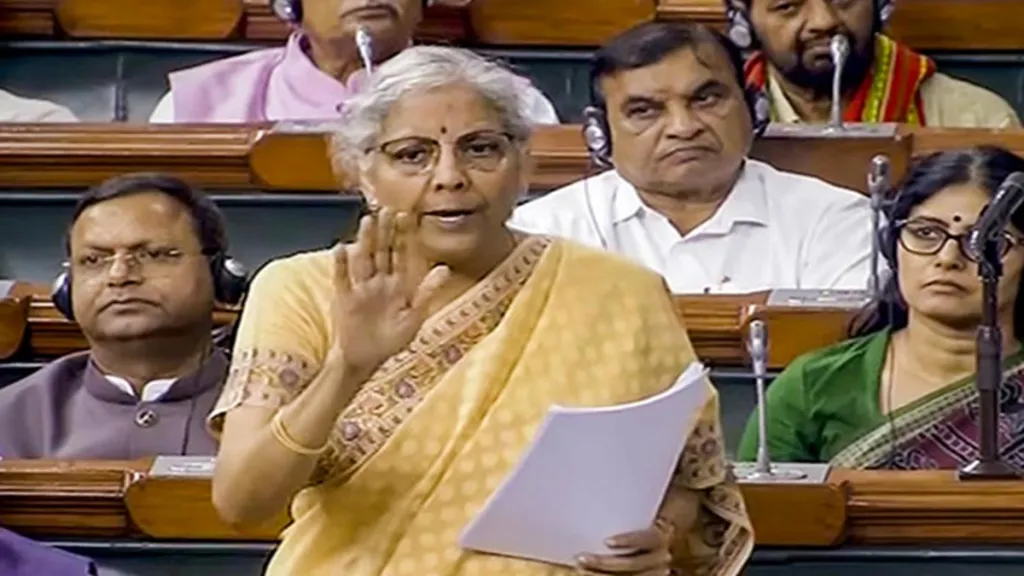

The new Income Tax Bill, 2025 was passed in the Lok Sabha on Monday without debate. Earlier today, Finance Minister Nirmala Sitharaman reintroduced the Income-Tax (No 2) Bill in the Lok Sabha, days after it was withdrawn in the House to incorporate key recommendations of the Select Panel of the Lok Sabha.

One more bill – Taxation Laws (Amendment) Bill – was passed by the Lok Sabha today. The bill aims to provide tax exemptions to subscribers of the Unified Pension Scheme.

Both these bills were passed in the House by voice vote without any debate amid strong protests by Opposition over certain issues.

The government has included “almost all of the recommendations of the Select Committee” in the revised Income Tax Bill. In addition, suggestions have been received from stakeholders about changes that would convey the proposed legal meaning more accurately.

Introducing the Income-Tax (No.2) Bill, 2025, FM Sitharaman said the bill seeks to consolidate and amend the law relating to income-tax and will replace the Income Tax Act, 1961.

The government formally withdrew the old draft of the Income Tax Bill, 2025 introduced in Parliament on August 8. This is the same bill which was introduced during the Budget session in February and was immediately sent to the Select Committee.

“Almost all of the recommendations of the Select Committee have been accepted by the government. In addition, suggestions have been received from stakeholders about changes that would convey the proposed legal meaning more accurately,” said the statement of objects and reasons of the bill.

“There are corrections in the nature of drafting, alignment of phrases, consequential changes and cross-referencing. Therefore, a decision has been taken by the government to withdraw the Income-tax Bill, 2025 as reported by the Select Committee. Consequently, Income-tax (No. 2) Bill, 2025 has been prepared to replace the Income-tax Act, 1961,” the statement said.

Select Committee made more than 285 recommendations

After four months of intensive review, the committee prepared an over 4,500-page report with more than 285 recommendations. The purpose of these suggestions was to simplify the language of the law, bring clarity in the provisions and make compliance easier for taxpayers. Now the government has presented a new draft incorporating these changes.

1961 law vs new bill of 2025 — what is the difference?

The old Income Tax Act, 1961 has been in force for decades, but its language and structure have often proved confusing for the common man. The new bill has been brought with the intention of changing it completely.

It will have 536 sections and 16 schedules, which have been arranged in a clean manner.

There will now be a single concept of “Tax Year” instead of “Previous Year” and “Assessment Year”.

Unnecessary and contradictory provisions have been removed to reduce litigation.

CBDT has been given more power to make rules according to the digital age.

In simple words, the new law will be much easier to read, understand and implement than the old one.

What did the Select Committee say?

Some of these important recommendations were –

Flexibility in tax refund – Those who file returns late will also get the right to refund.

Dividend relief – Rs 80M deduction on inter-corporate dividends will be reintroduced.

NIL-TDS option – Those who do not have tax liability will be able to obtain advance NIL-TDS certificate.

Tax relief on vacant house – Provision of taxing only notional rent removed.

Clarity in house property deduction – 30% standard deduction after deducting municipal tax, and interest deduction on rented property will also be available.

Simplification of compliance rules – Provisions related to TDS on PF withdrawal, advance ruling fees and penalties clarified.

Alignment of MSME definition – MSME definition will be in line with the MSME Act.

Language and drafting improvements – Section numbering and terminology corrected.

Clarity in property classification – ‘occupied’ replaced with a term that avoids misclassification.

Extension of pension benefits – Non-employee individuals will also get commuted pension deduction.

Experts’ take on Lok Sabha Passing new Income Tax Bill, 2025

Rajesh Gandhi, Partner, Deloitte India, said, “The proposals relating to tax benefits for investment by foreign pension funds and sovereign funds in the infrastructure sector are similar to the existing tax law though the provisions have been drafted in a more structured and concise manner. The government could have considered industry suggestions while drafting the proposals including extension of tax benefits to holding companies setup prior to 2021, allowing reinvestment of dividend income within the group without triggering double taxation of dividend income, extension of tax exemption to indirect share transfers, extension of tax benefit to capital gains from unlisted bonds / debentures as well as removal of withholding tax on exempt income earned by such funds.”

Dinesh Kanabar, CEO, Dhruva Advisors, said, “While we study the provisions of the amended Bill, we see some very welcome changes. There were a number of provisions against which representations were made to select committee. These have now been accepted in the Bill presented today. To give a few examples, the provisions of levying Alternate Minimum Tax on LLPs has been done away with, the rigours placed on Charitable Trust have been removed, the provisions of Transfer Pricing and the definition of Associated Enterprise to whom these provisions apply, have been relaxed. A set of very welcome changes. Glad that the representations to the Select Committee have borne fruit”.