The rupee has depreciated over 15% against the US dollar since January this year because of rising crude prices, slowing flow of funds from foreign institutional investors and increase in the US Dollar index. The fall in the value of the home currency has kept bond yield higher. When the rupee depreciates against the dollar, exporters benefit because each dollar can buy more goods. However, it is detrimental for importers because their bill goes up, which in turn hits their profit.

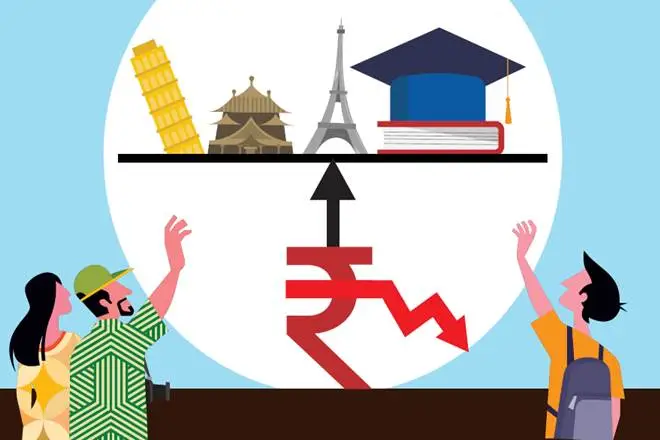

A falling rupee impacts an individual in many ways. Here are four of them.

Impact on foreign education: If one is studying abroad, or plans to do so, one should then brace for higher expenses. Students will have to pay more for exams such as TOEFL, GRE and GMAT. Tuition fee, boarding and lodging charges and study material will become costly. As tuition fees will have to be paid before the commencement of the semester, a sudden fall in the value of the Indian currency will impact parents.

Ideally, they should negotiate with the university management to pay a part of the fees before commencement of the semester and the rest when the exchange rate stabilises. Students should look for scholarship, low-interest education loan and even part-time jobs to earn some money. The fall in the value of the currency will impact education loans as banks will reduce the loan amount. Remember, there is no income tax deduction against loans taken for higher education abroad.

To avail the loan, a student will also have to furnish the admission letter of the institution and the fee structure of the particular course for each semester, or the annual charges. Students going abroad for higher education will have to give passport details, GMAT or GRE scores and total expenses for the course after factoring in currency fluctuations. Expensive foreign travel With the fall in the value of the rupee, your foreign vacations will become expensive.

For those who have booked in advance, the impact will be less. Ideally, one should plan visits to Asian countries as the rupee has not depreciated much against currencies of the continent. Most often, tour operators take forex to book accommodation, sight-seeing, etc., and people pay for the complete package in advance.

This way one can save costs during the foreign travel. Costly imported goods Imported goods will become costlier because of the falling rupee against the dollar and also with the additional duties levied by the government. Automobiles, mobile phones, washing machines, LCD TVs, etc., will become more expensive as input prices will rise.

A weaker rupee helps companies in the export-oriented sector such as IT and pharmaceuticals, a trend seen in the rising prices of stocks of companies in these sectors. Also, a fall in the value of rupee will impact companies with higher dollar debts, capital-intensive sectors, and companies with higher foreign currency borrowings.

Spike in bond yield: A gradual fall in the value of rupee will pose an inflationary risk as imports are costlier when the currency depreciates. This will only add to the RBI’s reasons for raising interest rates further. RBI had raised repo rate twice, by 0.25% each time, in June and August this year. Bond yields will remain high because of the falling rupee and will impact long-term debt fund. The net asset value (NAV) of debt mutual funds and the returns will fall when interest rates go up. Higher interest rates will also hurt borrowers as home loans, car loan and personal loans will become more expensive.