When it comes to investment purposes, three asset classes – gold, real estate and equity – score over other options. These three investment avenues too have their pros and cons, like other options. Gold for decades has been a preferred choice for Indian households due to traits like safe-haven appeal, liquidity advantage and cultural significance. Real estate is another popular investment avenue for people, thanks to low volatility and high returns in the medium- to long-term. On the other hand, equity gives a feeling of ownership to an investor after purchasing the stock of a particular company.

In this article, we will delve into the growth potential of an investment in these three asset classes. Let us look at the returns these assets have given to investors over the past 20-year period.

Gold returns over the past 20 years

20 years back, gold was at Rs 5,850 per 10 grams and is now trading at Rs 74,200. According to IBJA, the precious metal (24-karat) hit Rs 74,220 per ten grams on May 21. If we calculate the return on gold investment of these two decades, the yellow metal’s price has surged by 13.5% annually in the past 20 years. At this rate of return, an investment of Rs 1 lakh in 2004 in gold would have turned into around Rs 12.5 lakh by now.

“Over the past 20 years, gold has been one of the best investment instruments for retail investors,” says Suraj HS, co-founder of Aurm, an asset protection firm that offers automated safe-deposit vaults in residential communities in partnership with banks.

Real Estate Investment: A look back at the last 20 years

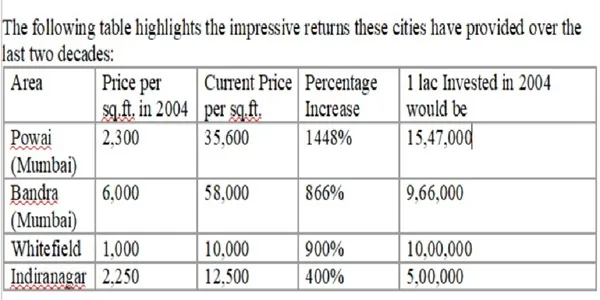

Imagine investing in an apartment 20 years ago in Powai, Mumbai, for a fraction of its current price. Today, that investment would be a goldmine! This is the story of many Indian cities. Areas like Whitefield (Bengaluru), Gachibowli (Hyderabad), Powai (Mumbai), Vashi (Navi Mumbai), Gurugram (Haryana), and Noida (Uttar Pradesh) have witnessed phenomenal growth, turning real estate investments into windfalls.

Back in 2004, the per square feet price of an apartment in Mumbai’s Powai area was Rs 2,300 against Rs 35,600 per sq feet in 2024, yielding nearly 1450% return. With this RoI, an investment of Rs 1 lakh made in 2004 would have grown to Rs 15.5 lakh now.

Karan Shetty, Co-Founder, Claravest Technologies, said, “Real estate investments require a keen eye for potential and a long-term vision, as the transformation of these areas didn’t happen overnight. Looking ahead, tier 2 cities in India hold a promising potential for transformation over the next 20 years with infrastructure development and economic boom. Investors who can identify and invest in these cities early on may enjoy similar, if not greater, returns.”

“The key to success in real estate is patience. Don’t expect quick flips. Look for areas with long-term development plans and infrastructure projects. While the initial years may not yield skyrocketing returns, the long-term benefits can be substantial,” he added.

Returns from Indian equities in 20 years

The monthly average level of the Sensex was 5204 in May 2004, falling to a low of 4,823 in June 2004. The BSE benchmark hit its life-time high of Rs 75,124 on April 9 this year.

The BSE Sensex has grown over 14% annually over the past 20 years. Rs 1 lakh invested in Indian equities 20 years ago would have grown to approximately Rs 14 lakh by now.

Considering the risks involved in stock investing, gold has been a much safer and stable investment option. In terms of return, real estate has scored over both gold and equity.

FinancialExpress.com does not endorse any specific investment instruments. Readers are encouraged to make their own informed decisions, as any losses incurred will be their sole responsibility.