The proportion of high-end housing units priced at Rs 1 crore and above has seen a notable increase in sales and launches across India’s major housing markets during the April-June period, data available with PropTiger.com show.

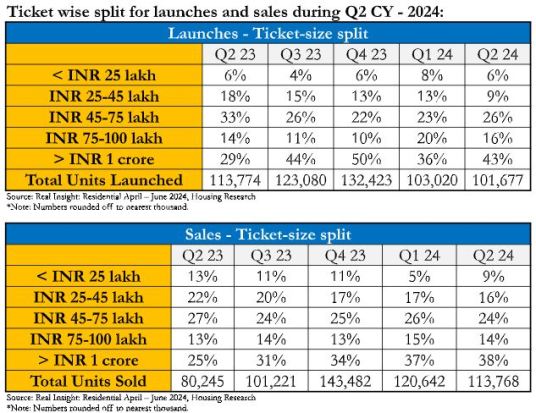

According to a quarterly report titled ‘Real Insight: Residential April-June 2024,’ 43% of all new launches in India’s eight prime residential markets during these three months were priced above Rs 1 crore. Additionally, housing units within this price bracket accounted for 38% of quarterly sales.

Housing markets covered in the report are Ahmedabad, Bengaluru, Chennai, Hyderabad, Kolkata, Delhi-NCR (Gurugram, Noida, Greater Noida, Ghaziabad and Faridabad), MMR (Mumbai, Navi Mumbai & Thane) and Pune.

Also Read: Should you have two or more savings accounts in the same bank

As per data, a total of 101,677 units were launched during the quarter ended June 30, showcasing a marginal decline of 1% from the previous quarter wherein 1,03,020 units were launched. On the other hand, 113,768 units were sold in Q2 2024 against 120,642 in the March quarter.

“The share of affordable housing has been affected in sales as well as launch numbers in the past few quarters, primarily due to higher demand for bigger homes offering greater amenities. In larger cities, the rising costs of construction and land prices are making it increasingly challenging for developers to deliver homes within the Rs 45 lakh budget (affordable category). As a result, there are fewer launches in this segment. On the other hand, the adverse impact of rising property prices on demand can also not be overlooked. While the rise in demand for high end homes is indicative of rising income levels in one of the fastest growing economies in the world, affordable housing’s dipping share is a matter of concern for the world’s most populous country,” said Vikas Wadhawan, CFO, REA India, and Business Head, PropTiger.com.

Only 15% units in new supply was in the up-to Rs 45 lakh price bracket, the government-defined benchmark for affordable housing in the country. At 25%, this percentage was comparatively higher in terms of quarterly sales, shows the report.

Wadhawan is, however, of the view that the share of affordable housing might improve because of the key measures announced in the Union Budget 2024, presented by Finance Minister Nirmala Sitharaman on July 23rd.

“Announcements like the launch of PMAY 2.0 along with the interest subsidy scheme, possible rationalisation of stamp duties by states coupled with higher disposable income in the hands of the salaried class due to the tweaks in tax structure would push demand for affordable housing in the country. The Government may also consider revising the limits for affordable housing in bigger cities,” added Wadhawan.

Even though India ranks 4th in terms of the increase in the number of millionaires between 2013 and 2023, affordability remains integral to housing ownership in the world’s fifth-largest economy with high urbanisation rates and a burgeoning middle class.