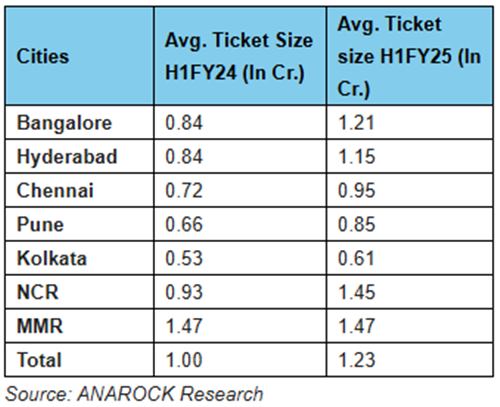

In the wake of increasing demand for luxury residences following the pandemic, the latest ANAROCK data reveals unprecedented new launches and sales of high-end properties in the top seven cities. During the first half of fiscal year 2025, the average price of homes sold in these urban areas reached Rs 1.23 crore, compared to Rs 1 crore in the same timeframe of fiscal year 2024.

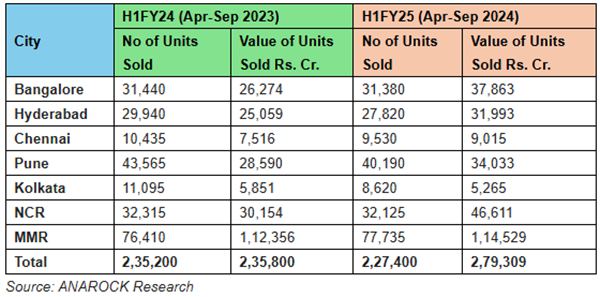

Anuj Puri, Chairman of ANAROCK Group, remarked on the situation, stating that “Between April and September 2024, over 227,400 units valued at approximately Rs 279,309 crore were sold across the seven major cities. In comparison, the same timeframe in FY2024 recorded around 235,200 units sold, amounting to Rs 235,800 crore. Although there was a 3% decline in the total number of units sold, the overall sales value increased by 18% compared to the previous year, highlighting the persistent demand for luxury residences.”

A deep-dive reveals that at 56%, NCR saw the highest average ticket size growth – from approx. Rs 93 lakh in H1 FY2024 to over Rs 1.45 cr in H1 FY2025. Approx. 32,315 units worth Rs 30,154 cr were sold in the region in H1 FY2024; in H1 FY2025, approx. 32,120 units worth Rs 46,611 cr were sold. While the value of sold inventory increased by 55% in this period, the total number of units sold declined by 1%.

Also Read: Gold prices falling: Is this the right time to buy?

“MMR saw no change in average ticket size in this period,” said Puri. “In H1 FY 2024, the average ticket size of sold units was Rs 1.47 cr. The region saw approx. 76,410 units worth Rs 1,12,356 cr sold in H1 FY 2024, while H1 FY 2025 saw approx. 77,735 units worth approx. Rs 1,14,529 cr sold.”

City-wise Breakdown

* At 44%, Bengaluru witnessed the second highest jump in average ticket size among the top 7 cities – it rose from Rs 84 lakh in H1 FY2024 to Rs 1.21 cr in H1 FY 2025. Approx. 31,440 units worth Rs 26,274 cr were sold in the city in H1 FY 2024. H1 FY 2025 saw nearly same number of units (31,381) sold, but their total value was higher at Rs 37,863 cr.

* In Hyderabad, H1 FY 2024 saw the average ticket size of sold units at Rs 84 lakh – this increased by 37% to Rs 1.15 cr in H1 FY 2025. Approx. 29,940 units worth Rs 25,059 cr were sold in Hyderabad in H1 FY 2024, while in H1 FY 2025, approx. 27,820 units worth approx. Rs 31,993 cr were sold.

* Chennai saw a jump of 31% in average ticket size – from Rs 72 lakh in H1 FY2024 to Rs 95 lakh in H1 FY 2025. Approx. 10,435 units worth Rs 7,516 cr were sold in the city in H1 FY 2024, while in H1 FY 2025, approx. 9,531 units were sold – but their total sales value was higher at Rs 9,015 cr.

* In Pune, the average ticket size in H1 FY 2024 was Rs 66 lakh – it increased by 29% to Rs 85 lakh in H1 FY 2025. Approx. 43,560 units worth Rs 28,590 cr were sold in the city in H1 FY 2024, while H1 FY 2025 saw approx. 40,190 units worth approx. Rs 34,033 cr were sold.

* Kolkata witnessed a 16% jump in average ticket size – it rose from Rs 53 lakh in H1 FY2024 to Rs 61 lakh in H1 FY 2025. Approx. 11,095 units worth Rs 5,851 cr were sold Kolkata in H1 FY 2024. In H1 FY 2025, approx. 8,620 units were sold at lower sales value of Rs 5,265 cr.

Commenting on the report, Aman Gupta, Director of RPS Group, said, “NCR is yet another region that has shown tremendous performance in India’s real estate in H1 FY2025 with the average ticket size growing dramatically by an extraordinary 56% to present a more appealing picture of the real estate in India. The area units’ average ticket sizes shifted from the previous INR 93 lakhs all the way to over INR 1.45 crores, making the area units real estate seem highly promising. There was a modest 1% drop in the units sold, however, the aggregate sales value in the area actually went up by 55% to reach INR 46,611 crore from the previous INR 30154 crore last year. These astonishing results show how the region has been moving in a dramatic fashion influenced by the increase in demand for high end homes and significant enhancement in the overall infrastructure of the region.”

Anurag Goel, Director, Goel Ganga Developments, said, “Pune’s real estate market demonstrated remarkable resilience and transformation during the first half of FY2025, reflecting significant changes in value appreciation despite a minor decline in unit sales. Throughout this period, the average transaction size in the city’s real estate sector experienced a substantial increase of 29%, rising from an average of INR 66 lakhs to INR 85 lakhs. Although the total number of units sold decreased from 43,560 to 40,190, there was a notable rise in the overall sales value, which surged from INR 28,590 crore to INR 34,033 crore. This trend indicates a robust increase in investments within the residential sector, highlighting enhanced buyer confidence, greater affluence, and a strategic focus on acquiring quality housing projects amid the fluctuating real estate landscape in Pune.”

Ashish Agarwal, Co-Founder, Enzyme Office Spaces, said, “Bangalore and Hyderabad exhibited significant real estate activity in the first half of FY2025, further solidifying the positive growth trajectory observed in the preceding period of the southern property market. In Bangalore, the average transaction size experienced a remarkable increase of 44%, rising from INR 84 lakhs to INR 121 lakhs. However, quarterly unit sales remained consistent at approximately 31,380 units, while the overall market value surged from INR 26,274 crores to INR 37,863 crores. Similarly, Hyderabad witnessed an increase in the average transaction size from INR 84 lakhs to INR 115 lakhs, marking a growth of 37%. Both cities are well-positioned to become central hubs for the rising demand for high-end residential units, driven by advancements in urban infrastructure and robust economic growth.”