Question: I am an employee working in the IT Industry and have been deputed for a project in a foreign country for a month. Due to the work assignment being in a foreign country, my employer has provided for a Per Diem Allowance in my salary structure. Kindly enlighten me on the taxability of such allowance.

Answer given by Dr. Suresh Surana, Founder, RSM India: There are instances wherein employers depute their employees to other foreign countries for a particular project or for a temporary period of time. The terms of such employment may differ across various entities, but generally, many employers tend to provide monetary benefits to their employees, in the form of daily allowance for incurring expenses during their period of onsite client visit.

Also Read: 5 reasons you must pay your home loan EMIs on time

In accordance with the provisions of Section 10(14)(i) read with Rule 2BB(1) of the Income Tax Act, 1961 (‘IT Act’), such per diem allowance provided by the employer to his employee which is incurred wholly and exclusively to perform his duties shall not be subject to tax in the hands of the employee if:

* the allowance is provided while on his tour to the foreign country and away from his normal place of duty, and

* the employee has actually incurred the expenses

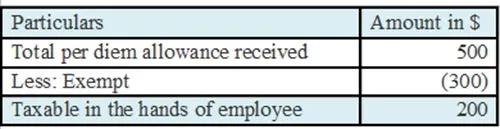

For instance, an employee is rendering services outside India for a specific project for a period of 1 month during which he receives $500 as a part of per diem allowance; out of which he spends $300 for meeting his day-to-day personal expenses and the balance $200 is unspent.

The tax implications in the hands of an employee is tabulated as follows:

$200 would be subject to tax as the same is partially utilized for personal purposes and partially remains unspent.

If the employee does not spend the entire amount of allowance while rendering services abroad exclusively for his duties, the balance will be subject to tax in India.

However, it is notable that any allowance/perquisite allowed by the Government of India to an Indian Citizen outside India for rendering services outside India is fully exempt from tax in India as per the provisions of section 10(7) of the IT Act.

This Q&A series is published every week on Thursday.

Disclaimer: The views and facts shared above are those of the expert. They do not reflect the views of financialexpress.com