The festive season holds a special place in the hearts of Indians as celebrations are not limited to just traditional customs and rituals for them. They also love buying new cars and shop for various other things due to multiple offers available during this time of the year.

One of the most significant aspects of the festive season is that every year, during festivals like Diwali, Dussehra and Navratri, there is an excitement in the air as families plan buying a new car. Let’s explore why it makes sense to buy a new car during the festive season.

Festive Offers

The festive season is synonymous with lucrative discounts and offers on all type of car models. This is the time when manufacturers roll out special promotions, cashback schemes, low or zero-interest financing, and other attractive deals to entice prospective buyers. These offers ensure you have opportunities to negotiate for additional benefits, making it a buyer’s market during these festivities.

Also Read: Building Your Dream Home: Key financial considerations for constructing a house in India

Auspicious Occasions

Festive seasons in India are considered highly auspicious for significant purchases, and buying a car falls squarely into this category. Many people believe that starting a new venture, such as purchasing a car, during the festive season brings good luck and prosperity. Consequently, families prefer to bring home a new car during festivals, as it’s seen as an investment that will drive blessings and good fortune into their lives.

New Models and Upgrades

Often car companies sell off old models to clear their inventory by offering more discounts on cars manufactured in the outgoing year. At the same time, car manufacturers often time the release of new models and upgrades to coincide with the festive season. This strategic planning ensures that customers have access to the latest and most advanced vehicles when they are most inclined to buy. New models often come with improved features, better fuel efficiency, and enhanced safety features, making it a compelling proposition for prospective buyers.

Gift of Choice

Gifting is an integral part of festivals. Many families consider a new car as the ultimate gift to themselves and their loved ones. They remain excited about bringing home a brand-new vehicle during a festival.

Higher Resale Value

The timing of your car purchase can also impact its resale value. At the time of purchase, car dealers may offer you two options – either to purchase the existing year car model or book the car and take the model that would be manufactured in the new year. Old year model may give you a higher discount while new year model might have a lower discount during the festive-time purchase. You must remember that the year you bought a car plays an important role to decide the resale value as it calculates the age of your car. This aspect is crucial for those who plan to upgrade to a new vehicle after a few years.

Buying a new car is not just about convenience; it’s also about emotions. The feeling of driving a brand-new car on auspicious occasions with loved ones is a unique and memorable experience that stays with the family for years to come.

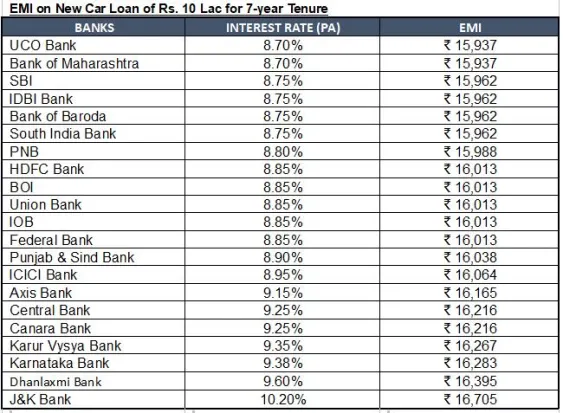

If you’re considering buying a new car, the festive season is undoubtedly the right time to make your dream a reality with more discounts and offers. The table below helps you compare the interest rates of car loans. It also compares the EMIs of a Rs 10-lakh car loan for a 7-year tenure.

Interest Rates & EMI on New Car Loan

Compiled by BankBazaar.com

Note: Interest rate on Car Loan for all listed (BSE) Public & Pvt Banks considered for data compilation (Excluding small finance banks and EV loan). Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 03 Oct 23. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on car loan is placed at top and highest at the bottom. Lowest interest rate offered by the banks irrespective of the loan amount is shown in the table. EMI is calculated on the basis of interest rate mentioned in the table for a Rs 10 Lakh Loan with a tenure of 7 years (processing and other charges are assumed to be zero for EMI calculation). Interest mentioned in the table is indicative and may vary depending on the bank’s T&C.