Mapping your personal finance journey is one of the challenging tasks that everyone comes across as it is not easy to create your financial journey in such a way that you are able to meet your money needs at different stages of your life. To help consumers address their financial confusions, Bankbazaar.com has released a primer ‘The Prosperity Planner & Workbook’ that not only highlights the key tips of saving money but also multiplying your investments by deploying different financial methods.

Saving money is a challenging yet crucial step towards financial advancement and satisfaction. Similar to Maslow’s hierarchy, where meeting physiological needs is foundational, saving allows for wealth growth, enjoyment, and eventual financial stability. Without savings, one can’t invest and expand wealth, provide insurance against life’s uncertainties, access loans, purchase a home, afford education for children, or prepare for retirement.

How much should you save?

It is one of the confusing questions for many to understand how much they need to save. However, there is no singular amount that qualifies as adequate savings. How much you want to save depends on the goals and objectives you have set for yourself.

Adhil Shetty, CEO, Bankbazaar.com, says, “It is recommended to assess your financial situation periodically. As you transition through different life stages, your requirements and obligations transform. It’s crucial to keep your financial plan current by reviewing and adapting various aspects such as your emergency fund, life and health insurance, asset distribution, and the size of your retirement savings to match your evolving needs.”

Also Read: 5 things you must know before you prepare your Will

Emergency Funds

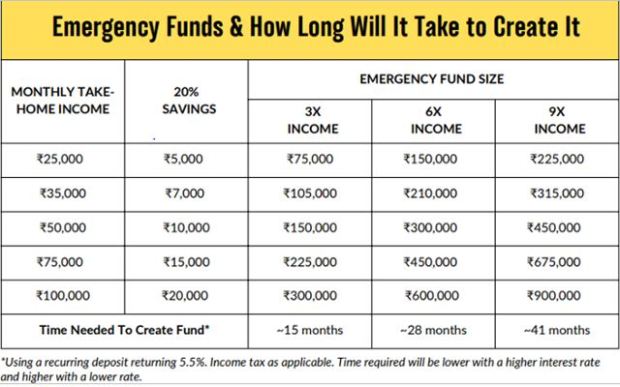

The saving strategy for each objective will be different, so it is important that you are clear on your objectives before you begin saving for them. Let’s take the example of an emergency fund, which is one of the most basic forms of saving.

Your emergency fund should ideally be 3 to 6 times of your monthly income and can help you tide over sudden emergencies like a job loss or a medical emergency.

Insurance Coverage

Life insurance serves as your family’s shield, aiding them in pursuing their objectives in your absence. However, determining the appropriate coverage can pose a challenge. Several factors to consider in assessing your insurance needs include your age, present income, your family’s aspirations, the financial requirements of your dependents, inflation, and your existing assets and liabilities. As you age and your responsibilities grow, purchasing additional policies might be a consideration.

Like life insurance, health insurance too is essential for your financial well-being. Many factors, such as your family’s medical history and past hospitalisation costs, medical inflation, and your city of residence, come into play when deciding the optimum amount of health insurance coverage. As a rule of thumb, you could begin with a health cover that is at least 50% or more of your annual income. Don’t simply rely on your employer’s coverage for it could cease when you switch jobs. If the need arises, you can either hike your coverage or opt for a top-up plan that provides you the necessary coverage.

Role of Credit Products

The report also highlights that credit products like loans and credit cards are products that allow us to enrich our lifestyle and fulfil our wants and needs. Borrowing, however, can be constructive or destructive. If you take a loan to build your business, it will help you become financially stronger. But taking a high-value loan to buy a car whose value will depreciate with time may not be a smart money move. Similarly, credit cards, with their myriad discounts, cashback, and rewards help you save on a variety of expenses. But if you delay paying the bill after using these benefits, the penalty will negate the benefits and harm your finances.

Investing for Saving Tax

Tax planning and investment planning are intertwined. Taxes can diminish investment returns, and a sound investment strategy considers this factor. Moreover, different investment returns are subject to varying tax rates – some incur higher taxes while others may be tax-exempt. Your income level also dictates the amount of tax you pay, with higher incomes incurring higher taxes. Tax deductions play a role in reducing your overall taxable income, thereby lessening your tax obligation. Hence, investments aimed at tax savings not only serve to reduce taxes but also contribute to your investment portfolio.

Power of Compounding

When it comes to investing, compounding stands as your greatest ally. This process allows you to earn interest not only on your initial investment but also on the returns it generates. To illustrate, imagine investing Rs 10,000 per month in a plan offering a 12% return over 10 years, resulting in a principal investment of Rs 12 lakh. At the end of the 10-year period, the promised returns would yield a total of Rs 23.23 lakh.

If this investment were extended to 20 years instead of 10, the accumulation wouldn’t just be Rs 46.46 lakh. Thanks to compounding, the 20-year investment would generate returns of Rs 99.91 lakh. Continuing the investment for an additional 5 years would double the returns to Rs 1.82 crore, and in another 5 years, they would double again to reach Rs 3.52 crore. This showcases the incredible power of compounding.

Strengthening your finances involves various elements, and understanding and leveraging the magic of compounding is a key factor in wealth accumulation. These steps will help you create a financial map that leads you to a successful journey.