Alternate Minimum Tax vs New Income Tax Regime: In Finance Bill 2020, the government proposed to insert section 115BAC, which provides an option to individuals and Hindu Undivided Family (HUF) to pay taxes at reduced rates if they do not avail specified incentives or deductions and meet certain conditions. Individuals or HUF will not be required to pay Alternate Minimum Tax (AMT) if they opt for the new concessional tax regime. Will the individuals or HUF benefit by opting for new regime instead of going for AMT? FE Online talked to experts for an answer. But first let us understand what is AMT,

According to Sameer Mittal, Managing Partner, Sameer Mittal & Associates LLP, AMT is the minimum tax a taxpayer has to pay irrespective he has NIL tax liability as per the normal Income Tax provisions.

AMT came into force in 2011. It was made applicable to all non-corporate taxpayers in a modified pattern. AMT included Individual, Hindu Undivided Family(HUF), an Association of Persons(AOP), a Body of Individuals(BOI) (whether incorporated or not), an artificial juridical person, Limited Liability Partnership firm (LLP), partnership firm etc, said Mittal.

“The alternative minimum tax (AMT) is a special tax that prevents non-corporate people with high incomes from abusing deductions and liable to pay little or no income tax,” he added.

Archit Gupta, Founder and CEO, ClearTax, said, “Alternative Minimum Tax (AMT) is payable by an individual or any other taxpayer, other than a company. AMT is levied to ensure that the taxpayer claiming various tax incentives pays a minimum amount of tax.”

Gupta said that a taxpayer has to compare the tax payable under regular provisions and under AMT. In case the regular tax is lower, the taxpayer has to file income tax return paying AMT.

AMT rate and Tax credit

AMT is levied at 18.5% (plus cess and surcharge) on the adjusted total income arrived after removing the claim for tax deductions and exemptions. Gupta said that this rate is lower than the peak rate of tax at 30 per cent. The taxpayer is allowed a tax credit of the excess AMT paid over the regular income tax payable. The credit is allowed to be carried forward and set off for a period of 15 years, in the year where the regular income tax payable exceeds the AMT payable for that year.

Where AMT applies

According to Mittal, the provisions of AMT will apply to every non-corporate taxpayer who has claimed:

- Deduction under section 80H to 80RRB (except 80P): Deductions which are relating to in respect of profits and gains of specific industries such as hotel business, small scale industrial undertaking, housing projects, export business, infrastructure development etc.

- Deduction under section 35AD: Under this deduction, 100% deduction is allowed on capital expenditure incurred for specified business such as operation of cold chain facility, fertilizer production etc.

- Deduction under section 10AA: Deduction of profit varying from 100% to 50% is provided to units in Special Economic Zones (SEZs).

“Thus, the provisions of AMT are not applicable to a non-corporate taxpayer who has not claimed any deduction under above-discussed sections,” said Mittal.

When AMT is not applicable

According to Gupta, AMT is not applicable to an individual, Hindu Undivided Family (HUF), Association of Persons (AOP), Body of Individuals (BOI) and an artificial juridical person whose adjusted total income does not exceed Rs 20,00,000.

The Finance Bill 2020 proposed an alternative tax regime under new section 115BAC for individual and HUF taxpayers. The new regime provides for lower tax rates and removes tax exemptions and deductions, in a manner similar to AMT. The benefit of lower tax rates is proposed for such taxpayers in the income bracket Rs 5 to 15 lakh.

AMT vs New Tax Regime: Comparision

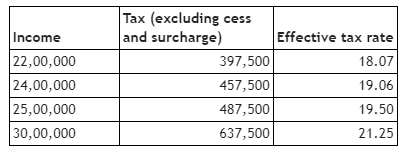

Gupta said that AMT provisions are not applicable for income up to Rs 20 lakh. Hence, on a comparison of the new regime with AMT, for income above Rs 20 lakh, the effective tax rate works as follows:

“Thus, the effective tax rate is higher under the new regime in comparison to AMT. The tax rate increases with an increase in income. Also, under the new regime, a taxpayer loses the benefit of carrying forward and set off of tax credits, as against regular tax regime and AMT,” said Gupta.

No tax credit in New Regime

According to Gupta, the AMT provisions allow for a tax credit by making a comparison each year of regular tax with AMT. “However, in the case of the new regime, a business taxpayer cannot opt-in and opt-out of the new regime each year. A business taxpayer who opts out of the new regime cannot opt-in again, and has to pay tax under regular provisions.”