The dream run of mid-cap and small-cap funds and indices in the last six months has caught the attention of investors and critics alike. While investors are enjoying the extraordinary run, critics have been cautioning about the steep rise in valuations. Some have even likened the meteoric rise of mid and small-cap segments to an irrational exuberance. However, both sides have worthy points to justify their stand at this phenomenal turn of events over the last six months, writes Gopal Kavalireddi, Vice President – Research at FYERS, in a report. The following are the edited excerpts from the report:

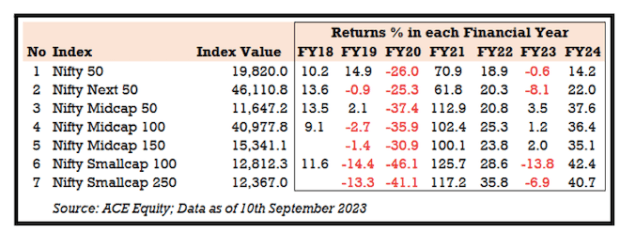

As per AMFI’s August data, equity mutual funds witnessed higher flows for the fifth consecutive month. Of the Rs 20,245 crore of equity inflows, Rs 6777 crore (33%) net inflow was into mid and small-caps. Moreover, since the start of FY24, the Nifty 50 index has delivered a 14.2% return compared to the over 36% return from Nifty midcap indices and more than 40% return from the Nifty small-cap indices (See chart below).

While the shorter-term scenario looks like investors are chasing momentum and infusing more capital into mid and small-cap stocks, a larger time frame reveals a different perspective.

After three years of underperformance between 2017-2020, FY21 and FY22 were very rewarding for market participants, with mid and small-cap indices outperforming Nifty 50 by a considerable margin. However, the trend changed in FY23, as the Nifty 50 and Nifty midcap indices delivered flat returns, and the Nifty small-cap 100 delivered a negative return of 13.8 per cent.

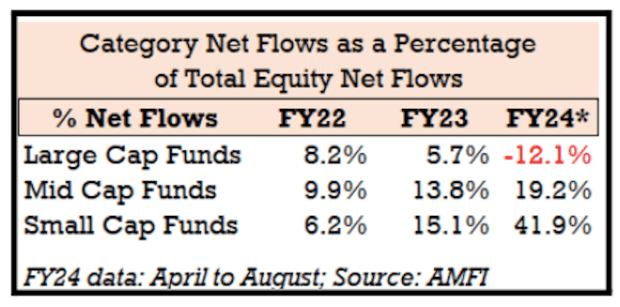

Recognizing the undervaluation in mid and small caps in light of the improving economic environment, vigilant investors moved their allocation from large caps to mid and small-cap segments of the market. The AMFI data on equity flows since FY 22 have highlighted this change in trends.

Also Read: Sold ancestral property? Know the rules for parking or investing sale proceeds to save tax

Since FY22, net flows into large-cap mutual funds continued to decrease. From 8.2% of total equity net flows in FY22, the net flows dropped to 5.7% in FY23 and witnessed a de-growth of 12.1% in FY24 (April to August).

In the same period, Mid-cap mutual funds inflows increased from 9.9% to 19.2% while small-cap fund flows rose from a mere 6.2% to 41.9% per cent in FY24 (see chart below).

Some of the factors that have contributed to the above trends include the following:

- First, investor participation in the stock markets has increased tremendously since the COVID-19 pandemic. Demat account openings are currently clocking around 3 million a month. As of August 2023, demat accounts opened are up by 25.8% year-on-year. The total demat account tally stands at 12.66 crore in comparison to 4 crore accounts as of March 2020.

- Second, improving the economic environment and government reforms across sectors opened up immense opportunities for all investors – domestic and overseas to explore and invest in companies beyond the top 100 market cap firms. These tailwinds resulted in a renewed focus on mid and small-cap companies with growth potential and lower valuations.

- Third, over the last few years, balance sheet cleanup, IBC implementation, lower interest rate cycle, divestment plans and government capex in public sector companies, PLI schemes resulted in the opening of opportunities in railways, defence, electronic manufacturing, electric vehicles, green energy and utilities. Most companies in these undervalued segments were from the mid and small-cap categories.

- Fourth, between January 2021 and September 2023, most of the 129 IPOs listed on the stock exchanges were from the mid and small-cap categories. The Small and Medium Enterprise (SME) primary market has also been vibrant. The number of actively traded stocks on BSE stands at 4100, with fresh additions regularly. With only 100 companies in the large-cap category, investors realized that 97.5% of the market comprises mid and small-caps. With such a broader choice available for stock selection, the fund flows from new investors and mutual funds moved into these segments.

How should investors approach mid and small-cap segments now?

Long-term Investors

A few segments of the mid and small-cap category have seen a tremendous rise in stock prices, owing to the bulging order books and capex investments by the government and private sectors. Capital goods, engineering, Realty, metals, and PSUs in banking, railways, defence, and shipbuilding have seen a turnaround in their fortunes and investor interest.

Across manufacturing companies, the latest metric employed is market cap to order book, a marked deviation from the price-to-earnings, price-to-book, or price-to-sales metrics used over the decades. While it is good to invest in companies with good order books which provide revenue visibility over the longer term, execution of the order book remains a critical factor.

With election season coming up and governments in a spending mode, many orders across segments of the economy will see a substantial build-up. However, long-term investors must track the implementation and execution of these projects to remain invested in the companies.

Also Read: Nifty 50, Sensex at All-Time High: Should SIP investors interrupt compounding to book profit?

Short Term Investors

Short-term investors can take their foot off the pedal from infusing fresh funds into some sectors, as the stocks are well-priced or overpriced to their FY24, FY25 and, for certain companies, FY26 earnings growth too. Sector rotation in investing is a common phenomenon and is bound to happen continuously. Investors can choose companies from financials, IT, Pharma, consumer durables, discretionary consumption, textiles, or other under-invested and reasonably valued sectors.

Conclusion

Most large caps of today rose from mid and small market caps over the years, aided by good corporate governance standards, excellent growth prospects, expanding product portfolios, and consistently increasing pricing power/margins. While large caps are well-discovered, with steady cash flow growth and business prospects, offering consistency in returns to investors, the mid and small-caps show immense potential for wealth generation in the coming years. Not all mid and small caps will stand the test of time. Hence, investors need to pick and choose the right stocks from the sectors that are the building blocks of the rising Indian economic prospects.

Disclaimer: The above article is for informational purposes only based on a report written by Gopal Kavalireddi. Views expressed above are those of Kavalireddi and they do not reflect the views of financialexpress.com. Investing in mutual funds and stocks is subject to market risks. Please consult your financial advisor before investing