While purchasing a new car, a buyer is likely to get confused between electric vs non-electric vehicles. Sometimes it is challenging to decide whether to buy an electric or non-electric car. It becomes more difficult when you have the budget to afford both types of vehicles. However, the choice between electric and non-electric vehicles not only affects the environment but also has significant financial implications. Both options present distinct advantages and disadvantages from a financial standpoint, influencing consumers’ car loan decisions.

Let’s look at the pros and cons of both the options from financial point of view to understand and help you take an informed decision without getting confused at the time of purchase.

Electric Cars

Pros:

Lower Operating Costs: Electric vehicles (EVs) are renowned for their energy efficiency and lower operating costs. With electricity being generally cheaper than gasoline, EV owners can save a substantial amount on fuel expenses over the life of the vehicle.

Tax Incentives and Rebates: Many governments offer attractive tax incentives, rebates, and grants to promote the adoption of electric vehicles. These financial benefits can significantly reduce the overall cost of purchasing an electric car and make them more financially appealing.

Also Read: How to save for your child’s education? Here are 5 tips for parents

Lower Maintenance Costs: Electric vehicles have fewer moving parts than their non-electric counterparts, leading to reduced maintenance costs. EV owners often spend less on regular maintenance and repairs, saving money in the long run.

Resale Value: As the demand for electric vehicles continues to rise, their resale value is expected to remain relatively high, which can be advantageous for those who plan to upgrade or sell their car in the future.

Cons:

Higher Initial Cost: Electric vehicles typically have a higher upfront cost compared to non-electric vehicles. Although tax incentives and rebates can offset this to some extent, the initial investment may still be a barrier for budget-conscious buyers.

Limited Charging Infrastructure: While charging infrastructure is improving, it may still be less accessible than traditional gas stations in some areas. This limitation can cause inconvenience for EV owners, especially during long journeys.

Depreciation Concerns: The technology in electric vehicles is rapidly evolving, and newer models often come with improved features and longer ranges. This can lead to concerns about potential depreciation as newer and more advanced EVs enter the market.

Non-Electric Cars:

Pros:

Lower Initial Cost: Non-electric vehicles generally have a lower upfront cost compared to electric vehicles, making them more affordable for many buyers.

Established Infrastructure: The infrastructure for non-electric vehicles, such as gas stations and service centres, is well-established, providing a convenient refuelling and maintenance experience for car owners.

Wide Range of Options: The non-electric vehicle market offers a wide range of options, from budget-friendly to luxury vehicles, allowing buyers to find a car that suits their budget and preferences.

Cons:

Higher Fuel Expenses: Fuel prices can be unpredictable and subject to fluctuations, leading to potentially higher fuelling costs over time. Additionally, non-electric vehicles tend to have lower fuel efficiency, resulting in increased fuel consumption.

Maintenance Costs: Internal combustion engines in non-electric vehicles have more moving parts, which can lead to higher maintenance and repair expenses compared to electric vehicles.

Environmental Impact: Non-electric vehicles contribute significantly to greenhouse gas emissions and air pollution, potentially leading to stricter regulations and potential additional costs in the future.

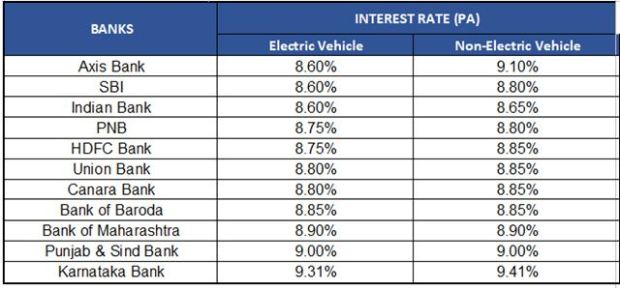

The table below compares the interest rates of multiple banks for electric and non-electric car loans. You can compare and take the decision based on your requirements.

Interest Rates: Electric Vs Non-Electric Car Loan

Compiled by BankBazaar.com

Note: Interest rate on Car Loan for electric and non-electric vehicle for all listed (BSE) Public & Pvt Banks considered for data compilation (Excluding small finance banks). Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 18 Jul 2023. Top banks with lowest interest rates on e-vehicle are listed in ascending order i.e. bank offering lowest interest rate on electric car loan is placed at top and highest at the bottom. Lowest interest rate offered by the banks irrespective of the loan amount is shown in the table.