The government has appointed a total of 33 members to the GST Appellate Tribunal (GSTAT), including IAS and IRS officers. According to a report by The Hindu BusinessLine, IAS A Venu Prasad and IRS Anil Kumar Gupta will serve as Technical Members (State) on the Principal Bench of GSTAT at New Delhi. The remaining 31 members will be posted in the State benches.

GST Appellate Tribunal

All 31 members have been appointed for a period of four years or until they reach the age of 67 years, whichever is earlier. The technical members will draw a monthly salary of Rs 2.25 lakh.

According to the outlet, the Standing Committee on Finance, in its report tabled in Lok Sabha, said that the tribunal is not operational pan-India, as only a few states have sent nominations. The report said that it has only received recommendations for Technical Members (State) from Uttar Pradesh, Orissa, Gujarat, Bihar, Maharashtra and Goa.

It also urged the government to expedite this process to help benches function properly without delays.

“The Committee would like to re-emphasise that the persistent delays in Goods and Services Tax Appellate Tribunal (GSTAT)’s full functionality adversely impact the larger GST ecosystem, resulting in prolonged litigation, overburdening of High Courts, and denial of timely relief to taxpayers, a part of the report, per the outlet mentions.

It added, “The Committee, therefore, desires that the Ministry should adopt a time-bound approach to complete all remaining formalities.”

About GST Appellate Tribunal

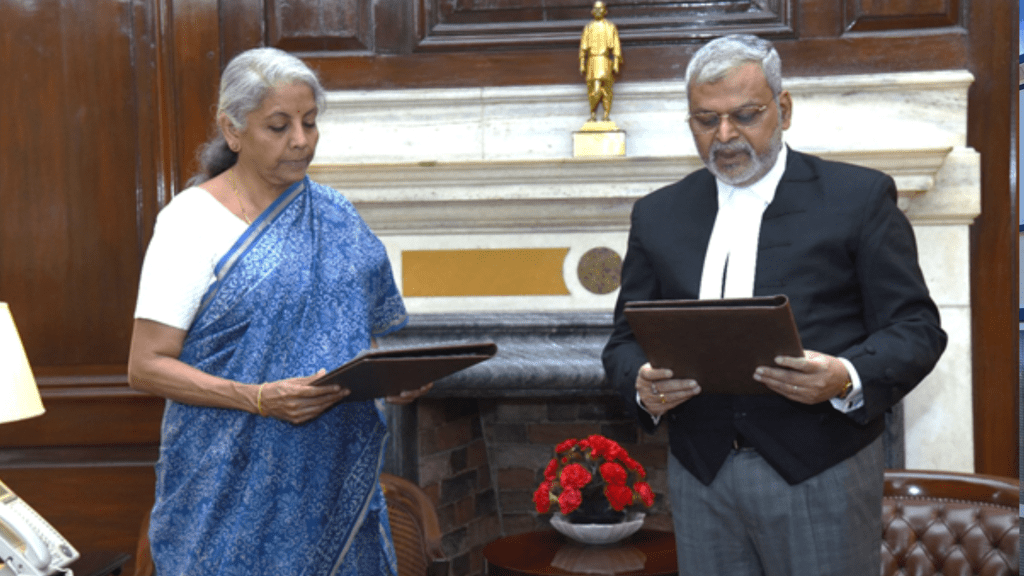

The centre appointed Justice (Retd.) Sanjaya Kumar Mishra as the President of the GSTAT last year. He is the first president of the GSTAT and was selected by a Search-cum-Selection Committee headed by the CJI.

GSTAT was constituted under the Central Goods and Services Tax Act, 2017, to hear appeals under this as well as the corresponding State and Union Territories GST Acts, challenging decisions made by the first appellate authority. It consists of a Principal Bench and various State Benches, and the Principal Bench sits at New Delhi.

The Tribunal was set up to ensure that the disputes related to GST are resolved swiftly with fair and just means. This will also reduce the burden on higher courts, enhance the effectiveness of the GST system in India and provide for a more efficient tax environment in the country.