Many salaried employees across companies have received poor appraisals from their employers this year. While annual salary hikes may vary from year to year, employees, who are also investing in mutual funds, can reach their financial goals fast by increasing annual SIP by the same percentage by which their salaries increase every year.

In mutual funds, investors are allowed to increase their SIP amount every year by a fixed percentage to maximise their returns over the long term. This feature, also popularly known as Step Up SIP, is a very useful tool in the hands of an investor. Let us understand this with the help of an example.

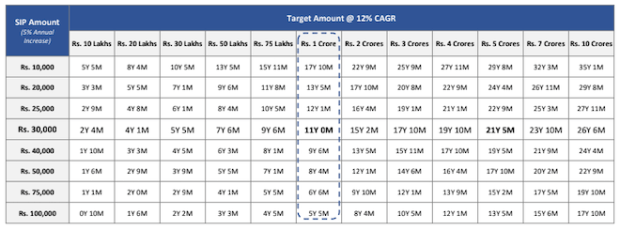

But first, some assumptions: Suppose you have received a 5% appraisal and you expect your salary to increase at least by this percentage every year. You are also investing in a mutual fund with a goal of getting Rs 5 crore during the investment period. Also, the scheme in which you are investing is giving an annualised return of 12%.

A calculation done by FundsIndia shows that by increasing the SIP amount by 5% every year, the total time required to reach the Rs 10 crore goal will significantly reduce (see below).

Rs 10,000 SIP: If you are doing a monthly SIP of Rs 10,000, it will take you 32 years and 11 months to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 29 years and 8 months.

Also Read: Equity savings fund gaining popularity due to stable returns

Rs 20,000 SIP: If you are doing a monthly SIP of Rs 20,000, it will take you 27 years and 3 months to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 24 years and 4 months.

Rs 25,000 SIP: If you are doing a monthly SIP of Rs 25,000, it will take you 25 years and 6 months to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 22 years and 9 months.

Rs 30,000 SIP: If you are doing a monthly SIP of Rs 30,000, it will take you 24 years to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 21 years and 5 months.

Rs 40,000 SIP: If you are doing a monthly SIP of Rs 40,000, it will take you 21 years and 9 months to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 19 years and 5 months.

Rs 50,000 SIP: If you are doing a monthly SIP of Rs 50,000, it will take you 20 years and 1 month to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 17 years and 10 months.

Also Read: Should you invest in a child plan or mutual funds?

Rs 75,000 SIP: If you are doing a monthly SIP of Rs 75,000, it will take you 17 years to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 15 years and 2 months.

Rs 100,000 SIP: If you are doing a monthly SIP of Rs 1 lakh, it will take you 15 years and 1 month to reach Rs 5 crore if the annualised return on the investment is 12%. But with a 5% Step-Up, you can reach this goal in 13 years and 5 months.

Note: Several mutual fund schemes in the last 15 years have given more than 12% returns. Any increase in annual returns will help you reach your financial goal even faster.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing