If you are worried about increasing interest rates and hesitating to take a home loan, then here’s what you should know. Despite rising interest rates, spreads on home loans have fallen. How can this be a good opportunity for new borrowers? Take a look.

According to the latest Bankbazaar report – Inflation and Your Loan — an interesting thing is happening with home loan interest rates. Interest rates have returned to pre-pandemic levels, from the all-time low of 6.40% in 2022 to nearly 9.00 now. But at the same time, interest rate spreads have fallen to new lows. This presents an opportunity for home owners in the regime of rising rates.

Every retail loan interest rate has two components: the benchmark rate and the spread. Most banks today benchmark home loan rates to the repo rate, which stands at 6.50% as of March 2023. The benchmark rate is the lowest rate at which a loan is given. The spread varies from one borrower to another. It is calculated basis such parameters as the borrower’s credit score, source of income, and the size of the loan.

For example, a salaried borrower with a credit score of 750 will pay a spread of 2.50 over the repo rate. Therefore, their interest rate is 6.50 + 2.50 = 9.00.

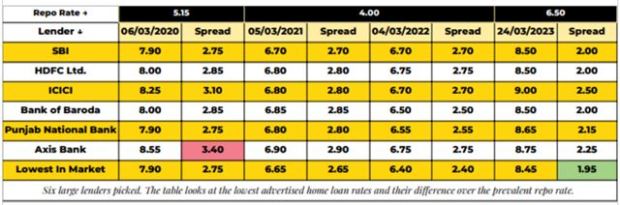

HOME LOAN RATES AND SPREADS SINCE MARCH 2020

Home loans are mostly floating rate loans. The rates react to inflation, changes in the repo rate, and the lender’s policies. With the repo benchmarking in force since October 2019, banks provided home loan rates reset by the same margin as the changes in the RBI-mandated repo rate. However, the spread must remain constant for the loan’s duration. So, in the above example, if the repo rate rises by 25 basis points to 6.75%, the loan rate will change by an equal measure to 9.25%.

Also Read: Home Loan: Smart ways to manage a longer tenure loan

But as things stand, home loan spreads have been falling year after year. As per the research done by BankBazaar, the lowest spreads on home loans stood at 1.95 in March 2023, steadily falling from the nearly 3.50 prevalent in March 2020.

Rising rates with falling spreads create complexities that home owners must understand. In a high-inflation scenario, exploiting these rate differences could help them save lakhs of rupees on outstanding loans. More rate hikes are expected. Home owners must act now and stop their loans from ballooning out of control.

In March 2020, the difference between the lowest home loan rates and the prevalent repo rate was 2.75, going up to 3.50 in many cases. This difference has fallen steadily. By March 2021, it had reduced to 2.65. A year later, it fell to 2.40. As of March 2023, there are many lenders pricing themselves at 2.00 over the repo, with a few going as low as 1.95 with their special year-end offers.

The lowest rate or spread is accorded to the most credit-worthy borrowers. These would be borrowers with high credit scores and stable income. While rates fluctuate, borrowers retain the spreads they had purchased the loan with. These complexities mean that new borrowers are at an advantage over old borrowers. They can lock into a lower spread now and pay less in comparison to a pre-pandemic borrower who may be paying a substantial premium over the market rates. A simple fix is a loan refinance.

There is one advice for those whose loan interest rates have gone up. Adhil Shetty, CEO, BankBazaar.com, says, “The pain isn’t over yet. Your home loan rate will continue to go up in the first half of 2023. Simply paying EMIs may not be enough right now. You should consider refinancing to a lower spread, voluntarily hiking your EMI, and pre-paying wherever possible. Not acting now would mean spending many more years in debt later.”

The fall in spread indicates that new home loan borrowers have an opportunity to borrow at the lower cost especially those who have higher credit score and whose income is stable with clean credit records. If you are planning to buy a house, go ahead after assessing your finances.