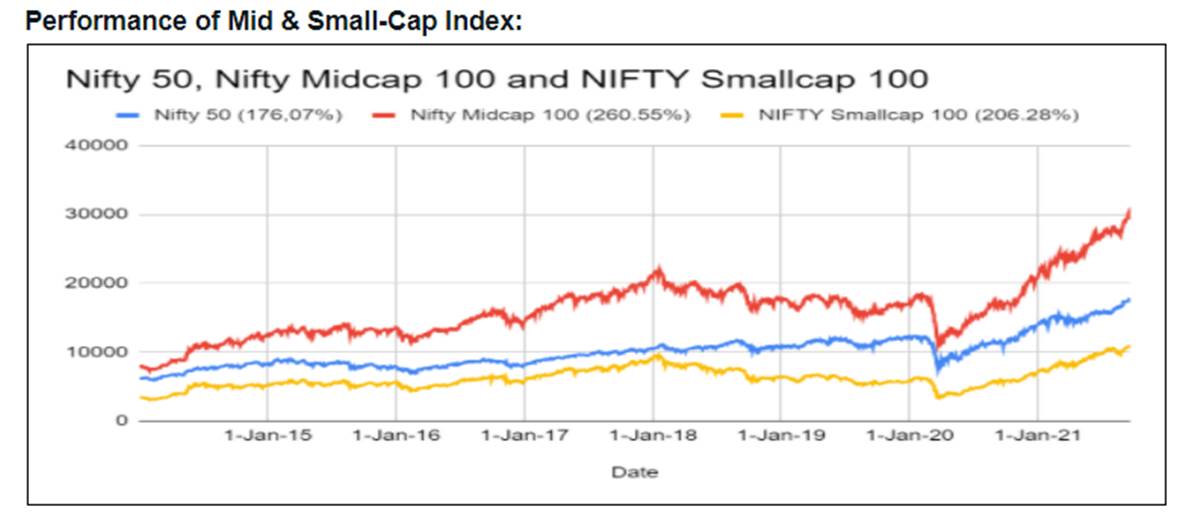

Nifty Smallcap and Midcap indices reached an all-time high level of 10,617 and 28,266 on 2nd and 3rd August 2021. This rally came following a sharp underperformance between 2018 and 2019. During that period small and mid-cap segments faced various headwinds like NBFC crisis, slow growth, SEBI recategorization for small and mid-cap, etc.

Going forward, experts believe that both mid and small-cap funds have strong prospects for growth in India and these have performed well in the long run when compared to large-cap or Flexi-cap funds.

“If we see historically these funds have performed well in the long run compared to large-cap funds or Flexi-cap funds. Given the 10-year time frame, mid-cap funds and small-cap funds have given 5-6% excess return,”Anurag Garg, Founder and CEO, Nivesh.com, told FE Online.

Garg further said that even though the years of 2018-19 were the year of underperformance for mid-cap funds and small-cap funds, these funds have averaged out their returns over longer period.

“5-year CAGR of mid-cap funds is 15.5% and for small-cap funds it is 16.9%. While last 1-year CAGR stands at 62.8% and 76% respectively. This also goes to prove that the performance gets averaged out in the longer time horizon,” he said.

Will mid and small-cap funds continue to perform in the long run?

According to Garg, the prospects of mid and small-cap companies are very strong in India.

“If we see the historical trend of emerging economies, small and mid-caps benefit most from the economic growth. We have examples of China, Taiwan, & Philippines. Right now, the per capita income of India is $2,000. Historically the highest growth in any country has happened when their per capita income increased from $2,000 to $10,000 as this helps in increasing the discretionary expenditure sharply people. Mid-cap and small-cap companies are obvious beneficiaries of such an increase in consumption. As the Indian economy grows over next 5-10 year period, the small-cap and mid-cap stocks will continue to benefit delivering superior returns to the investors,” said Garg.

He further said that many companies which were small-cap 12 years back are large-cap now. For example, Bajaj Finance had a market cap of Rs 1,859 crore in 2007. Now it has a valuation of more than Rs 4 lakh crore. Same is the case with Titan – it had a valuation of Rs. 7,398 crore in 2007 and now it is valued at Rs. 1.84 Lakh crore. Other examples include HCL, Asian Paints, Hero Moto Corps.

(Disclaimer: Investing in mutual funds is subject to market risks. Please consult your financial advisor before making any investment in mutual funds)