Both Fixed Deposit and Target Maturity Funds (TMFs) became attractive in 2022. As FD rates have gone up and bond yields have also risen sharply this year, investors in a higher tax slab may find it difficult to decide which is better. One way to do this is by comparing the tax implications on returns from FDs and TMFs.

Before getting into details, let’s have a look at how TMFs and FDs compare as investment options.

FD vs TMF

Fixed Deposit schemes are offered by banks and the Post Office. They give you fixed returns basis a pre-determined interest rate and tenure. Target Maturity Funds are passively managed debt funds that mature at a specific date. The returns of these funds will be closer to the net yield-to-maturity (YTM) at the time of investment if you stay invested until maturity.

According to Srinath ML, Senior Research Analyst at FundsIndia, Target Maturity Funds have become attractive and offer a good entry point. This is because the RBI has been increasing interest rates in 2022 to address high inflation, which has led to a sharp rise in bond yields.

Tax implications

Fixed deposits do not offer any indexation benefit. They are taxed as per your slab irrespective of how long you stay invested. This means the returns from FD will be taxed higher if you are in a higher tax slab. In contrast, TMFs offer indexation benefits.

“Target maturity funds with a maturity longer than three years are eligible for long-term capital gains taxation where the gains are taxed at 20% post-indexation (i.e. only the gains over and above inflation will be taxed),” said Srinath.

Also Read: Senior Citizen Fixed Deposit interest rate jumps to 9%: Know how much return is guaranteed

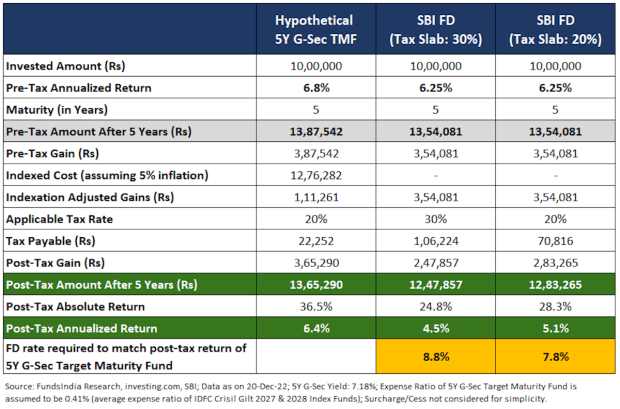

To understand the tax implications of FDs and TMFs, Srinath shared a comparison of a hypothetical 5-year Target Maturity Fund (investing in G-Secs) versus a 5-year SBI Fixed Deposit for Rs 10 lakh investment.

The above chart shows that TMF offers better tax efficiency, and hence better returns, than FD if you are in a higher tax slab.

Also Read: Fixed Income: Target maturity funds a good bet

Which TMF should you select?

Srinath suggested that investing in a TMF with 3-5 year maturity is better at present because bond yields in the 3-5 year segment are currently attractive. Moreover, tax efficiency kicks in after 3 years.

“If you have goals coming up in the next 3-5 years and need a predictable low-risk investment option, you can go for target maturity funds. The investments can be made either as a lump sum or can be staggered over the next 1-3 months,” he said.