The Income Tax Act 2025 has been notified after receiving the President of India’s assent. Based on the new Act, the Income Tax Department is now looking at coming up with a fresh set of FAQs (frequently asked questions), SOPs (standard operating procedures) and other guidelines to educate taxpayers. These will come in due course of time before April 1, 2026. The new Income Tax Act will come into force from the new financial year 2026-27.

The new Income Tax Act 2025, which will replace the existing Income Tax Act 1961, has been brought mainly to simplify the language and remove archaic provisions by significantly reducing the Sections and Chapters.

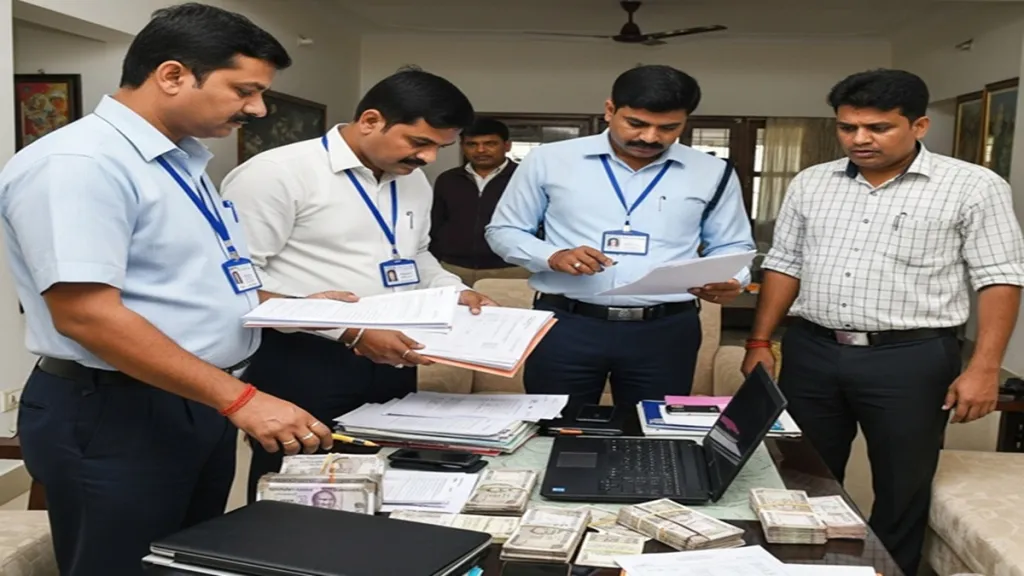

The Income Tax Bill 2025 also stirred debate among taxpayers due to some proposals. One of them is – expanding discretionary powers of income-tax officers in assessment and search cases. While the government claims the bill is aimed at simplification and modernization of tax laws, many taxpayers fear it could make life difficult for them.

The Government of India has recently notified the Income-tax Act, 2025, which will come into force from April 1, 2026. This law is considered a big step towards simplifying and modernizing the old tax structure. But some of its new provisions have sparked debate among taxpayers — especially the rules related to ‘digital access and password override’ have raised questions on privacy and taxpayer rights.

Definition of ‘virtual digital space’

For the first time, ‘virtual digital space’ has been clearly defined in the law. This means that during search and seizure proceedings, officers can access not only home-office papers, but also your digital accounts and servers.

This definition includes — e-mail accounts, social media profiles, net-banking, trading and investment accounts, cloud storage/remote servers, and those digital platforms where property details are recorded.

The new Income Tax Act has given tax officials more power, allowing them to forcibly break into personal emails and social media accounts of taxpayers during search and seizures.

Password override: The most controversial provision

The biggest discussion is about the provision that if the password/access-code of an account or system is not provided, then the officers can enter it by ‘overriding’ it themselves. This is the first time that such a provision is mentioned in the law.

In simple language — if you refuse to give the password, then the officers can extract the information even by breaking the digital lock through technical means.

What is government’s stand on ‘digital access and password override’ matter?

The government says that its purpose is not to violate the privacy of common taxpayers. This provision is limited only to those cases when search or survey action is being taken and the officers have ‘reasonable’ belief that important evidence is present in the digital account. The department believes that this is only a modern form of existing powers, so that legal clarity is maintained in gathering evidence in the digital age.

Concerns of citizens and experts

On the other hand, privacy advocates and digital rights groups believe that such a broad definition and powers like password override increase the possibility of misuse. They say that – at what level of approval will this power be used, what will be the guarantee of security and deletion of data after access, and whether judicial monitoring is sufficient – all these things are not clear yet.

They are demanding that it should be clearly written in the rules that data-minimization, timely deletion, audit-trail and appeal facility will be ensured.

What does it mean for the common taxpayers?

Common people need not fear that this rule will be applicable in cases of everyday scrutiny or return filing. This is limited only to specific circumstances—such as search and seizure actions – this is what the government says. However, it is important that taxpayers keep their digital records organized and cooperate with legal advice if such action is ever taken.

What is the way forward on these tax provisions

The framework of the law has been notified, but the real picture will be clear when detailed rules and SOPs (standard operating procedures) are prepared for it. There it will be decided — Who can use the ‘override’ and when, at what level will the monitoring be, and what will be the appeal/redressal mechanism to protect taxpayer rights.

Summing up

The Income-tax Act, 2025 has changed the definition of income tax investigation in accordance with the digital age. While this law gives the government the power to gather evidence in the digital space, it also poses a privacy challenge to citizens. In the times to come, it will be important to see how the government strikes a balance between transparency and security.