Short-term fixed deposits (FDs) offer a range of benefits. These FDs, typically with a maturity period of less than a year, provide a unique avenue for investors to park their funds and earn returns while retaining liquidity.

One of the primary benefits of short-term FDs is their flexibility and liquidity. Unlike long-term FDs that lock in funds for several years, short-term FDs allow investors to access their funds relatively quickly. This liquidity feature makes them suitable for individuals who may need access to their funds in the near future for various reasons such as planned expenses, emergencies, or investment opportunities.

Besides liquidity, short-term FDs offer a predictable and assured rate of return. The interest rates for these FDs are fixed at the time of investment, providing investors with clarity on their earnings. This predictability is valuable for investors seeking stability in their investment portfolio, especially during uncertain economic times or volatile market conditions.

Also Read: Credit Card Bill Payment: When should you pay your credit card bill?

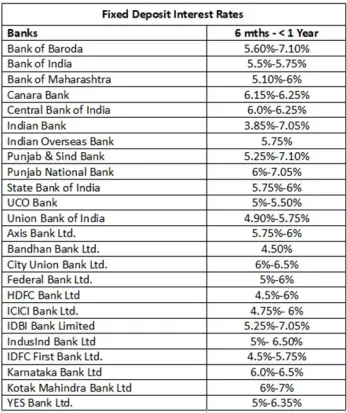

Moreover, short-term FDs often come with competitive interest rates, especially when compared to standard savings accounts or shorter tenor investment options. While the rates may vary among banks and financial institutions, investors can shop around for the best rates or special offers to maximise their returns within the short investment horizon.

Another advantage of short-term FDs is their simplicity and ease of investment. Opening a short-term FD account is a straightforward process, requiring minimal documentation and usually accessible through online banking platforms. This convenience makes it an attractive option for both seasoned investors and those new to financial investments.

For investors looking to diversify their portfolio and manage risk, short-term FDs serve as a stable asset class. They offer capital protection along with reasonable returns, making them a preferred choice for conservative investors or those seeking a balanced investment strategy. By allocating a portion of their funds to short-term FDs, investors can mitigate risk while maintaining liquidity.

Furthermore, short-term FDs can act as a temporary parking space for funds between investment opportunities or during periods of market uncertainty. Instead of keeping idle funds in a regular savings account earning minimal interest, investors can opt for short-term FDs to earn higher returns without compromising on liquidity.

Tax efficiency is another aspect where short-term FDs offer benefits, especially for investors in lower tax brackets. The interest earned from short-term FDs is typically added to the investor’s income and taxed accordingly. However, investors can explore tax-saving FDs or utilise their annual tax exemptions and deductions to optimize their tax liabilities.

You can use these types of investments to meet short-term financial goals such as funding a vacation, purchasing consumer durables, or covering upcoming expenses like education fees or home renovations. It’s, however, important for investors to consider certain factors while investing in short-term FDs, such as the prevailing interest rates, penalties for premature withdrawals, and any associated fees or charges.

Note: Data taken from respective bank’s website as on 11 April 2024.

Compiled by Bankbazaar.com